In the world of forex trading, it’s imperative to prioritize transparency and adherence to regulatory requirements. However, Ether Finance lacks essential information regarding its regulatory standing, ownership, and registration credentials, raising valid doubts about its reliability and commitment to industry norms. Additionally, the absence of a valid forex brokerage license heightens concerns, suggesting potential risks for traders and investors who may be considering involvement with their platform.

Conversely, partnering with fully licensed and transparent brokers not only guarantees compliance with legal and financial regulations but also bolsters the security of investments and improves the overall trading process.

Ether Finance Regulation

From the start, Ether Finance’s decision to operate discreetly, avoiding accountability, raises doubts about its business ethics. This strategy, combined with the lack of a valid forex trading license, heightens risks for potential clients, highlighting a serious disregard for regulatory compliance and oversight.

Adding to these concerns, the Central Bank of the Russian Federation has explicitly warned against Ether Finance’s unauthorized operations within its jurisdiction. This warning serves as a significant alarm and emphasizes the legal and financial dangers associated with dealing with Ether Finance.

Given these substantial concerns, potential traders are strongly advised to steer clear of engaging with Ether Finance. Safeguarding your financial security should be paramount, especially in the forex market, where it’s crucial to align with brokers that are transparent, fully licensed, and regulated. Opting for partnerships with reputable and compliant entities ensures the safety of your investments and ensures that you’re trading within a framework designed to protect your interests.

Trading Platform

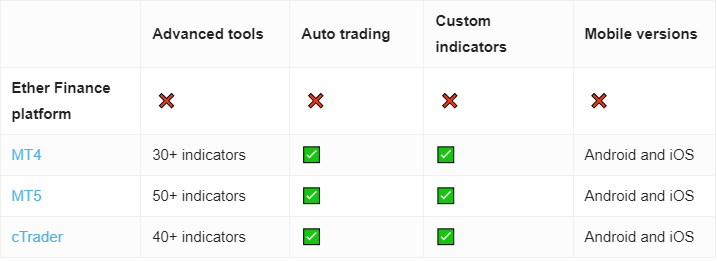

Ether Finance’s digital platform noticeably lacks the reliability and functionality that traders rely on and expect from industry-standard platforms.

You can witness this for yourself by visiting their platform.

The lack of robustness and comprehensive features in Ether Finance’s platform can significantly hinder trading efficiency and success. Given these shortcomings, we strongly advise against investing your valuable resources—both money and time—into this platform.

For those seeking a reliable and versatile trading platform with a wide range of trading tools, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand out as excellent options. These platforms are highly regarded in the trading community for their stability, extensive analytical tools, and advanced trading features. Their track record of excellence makes MT4 and MT5 the preferred choice for traders of all levels, from novices to seasoned professionals. Opting for these platforms provides access to cutting-edge trading technologies, improving your trading strategy and potentially leading to greater success in the forex market.

Minimum Deposit

Ether Finance employs a tiered structure for its trading accounts, each tailored to different types of traders and featuring distinct minimum trading amounts.

For beginners, the Basic account serves as an entry-level option, requiring a minimum trading investment of $150. Traders desiring more features and deeper engagement can opt for the Standard account, which mandates a minimum trading amount of $1,000. Experienced traders seeking enhanced services and benefits may consider the VIP account, which necessitates a minimum trading commitment of $5,000. At the apex of Ether Finance’s account offerings is the Prime account, designed for the most serious traders, with a minimum trading amount set at $25,000.

Payment Methods

Ether Finance’s payment options are notably limited, as the platform exclusively accepts Credit/Debit card transactions. This restriction starkly contrasts with the broader array of payment methods offered by more established and reliable brokers in the forex trading industry.

Typically, such brokers accommodate a diverse spectrum of payment solutions, including e-wallets like Skrill and Neteller, bank/wire transfers, and even cryptocurrencies. This flexibility caters to the varied preferences of traders and enhances accessibility and convenience, which are crucial factors in the fast-paced world of forex trading.

Ether Finance’s narrow payment approach may thus be perceived as a significant limitation, potentially impacting its attractiveness to a broader audience of traders seeking versatile and secure funding options.

Trading Instruments

Although Ether Finance promotes an extensive range of trading assets, encompassing Forex pairs, Commodities, Cryptocurrencies, Stocks, and Indices, concerns arise regarding the platform’s sophistication and the absence of regulatory oversight, raising doubts about its suitability for traders aiming to effectively diversify their portfolios. The lack of advanced trading tools and regulatory assurance significantly undermines the reliability and security of trading with Ether Finance.

Given these concerns, traders are advised to explore alternative platforms that not only offer a broad selection of trading assets but also ensure high functionality, security, and regulatory compliance. Such platforms better equip traders to manage a diversified portfolio, refine their trading strategy, and protect their investments.

Ether Finance Spread

The trading conditions at Ether Finance are notably less competitive, particularly when considering the spreads for major currency pairs, which is a crucial aspect for traders aiming to maximize their profitability. Direct observations from their platform reveal spreads such as 5.4 pips on EURUSD, 7.8 pips on GBPUSD, and 5.8 pips on USDJPY. These figures are significantly higher than the industry norm, where more reputable brokers typically offer much tighter spreads, often averaging around 1.5 pips.

High spreads directly lead to increased trading costs, which can erode profitability and negatively impact the overall trading experience. For traders, especially those involved in high-volume or frequent trading, these cost implications can be significant. This marked difference in spreads serves as a crucial point of consideration for anyone considering investing with Ether Finance, highlighting the importance of carefully examining trading conditions and costs as part of the broker selection process.

Ether Finance Leverage

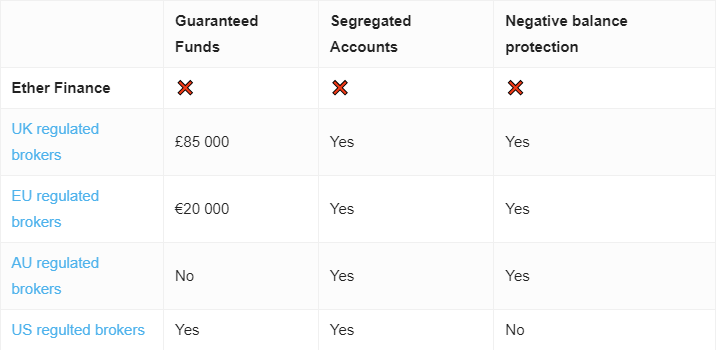

Ether Finance provides an impressively high maximum leverage of 1:400, which may seem appealing initially due to its potential for magnifying profits. However, this elevated leverage ratio raises significant concerns, particularly without the presence of negative balance protection. Negative balance protection is a vital safeguard for traders, ensuring that their losses cannot exceed the funds in their trading account, thereby preventing indebtedness to the broker.

Engaging in trading with high leverage without such protection significantly escalates the risk of substantial financial loss, potentially resulting in a negative balance in the account. This risk becomes especially pertinent in volatile market conditions, where price fluctuations can be dramatic and swift. Traders should carefully consider the absence of negative balance protection at Ether Finance, alongside the high leverage offered, as it poses a considerable financial risk. This emphasizes the importance of selecting brokers that not only provide favorable trading terms but also prioritize the safety and security of their clients’ investments.

Ether Finance Withdrawal Requirements

The lack of transparent and readily available information regarding withdrawal fees at Ether Finance presents an additional hurdle for traders. Clarity in fee structures, particularly concerning withdrawals, is essential for effective financial management and comprehending the complete trading costs. Without explicit information on these fees, traders experience uncertainty in fund management and could encounter unforeseen expenses when withdrawing their profits. This lack of transparency not only complicates financial planning but also casts doubt on the broker’s overall openness and reliability. We encourage traders to prioritize brokers that offer clear, detailed information on all potential fees and charges to guarantee a well-informed trading experience.