Although Ferdinandrim portrays itself as a trustworthy brokerage situated in the United Kingdom, the truth is that its absence of regulatory supervision raises considerable apprehension regarding the security of investors’ capital. The absence of oversight from esteemed financial authorities significantly diminishes assurance and safeguards for traders who opt to do business with this establishment.

Therefore, we strongly advise traders to meticulously scrutinize our comprehensive Ferdinandrim assessment prior to entering into any financial agreements. Prioritizing the protection of your investments is paramount, and it is essential to select a brokerage adhering to regulatory standards to safeguard your interests.

Ferdinandrim Regulation

Ferdinandrim’s assertions of regulatory adherence in the UK are misleading, as the company operates without a valid forex license from the UK Financial Conduct Authority (FCA) or any other recognized regulatory body worldwide.

Furthermore, the Central Bank of the Russian Federation, a reputable financial authority, has explicitly cautioned against engaging with the company, emphasizing that it lacks authorization to offer services within their jurisdiction. Such alerts are crucial in protecting individuals from potential financial hazards.

In unequivocal terms, associating with Ferdinandrim carries substantial risks. A wiser choice would be to opt for brokers endorsed by esteemed financial authorities.

Refer to the table above to discover our top recommendations from reputable global jurisdictions.

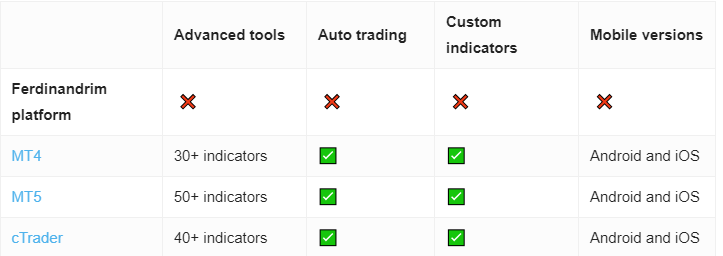

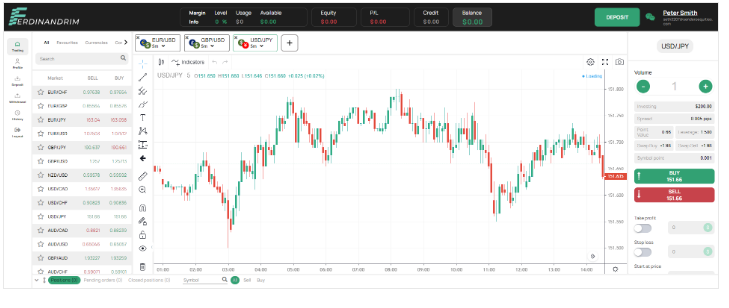

Trading Platform

Although Ferdinandrim’s online trading platform might be intuitive for beginners, it lacks the sophistication and user-friendly features found in more advanced platforms such as MetaTrader 4.

Given the abundance of regulated brokers providing top-tier platforms, there’s no need to settle for anything less. Don’t allow flashy software alone to sway you into compromising your security. Instead, opt for a broker that values your peace of mind and provides a user-friendly platform tailored to your trading requirements.

For a compilation of these trustworthy brokers, please consult the table provided above.

Minimum Deposit

Ferdinandrim presents a spectrum of account choices tailored to diverse trader profiles, commencing from the Newbie account requiring a minimum deposit of $1,000, escalating to $25,000 for the Experienced tier, and peaking with the top-tier Professional account necessitating a hefty $50,000 deposit. While these options may accommodate traders with varying experience levels and capital, it’s noteworthy that Ferdinandrim’s minimum deposit requirements are notably higher compared to many respected brokers in the market.

For instance, prominent brokers frequently offer account options with minimum deposits below $250, widening access to trading for a broader range of traders, including those with limited capital. This substantial contrast in minimum deposit prerequisites may provoke apprehension among potential traders, particularly those who prioritize affordability and accessibility when selecting a brokerage. Consequently, it’s imperative for traders to meticulously evaluate their financial circumstances and trading objectives before committing to an account with Ferdinandrim.

Payment Methods

Ferdinandrim’s payment methods are notably restricted compared to those provided by reputable brokers in the industry. The company exclusively supports cryptocurrencies and credit/debit cards for both deposits and withdrawals, with the latter option presently unavailable. Moreover, Ferdinandrim introduces a relatively uncommon online payment method, GarryPay, for transactions.

Conversely, esteemed brokers typically offer a broader array of payment options to cater to the diverse needs of traders. These may encompass credit cards, bank transfers, and popular e-wallets like Skrill and Neteller, offering enhanced flexibility and convenience for clients during fund deposits or withdrawals. The limited payment options at Ferdinandrim may present obstacles for traders who prefer more traditional or widely accepted payment methods.

Trading Instruments

Additionally, despite Ferdinandrim’s assertion of providing a diverse range of trading instruments on their website, encompassing Forex, Stocks, Cryptocurrencies, Commodities, and Indices, the numerous red flags linked with the company cast doubts on the reliability and legitimacy of these offerings.

Hence, we advise seeking alternatives to this broker if you aim to diversify your trading portfolio. It’s crucial to prioritize safety and security when choosing a broker to guarantee a favorable and prosperous trading journey.

Ferdinandrim Spread

While Ferdinandrim may advertise appealing spreads, such as 0.5 pips for EURUSD, 0.7 pips for GBPUSD, and 0.0 pips for USDJPY, it’s important to recognize that these favorable spreads are meaningless as the platform doesn’t support actual trading.

Don’t be misled by figures that don’t translate into genuine trading opportunities. It’s vital to look past attractive spreads and prioritize factors like regulatory adherence, platform dependability, and overall reputation when selecting a broker for your trading requirements.

Ferdinandrim Leverage

Ferdinandrim makes appealing pledges of substantial maximum leverage options, touting ratios of up to 50:1 for retail clients and 100:1 for professional clients. Nevertheless, it’s crucial to acknowledge that these assertions prompt concerns regarding regulatory conformity.

In jurisdictions where brokers must limit their provided leverage for retail clients to 30:1, Ferdinandrim’s offer surpasses the mandated thresholds. This incongruity implies that the company might not be regulated in the declared jurisdiction, signaling potential hazards for traders.

Ferdinandrim Withdrawal Requirements

The absence of information concerning withdrawal fees or minimum withdrawal amounts on Ferdinandrim’s website is troubling and indicates a significant lack of transparency. This lack of clarity can unsettle traders who rely on clear and detailed information about the expenses associated with accessing their funds. Without this essential information, traders may encounter unforeseen charges or restrictions when trying to withdraw their funds, exacerbating the uncertainty surrounding Ferdinandrim’s services.