Investfing.org, also known as General Invest, presents itself as a reputable forex broker under regulation, offering a secure place for investors’ funds. However, the reality couldn’t be more different. Rather than being a trustworthy platform, this website appears to target individuals who are inexperienced in financial trading, aiming to mislead them. In this assessment, we will elucidate why it’s advisable to avoid Investfing.org and recommend alternative investment intermediaries that are more reliable.

Investfing.org Regulation

Authentic forex brokers ensure transparency by offering comprehensive information about the legal entity managing their operations, including its location, licenses, and regulatory oversight. Conversely, the absence or improper presentation of such details serves as a warning sign, suggesting potential fraudulent activity.

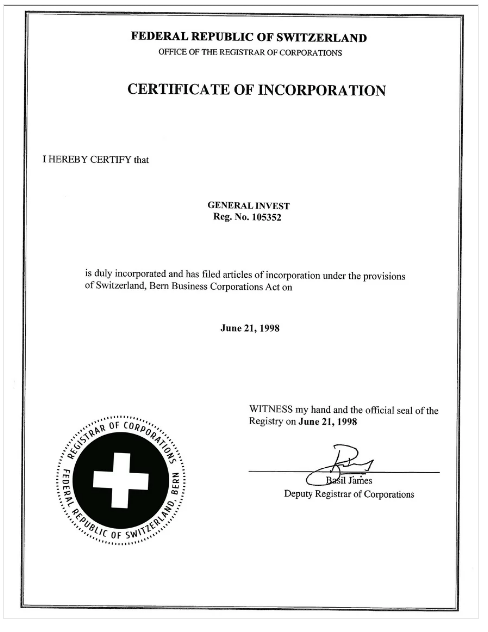

Investfing.org operates entirely anonymously. Neither the website nor its legal documents disclose a company name, and no contact address is provided. Although an image of an alleged certificate of incorporation from Switzerland is displayed on the website, the document lacks any mention of a legal entity, indicating its fraudulent nature.

Investfing.org lacks association with any licensed financial services provider listed in the Swiss Financial Market Supervisory Authority (FINMA) database.

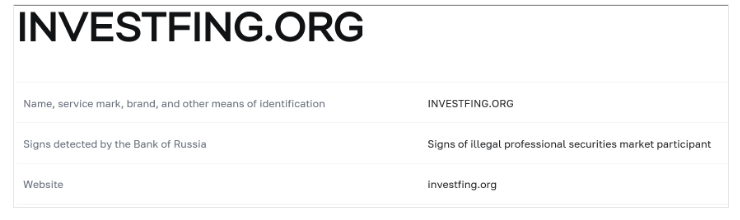

The website predominantly caters to a Russian-speaking audience, evident from its primary language being Russian. Russian financial authorities have flagged Investfing.org for its fraudulent operations and subsequently blacklisted the website.

When deciding to invest in financial instruments, it’s crucial to opt for more reliable options. Depending on your location, selecting a company regulated by reputable institutions like the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), or a European Union regulator such as the Cyprus Securities and Exchange Commission (CySEC) is advisable.

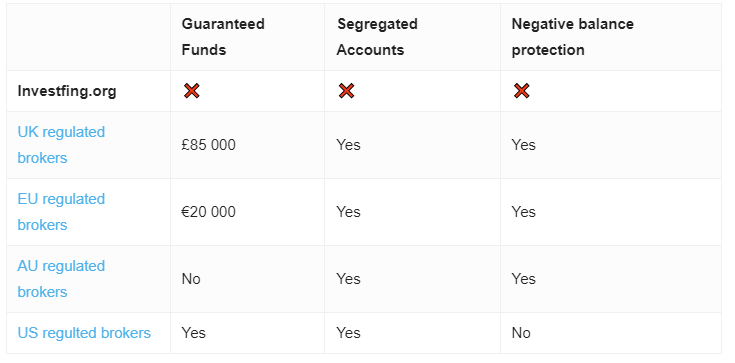

Clients of these regulated brokers benefit from various protections, including negative balance protection and the segregation of client funds from the broker’s funds. Additionally, in the EU and the UK, brokers are required to participate in guarantee schemes that offer coverage for a certain portion of the trader’s investment in the event of the broker’s insolvency.

Trading Platform

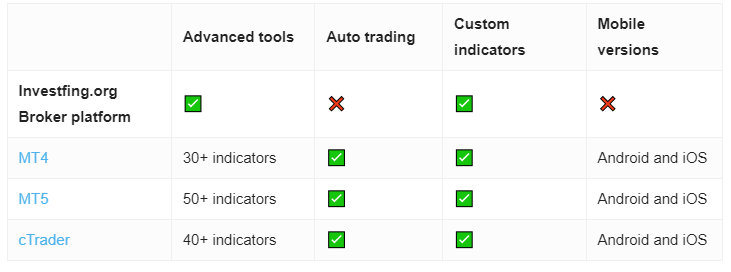

Investfing.org offers web-based trading software with fundamental features for order placement, chart customization, and utilization of technical indicators. However, it lacks the advanced functionality present in industry-leading trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

It’s important to emphasize that the mere existence of a trading platform on a website doesn’t enhance its legitimacy or ensure that the purported broker facilitates genuine trading activities. Numerous scammers employ manipulated trading software to deceive victims into believing their funds are being invested.

Minimum Deposit

Investfing.org mandates a minimum deposit of 500 USD, a considerably higher amount compared to industry norms. Typically, reputable brokers allow traders to open accounts with as little as 50 USD, or even as low as 5 USD in some cases.

Payment Methods

The exclusive acceptance of cryptocurrency deposits by Investfing.org is a common characteristic among financial scammers.

Cryptocurrencies serve as the preferred payment method for scammers due to the anonymity they afford, coupled with the inability for victims to request refunds. Legitimate brokers, however, may accept digital currencies like Bitcoin in addition to other transparent payment options such as credit/debit cards, bank transfers, or popular e-wallets like PayPal, Neteller, or Skrill.

Trading Instruments

Investfing.org promotes trading across various asset classes including forex, indices, stocks, metals, energy, and cryptocurrencies. However, as previously highlighted, the trading activities facilitated by this anonymous website are unquestionably fictitious.

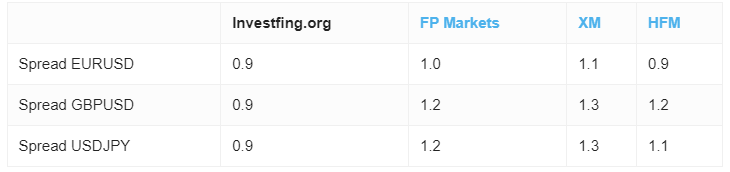

Investfing.org Spread

Even though the trading platform presents a competitive spread of 0.9 pips, which might appear attractive in theory, its relevance diminishes when the trades executed are fictitious and the broker is involved in fraudulent activities.

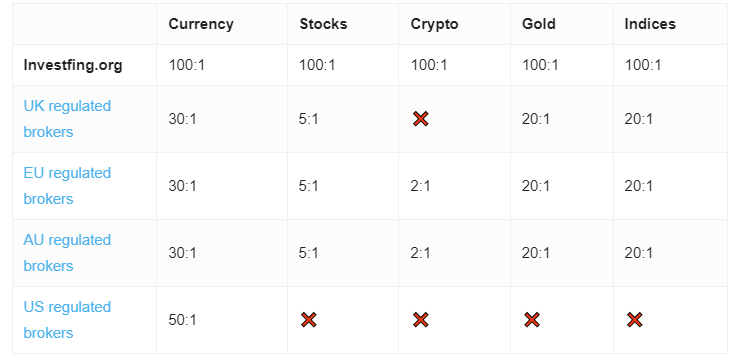

Investfing.org Leverage

Investfing.org provides leverage of 1:100 for trading currency pairs, 1:50 for trading stocks, and 1:20 for trading indices, surpassing the limits set in most regulated jurisdictions. Regulated brokers typically offer higher leverage solely to professional clients who must meet stringent criteria in terms of capital and experience, thereby forgoing the protections available to retail traders.

For those willing to assume the risks associated with high leverage and seeking to capitalize on bonuses and promotions, the optimal approach is to invest through an offshore division of a well-established brand.

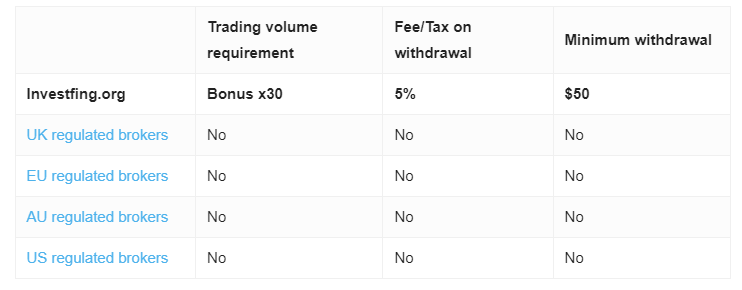

Investfing.org Withdrawal Requirements

Investfing.org stipulates that clients must withdraw a minimum amount of 50 USD. If the client has conducted fewer than 5 independent trades, a service fee of 5% of the total withdrawal amount applies. Withdrawal becomes significantly challenging if the account has received a bonus. In such cases, clients must meet minimum trading volume requirements of 10 to 30 times the value of the bonus. Regulated brokers typically refrain from offering bonuses as scammers often use them to tie withdrawals to steep fees and unattainable conditions. Additionally, Investfing.org imposes an inactivity fee equivalent to 5% of the account balance, with a minimum of 25 USD.