ExchangeUnity, alternatively spelled as Exchange Unity, asserts itself as a brokerage firm that has swiftly attained worldwide prominence within a brief span. However, discrepancies in the branding on the website are not the sole basis for skepticism regarding this claim. Indeed, every aspect of the website strongly suggests that ExchangeUnity is, in reality, a fraudulent operation. In this evaluation, we will elucidate the reasons why it is advisable to steer clear of ExchangeUnity and direct you towards more reputable investment intermediaries.

ExchangeUnity Regulation

ExchangeUnity omits crucial details regarding its brokerage services, such as the company’s identity and the absence of essential documents like Terms and Conditions or a Customer Agreement.

Legitimate financial service providers typically provide transparent information about their ownership, location, and licensing. While the presence of such details doesn’t ensure legitimacy, their absence strongly implies potential fraudulent activity.

Additionally, ExchangeUnity lists its contact address in Saint Vincent and the Grenadines (SVG), a jurisdiction with lenient regulatory oversight of brokers, further casting doubt on its reliability and credibility as a brokerage entity.

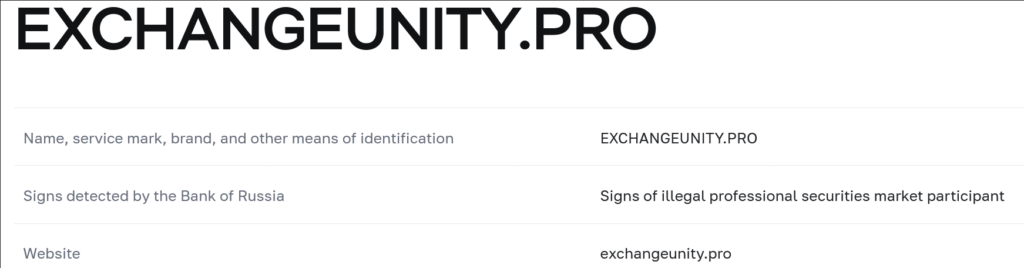

ExchangeUnity primarily targets a Russian-speaking audience, leading to the issuance of a warning by Russian financial authorities stating that the website lacks proper licensing.

For those considering investing in financial instruments, especially newcomers to trading, it’s vital to enlist the services of a licensed broker operating within a jurisdiction with robust regulations.

Depending on your location, it’s advisable to opt for a company regulated by respected institutions such as the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, or an EU regulator like the Cyprus Securities and Exchange Commission (CySEC).

Clients of these regulated brokers enjoy various protections, including negative balance protection and the segregation of client funds from the broker’s funds. Additionally, brokers in the EU and the UK are mandated to participate in guarantee schemes that provide coverage for a portion of the trader’s investment in the event of the broker’s insolvency. These guarantees typically amount to up to 20,000 EUR in the EU and 85,000 GBP in the UK.

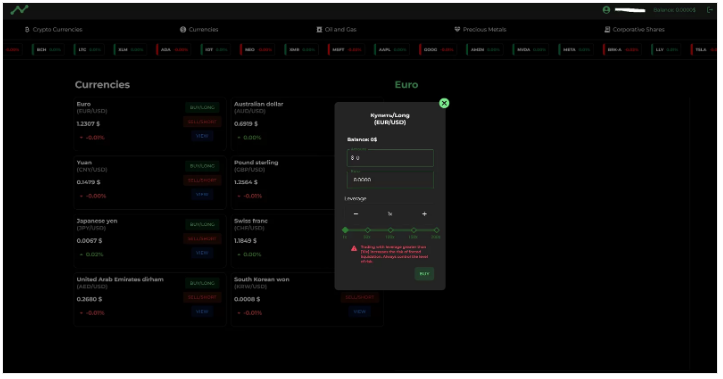

Trading Platform

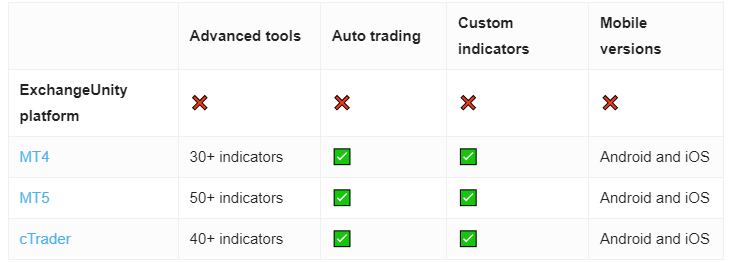

Despite claiming to provide one of the most advanced trading platforms, cTrader, according to the FAQ, ExchangeUnity fails to deliver upon this promise. Upon registering an account, users find themselves devoid of access to cTrader or any other robust trading software. Instead, the ExchangeUnity web trading platform proves to be deficient in basic functionality, resembling a subpar imitation of genuine trading software.

Even if ExchangeUnity were to present a more convincing platform, it wouldn’t lend credibility to the website. Fake brokers often utilize manipulated trading software to deceive victims into believing their funds are genuinely being invested, when in reality, the entire operation is fraudulent.

Legitimate brokers provide clients with a diverse array of trading software options, including desktop, mobile apps, and web-based platforms. Industry-standard platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used due to their extensive features, including customizable options, support for multiple accounts, the ability to design and implement custom scripts for automated trading, and the capability to backtest trade strategies. These platforms have earned their reputation as industry staples for their reliability and comprehensive functionality.

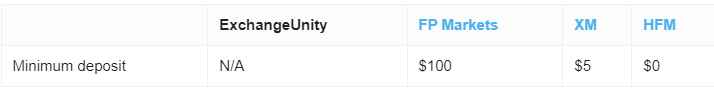

Minimum Deposit

The leading brands in the industry offer beginner traders starter accounts with a very low minimum deposit. You have no good reason to take chances with shady brokers like ExchangeUnity

Payment Methods

At the time of composing this review, the deposit menu on ExchangeUnity’s website was inactive, preventing us from determining the available payment methods. It’s been observed that fake brokers often promote conventional payment options but ultimately push potential victims toward cryptocurrency transactions. This approach ensures anonymity for the fraudsters and deprives victims of the ability to seek refunds or chargebacks.

In contrast, legitimate brokers usually provide clients with a range of transparent payment methods, including bank transfers, credit/debit cards, and reputable e-wallets like PayPal, Skrill, or Neteller. These established methods offer clients security and recourse in case of any issues with their transactions.

Trading Instruments

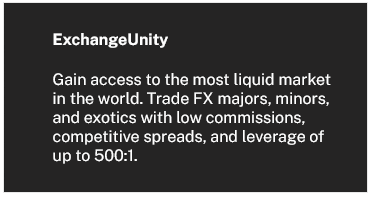

ExchangeUnity purportedly offers trading in various assets such as currency pairs, cryptocurrencies, energies, precious metals, and corporate stocks.

However, the lack of transparency and anonymity surrounding the website provides little reason to believe that genuine trading activities are conducted on this platform.

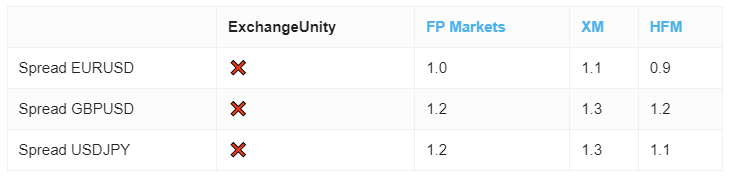

ExchangeUnity Spread

ExchangeUnity makes promises of tight spreads and low commissions, yet fails to offer clear information regarding the costs associated with trading. Genuine forex brokers typically provide transparent details about trading conditions, including fees and commissions. Additionally, legitimate companies often offer various account types tailored to accommodate clients with different levels of experience, capital, and investment objectives. The absence of such clarity and customization options raises doubts about the legitimacy of ExchangeUnity as a brokerage firm.

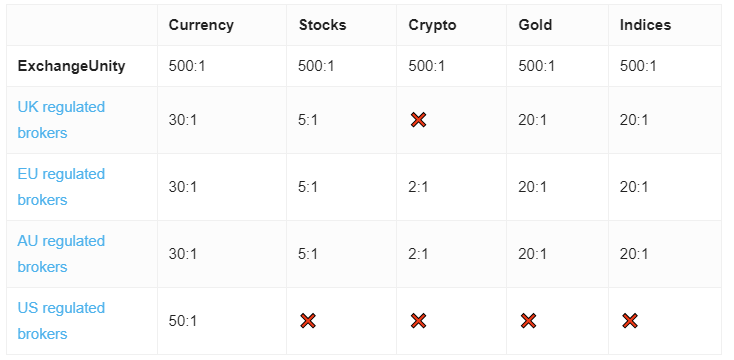

ExchangeUnity Leverage

ExchangeUnity’s questionable trading platform permits leverage of up to 1:200, with the website advertising an even higher ratio of 1:500. It’s worth noting that regulated brokers typically refrain from offering such high leverage levels to retail traders due to the significant risks involved, including the potential for sudden and excessive losses. Industry regulations aim to protect traders from the dangers associated with trading on high leverage, making this practice align with regulatory standards. The discrepancy in leverage offerings further raises concerns about the legitimacy and trustworthiness of ExchangeUnity as a brokerage service.

Regulated brokers typically offer higher leverage only to professional clients who must meet stringent criteria for capital and experience, and in doing so, they forego certain protections enjoyed by retail traders.

If you don’t meet the qualifications for professional trading but are willing to accept the risks associated with high-leverage trading, a practical option is to engage the services of an offshore affiliate associated with a reputable and established brand.

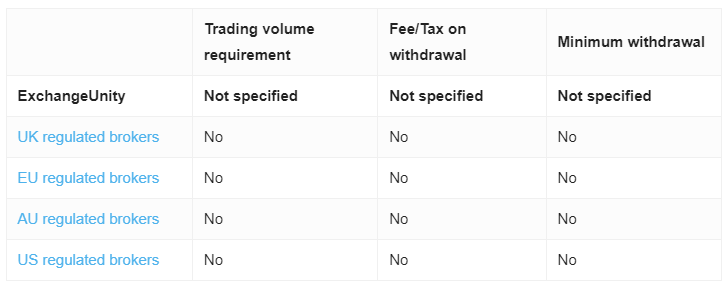

ExchangeUnity Withdrawal Requirements

The absence of publicly available Terms and Conditions or Client Agreement raises concerns about potential traps set by scammers, such as hidden fees and withdrawal terms that are impossible to meet.