Balts Capital presents itself as a reputable online broker based in the UK, promoting attractive trading terms. Yet, its assertion of reliability is weakened by a significant drawback: the absence of regulatory supervision. This regulatory gap significantly diminishes the firm’s credibility and raises concerns about its practices.

To safeguard your investments, it is highly recommended to avoid any financial dealings with Balts Capital. Prioritizing your financial safety is paramount, and engaging with an unregulated broker such as Balts Capital poses a substantial risk to it. It’s crucial to ensure that you interact with brokers who operate with transparency and adhere to regulatory standards to protect your investments.

Balts Capital Regulation

Balts Capital endeavors to portray itself as a trustworthy broker through website sections dedicated to transparency, client protection, and safety. However, it conspicuously omits any mention of regulation by respected financial authorities, a crucial aspect for establishing legitimacy.

Following a tactic common among fraudulent brokers, Balts Capital attempts to create the impression of being a regulated entity in one of the world’s most tightly regulated financial markets, the United Kingdom. It utilizes a UK address to exploit the naivety of traders who might not verify its claimed regulatory status with the Financial Conduct Authority (FCA).

Our comprehensive investigation reveals that Balts Capital is not regulated by the FCA. Furthermore, the FCA has identified the company’s deceptive practices and has issued a direct warning, categorizing Balts Capital as an unauthorized firm involved in fraudulent activities.

These warnings are issued based on genuine concerns, often stemming from reports of traders being scammed, and should therefore be taken seriously.

Given these findings, we strongly discourage engaging with brokers like Balts Capital that lack essential regulation and transparency. Your financial security and peace of mind are paramount, and involvement with unregulated entities could jeopardize both.

Trading Platform

Balts Capital advertises a web-based trading platform as a feature of its services. Yet, upon closer examination, it becomes evident that traders must make a deposit before gaining access to the purported trading platform.

Take a look:

This practice raises several concerns. Firstly, it restricts potential users from evaluating the platform’s functionality and user experience without committing financially. In the trading realm, transparency and the opportunity to test a platform are vital for making informed decisions.

Secondly, this requirement casts doubt on the platform’s legitimacy and the security of deposited funds. Reputable trading platforms typically offer users the chance to explore their features, often through demo accounts, without requiring upfront deposits.

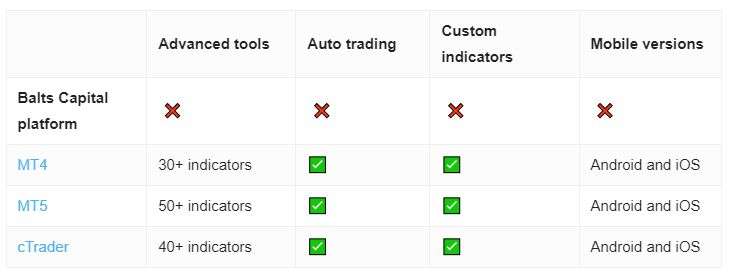

For those seeking to improve their trading journey, opting for reputable, regulated brokers is crucial. We strongly advise selecting brokers that provide established platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. These platforms are renowned for their advanced features, including comprehensive charting tools, a wide array of technical indicators, and robust execution models, all of which are fundamental for successful trading.

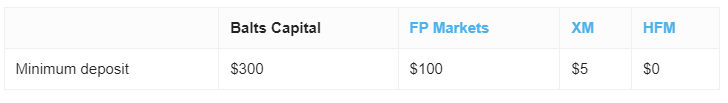

Minimum Deposit

Balts Capital offers a range of account types tailored to traders at different levels, each with its own minimum deposit requirement. These accounts span from the Starter account, which necessitates a $300 minimum deposit, to various VIP accounts designed for more affluent investors, with requirements extending up to $40,000. Here are the account tiers:

- Starter: Requires a minimum deposit of $300.

- Smart: Requires a minimum deposit of $2,000.

- Professional: Requires a minimum deposit of $5,000.

- Potential: Requires a minimum deposit of $8,000.

- Compounding VIP: Requires a minimum deposit of $15,000.

- Premium VIP: Requires a minimum deposit of $20,000.

- High return VIP plans: Requires a minimum deposit of $30,000.

- VIP Miners: Requires a minimum deposit of $40,000.

Allegedly, each tier is customized to suit various financial capacities and trading backgrounds, enabling traders to choose an account that aligns with their investment objectives and experience.

Nevertheless, it’s imperative for traders to proceed with caution and conduct comprehensive research into Balts Capital’s credibility and regulatory standing before investing their funds, particularly in light of existing doubts surrounding the platform’s legitimacy. Verifying that a broker is regulated by a reputable authority can offer substantial safeguarding for your investments.

Payment Methods

Balts Capital’s preference for cryptocurrency payments is indeed a potential cause for concern. While they claim to offer a variety of convenient payment methods, it appears that they primarily, if not exclusively, accept payments through cryptocurrencies. This practice raises several issues:

- Lack of Reversibility: Cryptocurrency transactions are irreversible. Once a payment is made, it cannot be undone or refunded through the blockchain. In contrast, traditional payment methods like credit cards or bank transfers often allow for disputes to be resolved, and funds to be recovered in cases of fraud.

- Anonymity and Lack of Traceability: Cryptocurrencies provide a higher level of anonymity compared to traditional payment methods. While this can enhance privacy, it also makes it easier for dishonest parties to conceal their identity and evade accountability.

- Volatility: Cryptocurrency values can be extremely volatile, introducing an additional layer of risk to transactions. Market fluctuations can result in significant differences between the amount sent and the amount received.

- Regulatory Concerns: Cryptocurrency payments are not subject to the same level of regulation as traditional financial systems in many jurisdictions. This lack of oversight increases the risk of fraud and scams for users.

The emphasis on cryptocurrency payments by Balts Capital may be interpreted as a strategy to reduce their own risk and accountability, rather than prioritizing customer convenience. Traders and investors should carefully consider these factors and prioritize platforms that offer transparency, security, and a variety of regulated payment methods.

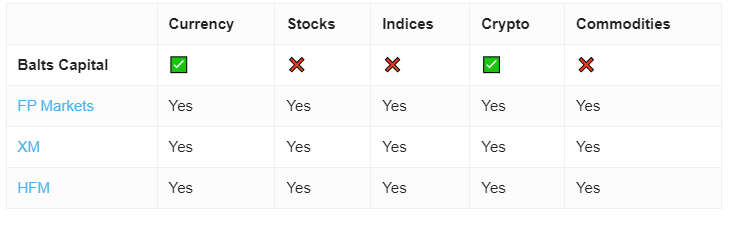

Trading Instruments

Balts Capital presents itself as a platform facilitating trading in forex and cryptocurrencies, aiming to attract traders interested in these dynamic markets. However, considering the earlier mentioned concerns about Balts Capital’s legitimacy, such as its unregulated status and questionable payment methods, traders should exercise caution.

Participating in trading activities on platforms lacking proper regulatory oversight can expose traders to unnecessary risks, including potential fraudulent activities and fund loss.

It’s advisable for individuals keen on trading forex and cryptocurrencies to conduct thorough research and opt for platforms that are transparent, reputable, and regulated by recognized financial authorities. This ensures a safer trading environment and provides traders with protection mechanisms and recourse in case of disputes.

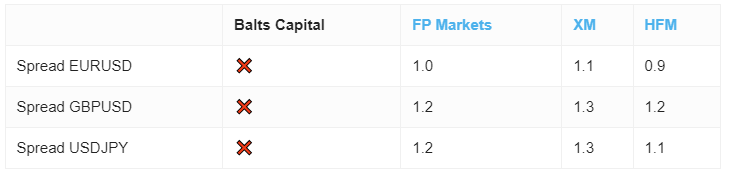

Balts Capital Spread

Balts Capital’s omission of its spreads is yet another warning sign for traders. Spreads, which denote the disparity between the buying and selling prices of a trading asset, play a pivotal role in forex and cryptocurrency trading. They directly influence trading costs and potential profitability.

Transparent disclosure of spreads is vital as it empowers traders to compute potential trading expenses and evaluate a broker’s competitiveness. Reputable brokers typically furnish comprehensive information about their spreads, elucidating whether they are fixed or variable and the trading conditions under which they are applicable. This transparency is indispensable for enabling traders to make well-informed decisions.

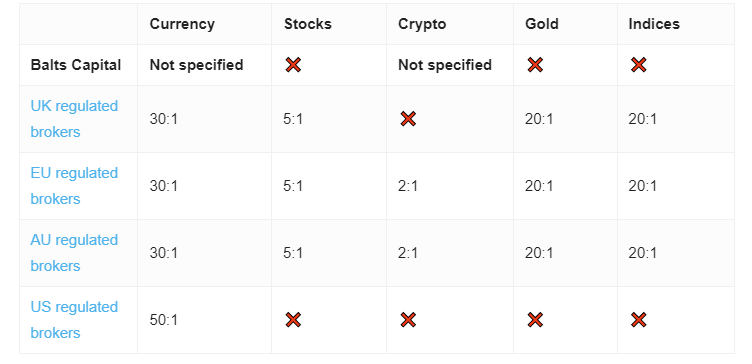

Balts Capital Leverage

Likewise, Balts Capital’s failure to reveal specific leverage details implies a deficiency in its dedication to trader education and risk management. This lack of transparency can impede a trader’s capacity to grasp the inherent risks and devise appropriate trading strategies.

Hence, traders should proceed with caution and give preference to brokers who are forthright and transparent about their leverage terms. Such openness is critical to ensuring that traders can effectively engage with the markets while responsibly managing their exposure to risk.

Balts Capital Withdrawal Requirements

Finally, the ambiguity surrounding the fees and withdrawal prerequisites on the Balts Capital platform poses a substantial concern. Clearness on these fronts is paramount for fostering a transparent and dependable trading environment. Fees linked with trading and financial transactions, alongside the terms governing withdrawals, are pivotal aspects of a trader’s decision-making process. This encompasses comprehending any concealed charges, minimum withdrawal thresholds, processing durations, and any documentation mandated for fund withdrawal.