A-DuoVation portrays itself as a trustworthy and safe broker, offering a platform for trading on financial markets with confidence. However, placing trust in this website would be a grave error. In reality, A-DuoVation is a classic financial scam masquerading as a forex broker. Let’s delve into why it’s imperative to steer clear of A-DuoVation and explore ways to identify a reliable broker instead.

A-DuoVation Regulation

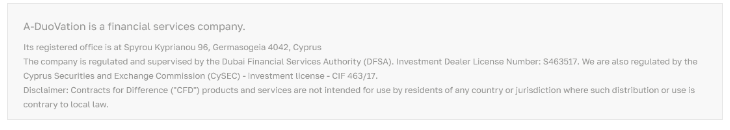

The crucial aspect of any financial services provider is its regulatory standing. Reputable brokers furnish comprehensive details regarding their operating entity, location, authorized jurisdictions, and regulatory oversight. However, upon visiting the homepage of this website, we encounter a declaration asserting that A-DuoVation is both based and licensed in Cyprus, with additional licensing in Dubai. Nevertheless, conspicuously absent is any mention of the company’s name.

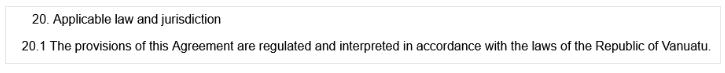

The absence of a company name in the Terms and Conditions is another concerning aspect. Instead, the document specifies Vanuatu, an offshore jurisdiction, as the applicable legal jurisdiction. This lack of transparency regarding the company’s identity and its choice of jurisdiction raises further red flags about the legitimacy of A-DuoVation.

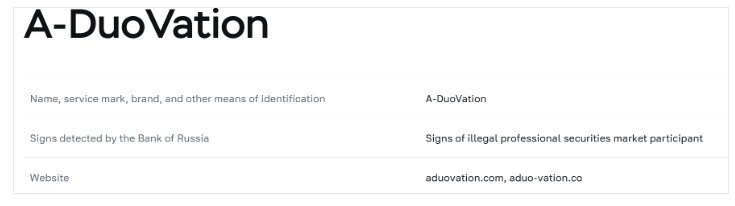

A thorough examination of records from all pertinent financial regulators reveals no licensed broker operating under the name and domain of A-DuoVation in the mentioned jurisdictions. Additionally, it’s noteworthy that the website is predominantly in Russian. The Bank of Russia has issued a cautionary advisory to investors, stating that A-DuoVation is operating unlawfully. These findings strongly indicate that A-DuoVation lacks the necessary regulatory authorization and should be approached with extreme caution, if at all.

Under no circumstances should you entrust your funds to such anonymous websites replete with deceptive and inconsistent information. Instead, consider opting for one of the numerous companies operating under the supervision of reputable regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK.

By becoming their client, you’ll benefit from several assurances, including negative balance protection and fund guarantees in the event of broker insolvency. In the EU, this guarantee extends up to EUR 20,000, while in the UK, it reaches 85,000 GBP. This level of regulatory oversight provides a safer and more reliable environment for your investments.

A-DuoVation Trading Platform

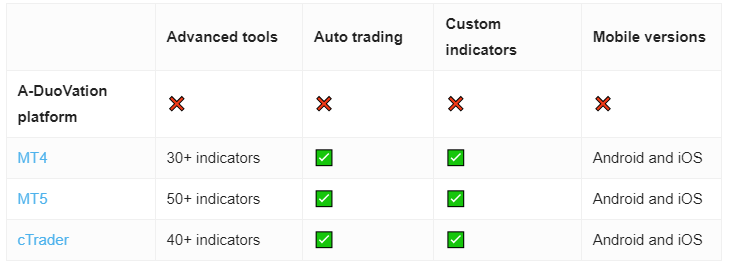

Upon registering an account, users gain access to a rather simplistic web trading platform lacking extensive customization options or advanced features. Interestingly, this platform bears a striking resemblance to ones utilized by several fraudulent brokers we’ve come across in the past. It’s a tactic often employed by scammers who utilize manipulated trading software to deceive victims into believing their funds are genuinely being invested and generating profits. This similarity raises significant concerns about the legitimacy of the platform and underscores the need for heightened vigilance when dealing with such entities.

Opting for the services of a licensed broker grants you access to established software equipped with advanced features and compatibility across various devices and operating systems. Among the most renowned trading platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have solidified their position as industry standards due to their extensive array of features. They offer diverse options for customization, support multiple account usage, enable the creation and implementation of custom scripts for automated trading, and facilitate the backtesting of trade strategies. Choosing a broker that offers these platforms ensures a robust and versatile trading experience.

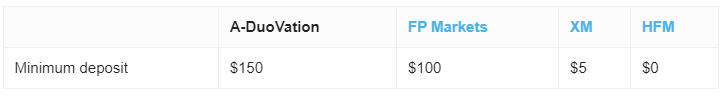

Minimum Deposit

While A-DuoVation sets a minimum deposit of 150 USD, which aligns with industry standards, it’s important to note that this amount could allow you to open a trading account with a reputable and fully licensed forex broker. Many prominent brands in the industry provide Micro and Cent accounts with extremely low entry thresholds, making them ideal for novice investors. Therefore, it’s worth considering alternative brokers that offer more favorable terms and are backed by solid regulatory oversight.

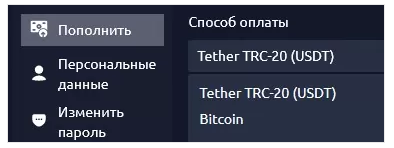

Payment Methods

It comes as no surprise that A-DuoVation exclusively accepts cryptocurrencies as the sole payment method.

The preference for cryptocurrencies as the primary payment method by most financial scammers stems from a couple of key factors. Firstly, cryptocurrencies offer a level of anonymity, making it harder to trace transactions back to individuals or entities. Secondly, once a cryptocurrency transaction is completed, it’s nearly impossible for the defrauded party to request a refund, providing scammers with a layer of protection from potential repercussions.

Trading Instruments

Although A-DuoVation’s trading software claims to include a variety of trading options such as currency pairs, stocks, indices, commodities, and cryptocurrencies, there is little reason to trust that this anonymous website facilitates genuine trading activities. It’s prudent to only invest through diligently licensed and regulated forex brokers to safeguard your interests and mitigate the risk of falling victim to fraudulent schemes.

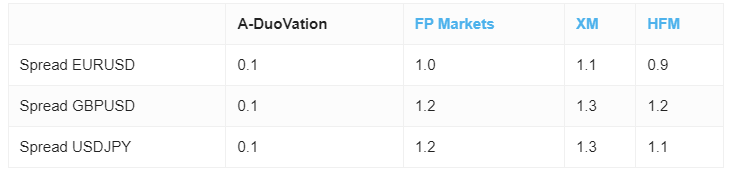

A-DuoVation Spread

The trading platform displayed by A-DuoVation features an unusually low spread of 0.1 pip, suggesting that the broker likely imposes an additional trading commission. Typically, such commissions are levied per lot traded. However, A-DuoVation fails to furnish clear and transparent information regarding the exact fees borne by the trader. This lack of clarity raises concerns about potential hidden costs and underscores the importance of dealing with brokers who provide comprehensive and upfront details about their pricing structure.

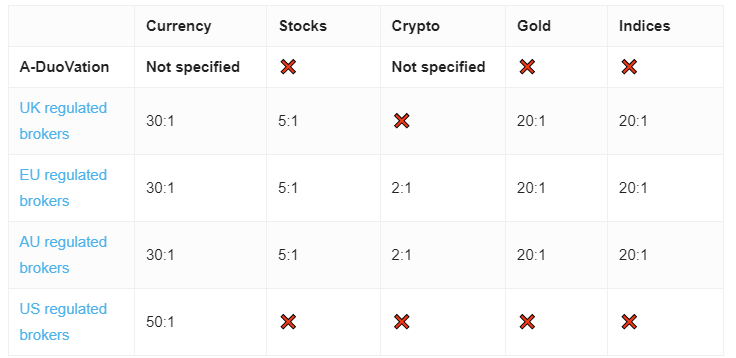

A-DuoVation Leverage

The offering of leverage ranging from 1:100 to 1:500 across various trading accounts by A-DuoVation serves as further indication that this broker is likely not operating legally within the European Union. High leverage provides the potential for greater profits but also amplifies the risk of substantial and abrupt losses. Consequently, leading regulators impose restrictions on leverage for retail traders to mitigate such risks. The absence of such restrictions with A-DuoVation raises red flags about its compliance with regulatory standards and underscores the importance of exercising caution when engaging with such brokers.

Regulated brokers typically provide higher leverage solely to professional clients, who are required to meet stringent criteria in terms of capital and experience. However, in exchange for this privilege, professional clients forgo certain protections enjoyed by retail traders.

If you do not qualify as a professional trader but are willing to accept the risks associated with high-leverage trading, a viable option is to utilize the services of an offshore affiliate associated with an established brand. While this option may still involve risk, it could offer more transparency and reliability compared to unregulated entities like A-DuoVation.

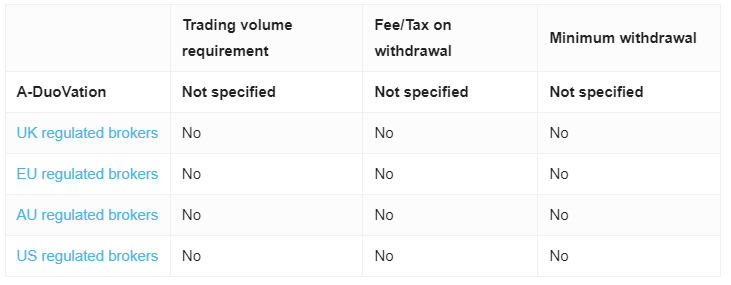

A-DuoVation Withdrawal Requirements

While A-DuoVation may not explicitly outline extraordinary conditions for withdrawals, it’s important to remain vigilant as scams of this nature often employ hidden fees and other tactics to hinder the withdrawal process. These schemes aim to make it challenging for individuals to retrieve their funds, further underscoring the need for caution when dealing with unregulated brokers like A-DuoVation.