Considering these risks, it is highly advisable to exercise caution and steer clear of BITradeCrypto. Opting for brokers that are transparent and comply with regulatory standards is essential for safeguarding your investments.

BITradeCrypto Regulation

When visiting the BITradeCrypto website, several red flags immediately become apparent. The foremost issue is their lack of transparency: they fail to provide a physical address, significantly hampering traceability and accountability. This obscurity poses a serious deterrent for trust in any institution.

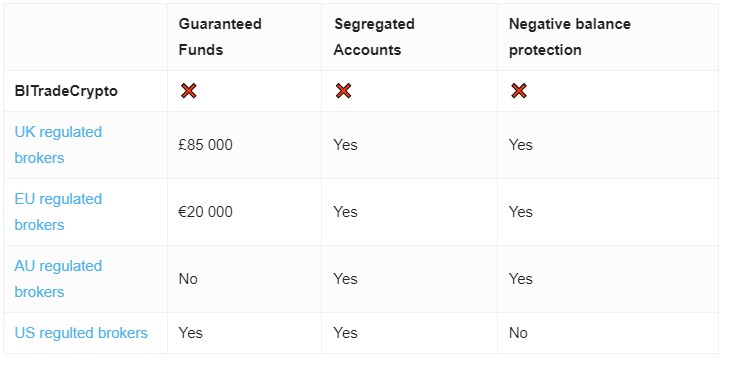

Furthermore, BITradeCrypto operates as an unregulated entity. They lack a legitimate forex license from any recognized regulatory body, posing severe risks to investors. The dangers of investing with an unregulated or offshore broker, especially for those intent on safeguarding their investments, cannot be overstated.

Moreover, BITradeCrypto has been flagged by two major regulatory authorities—Italy’s Commissione Nazionale per le Società e la Borsa (CONSOB) and the UK’s Financial Conduct Authority (FCA)—for its involvement in fraudulent activities. Both have issued stern warnings, categorizing BITradeCrypto as an unauthorized entity operating illegally within their jurisdictions.

Given these serious concerns, we strongly advise against engaging with BITradeCrypto or any similar unregulated and non-transparent brokers. Protecting your financial well-being is paramount, requiring partnership with brokers that are reputable, transparent, and possess a solid track record of safety and security.

BITradeCrypto Trading Platform

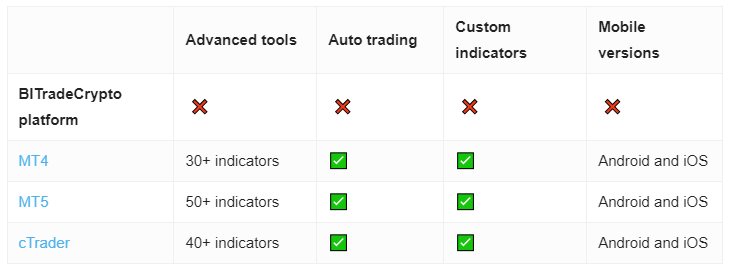

BITradeCrypto offers a generic and notably inadequate web-based trading platform that suffers from serious deficiencies in functionality and trading features. This platform fails to meet the needs of traders seeking a robust and efficient trading environment.

Take a look:

For those seeking a top-tier trading experience, it is crucial to avoid unreliable brokers and underperforming platforms like BITradeCrypto’s. Instead, consider the industry benchmark: the MetaTrader platforms. Renowned for their advanced charting tools and comprehensive array of features, MetaTrader is the globally preferred choice among traders. Its stellar reputation for reliability and comprehensive functionality makes it a far safer and more effective option for anyone serious about their trading activities.

Minimum Deposit

Additionally, BITradeCrypto offers a range of trading accounts purportedly designed to meet the diverse needs and experience levels of its clients. However, each account type is associated with a prohibitively high deposit requirement. The structure is as follows:

- Basic account: Requires £5,000

- Intermediate account: Requires £10,000

- Advanced account: Requires £50,000

- Professional account: Requires £100,000

- Institutional account: Requires £250,000

- VIP account: Requires £500,000

- Millionaire Club account: Requires £1 million

These deposit requirements are exorbitant and illogical for a company that lacks legitimacy and credibility, especially when compared to top brokers in the industry, which typically require no more than $250 to start trading. This stark discrepancy further underscores the risks associated with BITradeCrypto and highlights the need for potential investors to steer clear of such dubious entities. Choosing well-regulated and reputable brokers is crucial for safeguarding one’s investments in the volatile trading market.

Payment Methods

BITradeCrypto accepts payments via credit and debit cards, including Visa and Mastercard. However, given the substantial concerns surrounding the broker’s reputation and reliability, potential investors are strongly advised to exercise caution.

While the acceptance of commonly used credit and debit cards as payment methods might seem convenient, it does not compensate for the broker’s lack of regulatory compliance and transparency. Transactions with such entities could expose users to unforeseen risks, including fraudulent activities and significant financial losses.

Investors should consider these risks seriously and are encouraged to conduct thorough due diligence or consult with financial experts before committing funds to BITradeCrypto or any similarly unregulated firm.

Opting for well-regulated, reputable, and transparent brokers is critical for ensuring financial security and a positive trading experience.

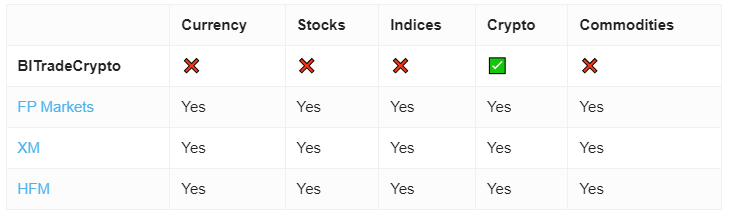

Trading Instruments

BITradeCrypto advertises the ability to trade CFDs on a wide array of assets, including stocks, forex, commodities, indices, and cryptocurrencies. This might appear appealing as it suggests the opportunity for traders to diversify their investments across various markets. However, in practice, their platform restricts users to trading only cryptocurrencies.

This discrepancy between advertised and available options is a significant red flag and further calls into question BITradeCrypto’s transparency and reliability. Additionally, the broker’s lack of regulatory compliance intensifies these concerns.

Given these issues, it is crucial for traders to proceed with caution. Engaging with a broker that exhibits such inconsistencies can lead to substantial risks, including possible financial losses. Traders should prioritize dealing with brokers that not only provide a wide range of trading assets but are also transparent, reputable, and fully regulated to ensure a secure and effective trading environment.

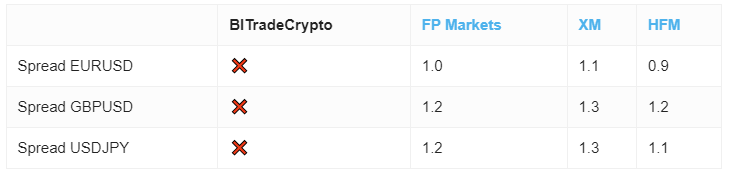

BITradeCrypto Spread

Furthermore, BITradeCrypto claims to offer competitive spreads, which could be attractive to traders seeking cost-effective trading options. However, given the limitations of their platform and the actual unavailability of promised trading instruments—restricted only to cryptocurrencies—this claim is likely dubious.

The inconsistency between their advertised spreads and the reality of their limited platform functionality raises serious doubts about their credibility. For traders, such discrepancies can be misleading and potentially financially damaging.

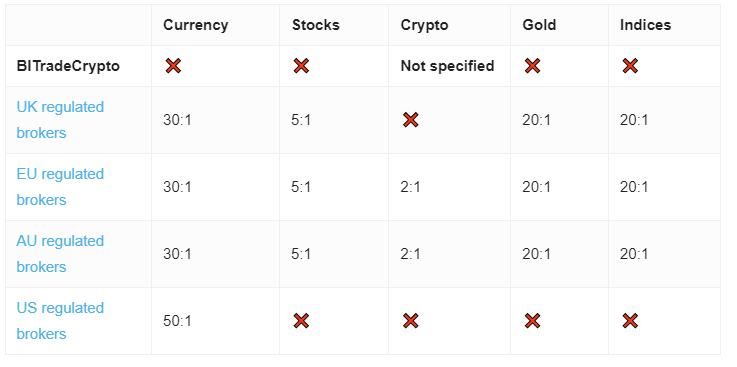

BITradeCrypto Leverage

BITradeCrypto does not disclose the offered leverage on its platform, which is a critical piece of information for traders aiming to understand the potential risks and rewards of their trading strategies. Leverage can significantly amplify both gains and losses, and the lack of transparency regarding its limits is a considerable concern.

This omission is particularly alarming given the already established issues with BITradeCrypto’s transparency and regulatory status. For traders, not knowing the leverage options means entering into trades without fully understanding the potential financial exposure.

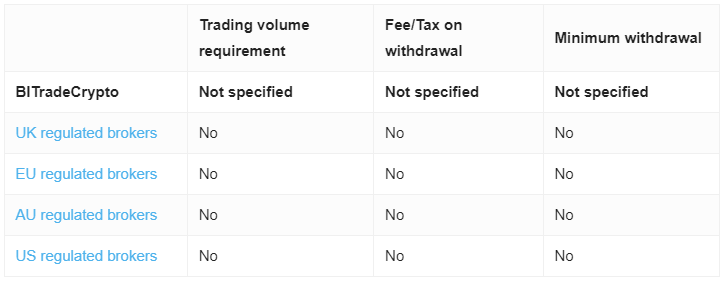

BITradeCrypto Withdrawal Requirements

Lastly, the absence of clear information regarding BITradeCrypto’s withdrawal fees and requirements presents another significant red flag. This ambiguity complicates traders’ ability to understand the full scope of potential costs involved in accessing their funds, which is a fundamental aspect of any financial service provider’s operations.

The lack of detailed disclosures about withdrawal policies not only undermines trust but also highlights the company’s overall lack of transparency and reliability. For traders, such uncertainties can lead to unexpected financial losses and difficulties in managing their investment efficiently.

Given these red flags, it is crucial for anyone considering BITradeCrypto for their trading needs to proceed with extreme caution. Engaging with more transparent, regulated, and reputable brokers is strongly advised to ensure a secure and predictable trading environment.