FX-FLAT’s website claims to be a legitimate broker regulated and authorized, boasting a clientele of over 200,000 satisfied customers. However, FX-FLAT serves as a cautionary tale, highlighting the importance of thorough fact-checking before investing your funds. Upon closer examination, it becomes evident that FX-FLAT does not uphold its purported status, making it unwise to entrust your finances to this entity.

FX-FLAT Regulation

FX-FLAT fails to disclose the name of its parent company or furnish any specifics regarding its regulatory authorization. When registering an account, users are prompted to agree to Terms and Conditions; however, the link to this document leads to a blank page.

A legitimate financial services provider typically furnishes clear and exhaustive details about its ownership, location, and licenses on its website. Authentic brokers also make available a comprehensive array of legal documents. While the presence of such information doesn’t guarantee authenticity, its absence strongly suggests the involvement of fraudulent activities.

Furthermore, FX-FLAT’s website is solely available in Italian, yet the contact address provided is located in Germany. This incongruity raises additional suspicions regarding the legitimacy of the platform.

According to the financial regulatory bodies in Italy and Germany, CONSOB and BaFin respectively, warnings have been issued regarding FX-FLAT’s fraudulent activities, labeling it as a scam.

BaFin warns about fx-flat.com, now redirecting to fx-flat.net, indicating FX-FLAT’s unauthorized imitation of XFlat Bank GmbH. It’s vital to verify a broker’s legality and information accuracy, ensuring registration with the proper regulator and domain approval.

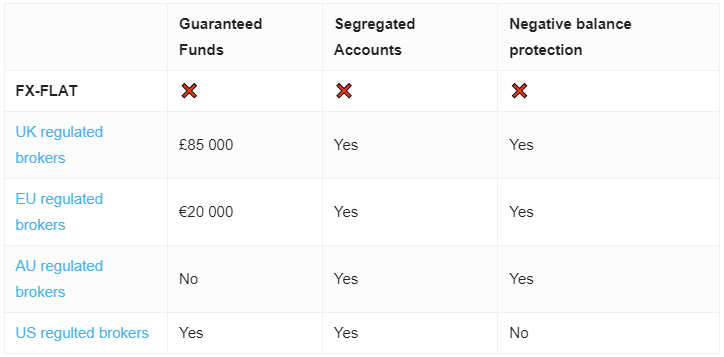

Avoid dubious platforms; opt for CySEC-regulated brokers for benefits like adhering to ESMA requirements, maintaining EUR 730,000 minimum net capital, and segregating client funds from operational ones. CySEC brokers also join the Investor Compensation Fund, covering up to EUR 20,000 per person against insolvency. Moreover, they ensure transparent reporting, bolstering investor protection and market integrity.

FX-FLAT Trading Platform

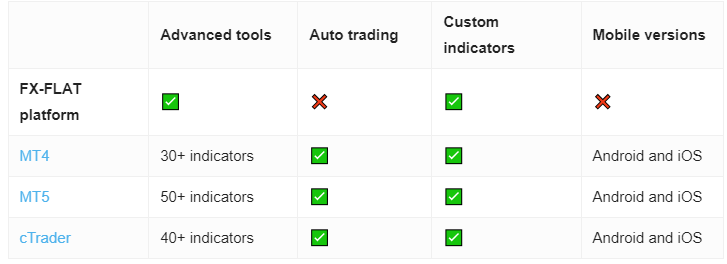

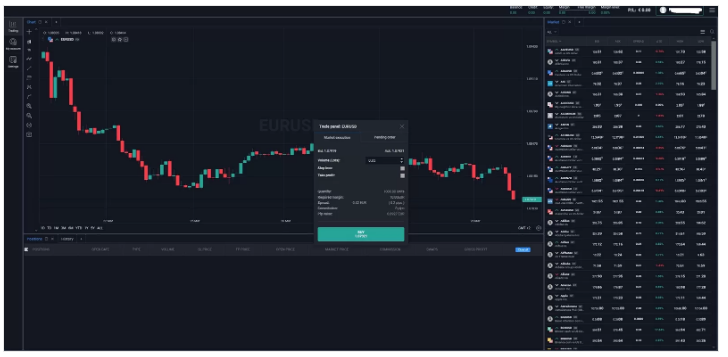

FX-FLAT claims to provide “advanced platforms of superior quality,” yet in reality, it only offers basic web-based software. This platform is identical to those utilized by numerous fraudulent brokers we’ve encountered. Scammers utilize manipulated trading software to deceive victims into believing that their funds are genuinely being invested and even generating profits.

Authentic brokers provide clients with a diverse range of trading software options, encompassing desktop, mobile apps, and web-based platforms. Among the most prevalent and respected platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-known for their robust features, user-friendly interfaces, and extensive capabilities, serving the needs of both novice and experienced traders.

Minimum Deposit

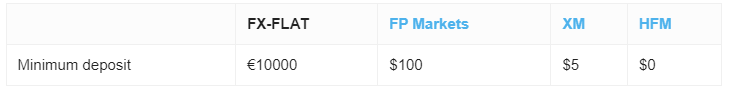

FX-FLAT imposes an exorbitantly high minimum deposit requirement of EUR 10,000. It’s important to note that many leading global brands allow traders to start trading with as little as 100 or even 10 EUR/USD/GBP. This stark contrast in minimum deposit amounts highlights the accessibility and flexibility offered by reputable brokers.

Payment Methods

While FX-FLAT prominently displays logos of popular e-wallets and credit/debit cards on its homepage, the deposit menu itself offers only one option: bank transfer. However, even this option is not readily available, indicating a lack of transparency and potentially deceptive advertising practices.

Experience has revealed that fraudulent brokers often promote traditional payment methods but ultimately guide their potential victims toward cryptocurrency transactions. This tactic not only ensures anonymity for the scammers but also denies defrauded individuals the recourse of requesting refunds or chargebacks.

In contrast, reputable brokers typically provide clients with a diverse selection of transparent payment methods, encompassing bank transfers, credit/debit cards, and established e-wallets like PayPal, Skrill, or Neteller. These options prioritize transparency and offer clients avenues for recourse in case of disputes or fraudulent activities.

Trading Instruments

In theory, FX-FLAT purportedly provides trading opportunities across numerous currency pairs, CFDs on equities, and cryptocurrencies. However, as previously noted, the trading activities offered by this fraudulent website are undoubtedly fictitious. It’s strongly advised to exclusively engage in financial market trading through diligently licensed forex brokers to safeguard investments and mitigate the risk of falling victim to scams.

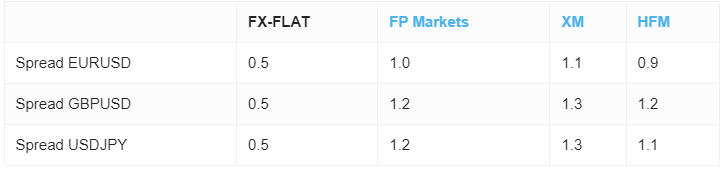

FX-FLAT Spread

In the trading platform, FX-FLAT advertises an exceptionally low spread of 0.5 pips. However, aside from the suspicion of fictitious trading activities, FX-FLAT fails to furnish clear information regarding trading parameters, including the availability of additional commissions.

When visiting a legitimate broker’s website, you’ll find diverse trading account options tailored to different investor preferences. Additionally, detailed descriptions of trading parameters like minimum deposits, order execution methods, tradable instruments, leverage, spreads, swaps, commissions, and more are typically provided. This transparency empowers investors to make informed decisions and ensures clarity regarding the terms and conditions of trading.

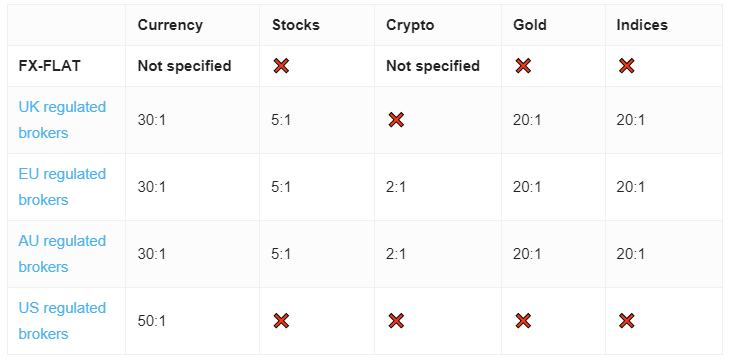

FX-FLAT Leverage

The FX-FLAT trading platform sets a high leverage level of 1:100, which is indicative of a scam rather than a regulated broker operating legally in the European Union.

EU regulators impose strict limits on leverage, typically restricting it to 1:30 for major currency pairs, 1:20 for non-major pairs, gold, and major indices, 1:10 for other commodities and non-major indices, and 1:2 for cryptocurrencies.

Higher leverage levels are only available to professional clients who trade entirely at their own risk. If you don’t qualify as a professional trader but are willing to accept the risks associated with high-leverage trading, the most prudent option is to utilize the services of an offshore affiliate of an established brand.

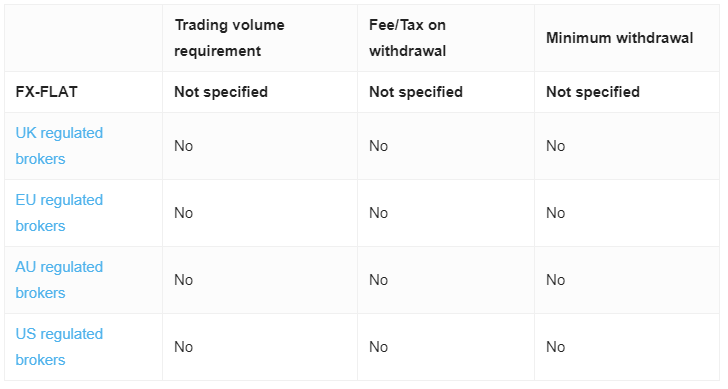

FX-FLAT Withdrawal Requirements

FX-FLAT’s high leverage of 1:100 suggests it’s a scam, as EU-regulated brokers adhere to lower leverage limits. Fake brokers often make withdrawals difficult with hefty fees and unattainable volume requirements.