Prime Assets Pro poorly attempts to deceive individuals by falsely claiming to be a regulated forex broker. Given that this scam preys on those with little to no experience in financial trading, it’s important to examine the evidence proving that it lacks legitimacy as a financial services provider.

Prime Assets Pro Regulation

A major warning sign regarding Prime Assets Pro is its complete lack of transparency on the website. There is no mention of any company name whatsoever, and access to essential legal documents, typical of legitimate brokers, is unavailable.

Prime Assets Pro provides a contact address in the UK, a jurisdiction known for its stringent regulations. Additionally, a certificate image is displayed on the website. However, the document lacks a company name; only a brand name, Wave Pro Trade, is included. This suggests that Wave Pro Trade may be another project associated with the same fraudulent actors behind Prime Assets Pro.

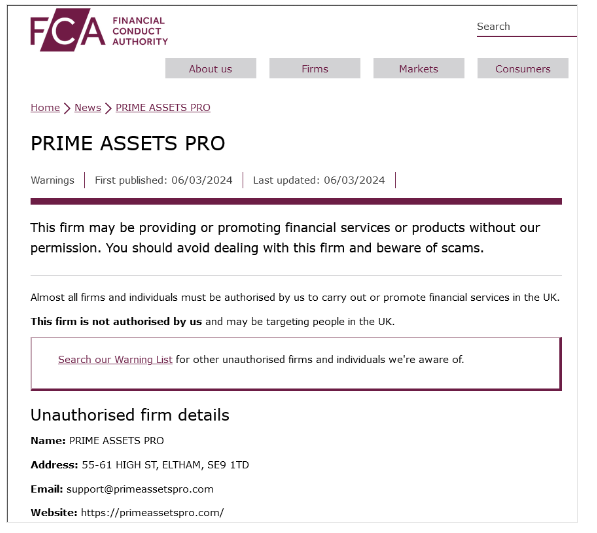

British financial authorities have issued a clear warning explicitly stating that this website is a scam.

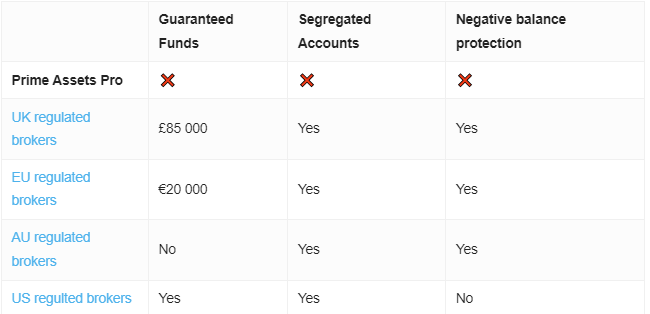

To trade on financial markets safely and avoid scams, consider reputable brokers operating from established financial hubs like the UK. These brokers adhere to stringent requirements set by the Financial Conduct Authority (FCA) for financial stability and operational transparency. They offer clients negative balance protection and participate in a guarantee fund that covers up to GBP 85,000 of a client’s investment in case of broker insolvency. Additionally, these brokers keep clients’ funds separate from their own operating funds in segregated bank accounts.

Trading Platform

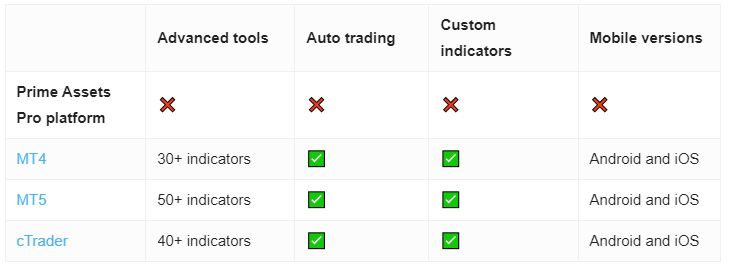

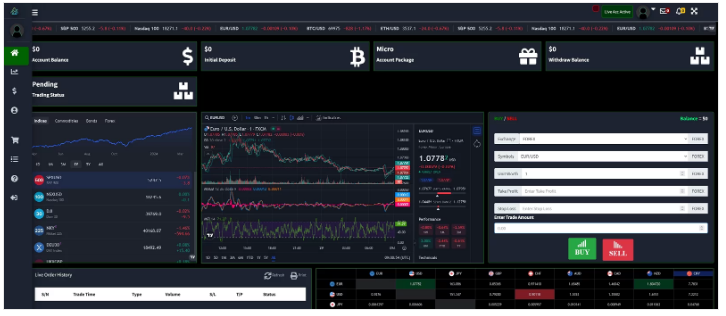

Prime Assets Pro claims to offer MetaTrader 5 (MT5), the widely used trading software in the industry. However, upon signing up for an account, users discover that they are provided access to a web platform that is not MetaTrader. Instead, it’s a substandard imitation of trading software that lacks functionality. This discrepancy serves as additional evidence indicating that Prime Assets Pro is a low-quality scam.

Even if Prime Assets Pro presented a more convincing platform, it wouldn’t make the website credible. Fake brokers often utilize rigged trading software to deceive victims into believing their money is genuinely being invested, when in reality, the entire operation is a sham.

It’s recommended to reach out to one of the many legitimate brokers that offer MetaTrader 5 (MT5) or the still highly popular MetaTrader 4 (MT4). These platforms have earned their reputation as industry leaders due to their extensive range of features, including customizable options, support for multiple accounts, the ability to design and implement custom scripts for automated trading, and the capability to backtest trade strategies.

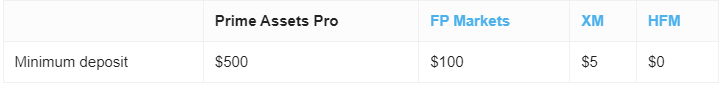

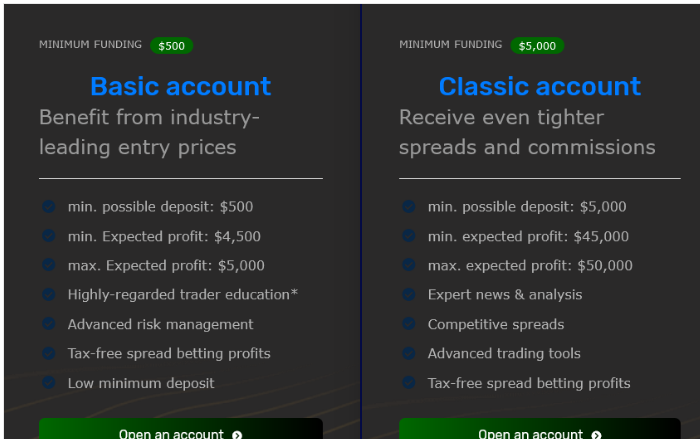

Minimum Deposit

Prime Assets Pro demands a minimum investment of 500 USD. However, it’s worth noting that with some of the industry’s top brands, you can open a trading account for as little as 50 USD or even just 5 USD.

Payment Methods

Prime Assets Pro advertises various payment methods, but upon inspection, only Bitcoin is available. Scammers often favor cryptocurrencies because transactions are irreversible, making refunds impossible. While some legitimate brokers do accept digital currencies like Bitcoin, they typically offer transparent payment options such as credit/debit cards, bank transfers, or popular e-wallets like PayPal, Neteller, or Skrill alongside them.

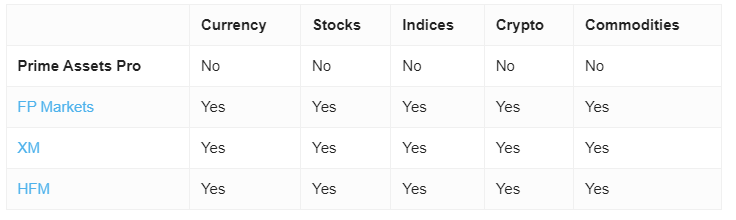

Trading Instruments

Prime Assets Pro advertises trading in all major asset classes, including cryptocurrencies. However, as previously established, this website lacks both the legal authority and the technological capacity to facilitate trading in financial instruments. Additionally, the Financial Conduct Authority (FCA) prohibits brokers licensed in the UK from offering cryptocurrency derivatives trading to retail customers.

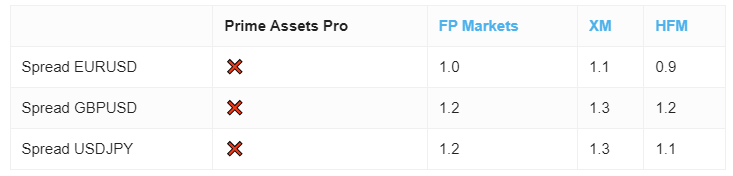

Prime Assets Pro Spread

Prime Assets Pro does not provide any specific information on the terms of trade. Instead, on the website we see promises of secure profits.

A reputable broker will never guarantee you profits as it is impossible to predict market movements with certainty. In fact, regulators mandate regulated companies to caution clients about the inherent risks of losses when trading financial instruments.

When you browse the website of a legitimate broker, you’ll encounter various proposals for different types of trading accounts tailored to investors with diverse preferences. Additionally, you’ll find detailed descriptions of trading parameters such as minimum deposit requirements, order execution methods, tradable financial instruments, leverage options, spreads, swap rates, commissions, and more. This transparency helps investors make informed decisions and manage their risk effectively.

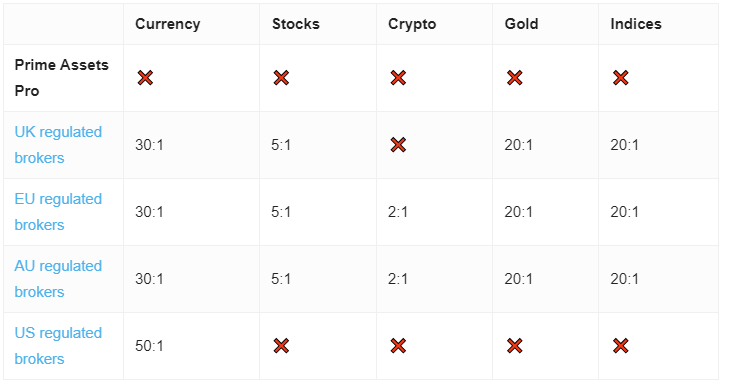

Prime Assets Pro Leverage

High leverage presents the potential for larger profits, but it also amplifies the risk of abrupt and substantial losses. Consequently, leading regulators impose restrictions on leverage for retail traders. For instance, the Financial Conduct Authority (FCA), along with regulators in the EU, imposes a leverage limit of 1:30 for trading major currency pairs, with even lower limits for more volatile assets. Australia follows similar regulations. In the United States, the maximum leverage limit is slightly higher at 1:50.

If you’re willing to accept the risks associated with trading high leverage and wish to take advantage of bonuses and promotions, investing through an offshore division of a reputable brand may be the preferred option. However, it’s crucial to conduct thorough research and exercise caution due to the potential risks involved with offshore trading.

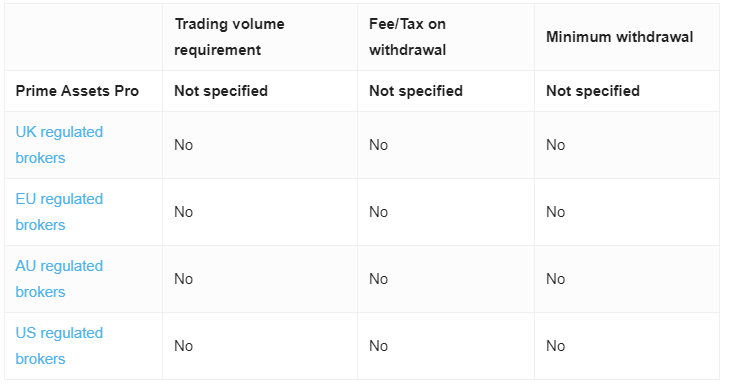

Prime Assets Pro Withdrawal Requirements

The absence of publicly available Terms and Conditions or a Client Agreement raises concerns, as scammers could potentially set numerous traps such as hidden fees and withdrawal terms that are impossible to meet. This lack of transparency leaves users vulnerable to exploitation and underscores the importance of thoroughly understanding the terms and conditions before engaging with any financial service provider.