Globalfxp attempts to deceive individuals by presenting itself as a reputable and reliable forex broker. However, upon closer inspection, it becomes evident that this platform exhibits numerous indicators characteristic of fraudulent schemes. This assessment will outline the reasons why entrusting your funds to Globalfxp is strongly discouraged and will direct you towards genuinely trustworthy financial service providers.

Globalfxp Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Globalfxp | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

Authentic brokers typically display transparent legal details, including their regulatory status, prominently on their website’s homepage. Conversely, on the Globalfxp homepage, there is an absence of even basic company identification.

Globalfxp asserts the existence of offices in the UK and Canada.

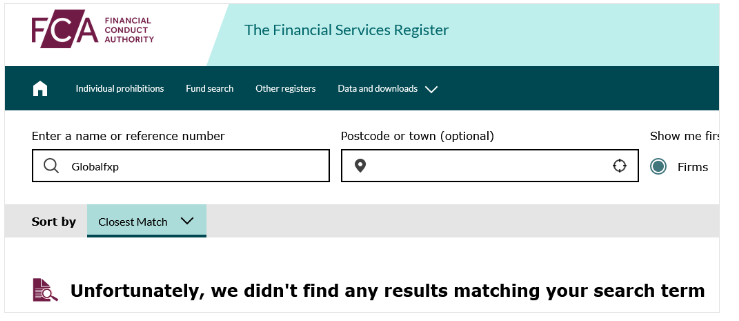

Despite Globalfxp’s claims, no licensed broker under the Globalfxp brand and domain is listed in the records of financial regulators in countries like the UK and Canada. Instead, financial authorities in Spain have issued a warning to investors, highlighting that Globalfxp lacks proper licensing.

According to the Terms and Conditions of Globalfxp, the broker is purportedly operated by Pine Consulting Ltd, which is based in the Marshall Islands. However, it’s important to note that the Marshall Islands lack a financial regulator, making it an offshore jurisdiction. Consequently, offshore brokers like Globalfxp are typically prohibited from offering services in regulated jurisdictions.

When delving into financial investments, it’s imperative to be wary of the abundance of fraudulent brokers prowling the internet. Always conduct thorough checks to ensure the broker you select holds the necessary licenses. Collaborating with a legitimately authorized and regulated entity by institutions like the UK’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Commodity Futures Trading Commission (CFTC) in the US, or Australian Securities and Investments Commission (ASIC) offers numerous advantages. Clients of these brokers enjoy protections such as negative balance safeguards and segregation of their funds from those of the broker.

Trading Platform

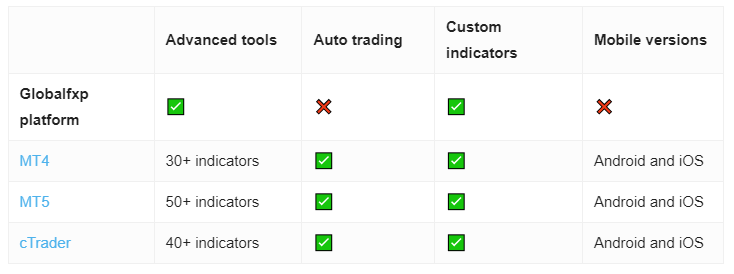

Globalfxp utilizes a web-based trading platform, which, while possessing fundamental order placement functionality, falls short when compared to the comprehensive capabilities offered by MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

It’s essential to recognize that the mere existence of trading software does not assure the legitimacy of a broker. Financial fraudsters frequently employ manipulated trading platforms to deceive victims into believing that their funds are being invested. However, in reality, these trading activities are entirely fictitious, and the funds are funneled directly into the scammers’ pockets.

Minimum Deposit

| Globalfxp | FP Markets | XM | HFM | |

| Minimum deposit | $5000 | $100 | $5 | $0 |

Globalfxp mandates an exceedingly high minimum deposit of 5,000 USD, as indicated in the descriptions of the various trading account types. In contrast, with reputable brokers, you could open a trading account for as little as 50 USD or even less.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

At the time of composing this review, the deposit menu on Globalfxp’s website was inactive, preventing us from determining the available payment methods. It’s worth noting that fraudulent brokers often promote traditional payment methods but ultimately push potential victims towards cryptocurrency transactions. This approach ensures anonymity for the scammers and denies defrauded individuals the ability to request refunds or chargebacks.

In contrast, legitimate brokers typically provide clients with a diverse range of transparent payment options, including bank transfers, credit/debit cards, and reputable e-wallets such as PayPal, Skrill, or Neteller.

Trading Instruments

Globalfxp claims to provide trading services in cryptocurrencies, forex, indices, and equities. However, this raises doubts regarding its status as a licensed broker in the UK, as local financial regulations prohibit trading in cryptocurrency derivatives. Moreover, it’s crucial to highlight that such trading may not be genuine but rather fictitious in nature.

Globalfxp Spread

| Globalfxp | FP Markets | XM | HFM | |

| Spread EURUSD | 0.1 | 1.0 | 1.1 | 0.9 |

| Spread GBPUSD | 0.1 | 1.2 | 1.3 | 1.2 |

| Spread USDJPY | 0.1 | 1.2 | 1.3 | 1.1 |

In the trading platform, we observe a narrow spread of only 0.1 pip. Such a tight spread suggests that the broker may be charging a commission for each trade. However, Globalfxp fails to disclose any details regarding the magnitude of these commissions.

Globalfxp Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Globalfxp | 1000:1 | 1000:1 | 1000:1 | 1000:1 | 1000:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

Globalfxp advertises leverage ratios as high as 1:1000, which raises concerns about its regulatory status. Offering such high leverage indicates that Globalfxp is likely not a regulated broker. While high leverage can amplify potential profits, it also significantly escalates the risk of sudden and substantial losses. Leading regulators, including those in the EU, UK, Australia, and the US, impose limitations on leverage for retail traders, typically capped at 1:30 in the EU, UK, and Australia, and 1:50 in the US. Moreover, this maximum level usually applies only to trading major currency pairs, with even more restricted leverage for volatile assets.

Additionally, Globalfxp’s promotion of bonuses is another red flag. Regulated brokers are prohibited from offering bonuses and promotions due to regulatory restrictions aimed at protecting investors. Scammers frequently exploit promises of generous bonuses to lure potential victims into accepting unfavorable terms and conditions.

Globalfxp Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Globalfxp | Bonus x25 | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Withdrawing funds from Globalfxp can become exceptionally challenging if the account has received a bonus. In such instances, the broker imposes minimum trading volume requirements typically set at 25 times the value of the bonus. This practice serves as a common scam tactic, intended to hinder users from accessing their funds and effectively trapping them within the platform.

Globalfxp Pros and Cons

| Pros | Cons |

| Notning to mention | Fake legal details |

| Unregulated | |

| Blacklisted by the CNMV | |

| Scam bonus terms | |

| Risky leverage ratios |

I have been scammed by this company. What can I do?

Hello Parker, click on this link to get help.

https://mychargeback.com/consultation/?a_aid=151124