ELTM Trading promotes itself as a well-established forex and CFD broker capable of assisting with financial market investments. However, even a cursory review uncovers numerous issues with these assertions. There is no evidence to suggest that ELTM Trading is anything other than an online scam. In this review, we will explain why it is unwise to trust your money with this site and guide you toward more reliable brokers.

ELTM Trading Regulation

When you visit the website of a legitimate broker, you can expect to find clear and detailed information about the owning and operating company, its location, and the regulatory regimes it follows. Licensed financial service providers are also required to provide comprehensive legal documentation.

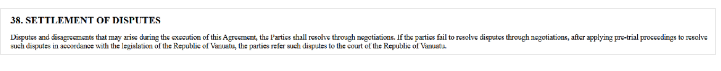

In contrast, ELTM Trading is entirely anonymous. There is no mention of a company name, regulatory license details, or even a contact address. The only document available is the Terms of Use, which references the jurisdiction of Vanuatu, an offshore zone.

We do not find similarly named companies among those registered in Vanuatu. As the website is also available in Russian, we also checked the Bank of Russia’s register. There we found a warning that ELTM Trading is not a licensed financial services provider.

Before investing in financial instruments, it is crucial to ensure you are doing so through a licensed intermediary, not one of the many scammers found online. Never trust your money to anonymous websites filled with false and contradictory information. Instead, consider one of the many companies operating under the supervision of respected regulatory bodies like the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK.

As a customer of these regulated brokers, you will benefit from several guarantees, including negative balance protection and a compensation scheme for your funds if the broker goes bankrupt, up to EUR 20,000 in the EU and GBP 85,000 in the UK. Regulations in the UK and EU incorporate important measures designed to enhance investor protection and promote market integrity and transparency, such as transaction reporting. Regulated brokers are also required to keep their operational funds separate from client funds.

Trading Platform

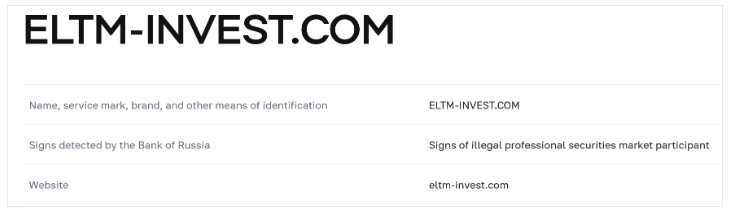

After registering an account we get access to a standard looking web trading platform.

While this platform allows for basic order placement, it falls short compared to the capabilities of MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have become industry standards for a reason. They offer extensive features, including various customization options, multiple account usage, the ability to design and implement custom scripts for automated trading, and the capability to backtest trading strategies.

However, the presence of a trading platform does not make this website more legitimate or guarantee that the broker offers real trading. Many scammers use rigged trading software to deceive their victims into believing their money is being invested.

Minimum Deposit

According to the descriptions of the trading account types, ELTM Trading requires a minimum deposit of $150. For the same or often a lower amount, you could open an account and start trading through a licensed and reputable broker. There is no good reason to risk your money with questionable brokers like ELTM Trading.

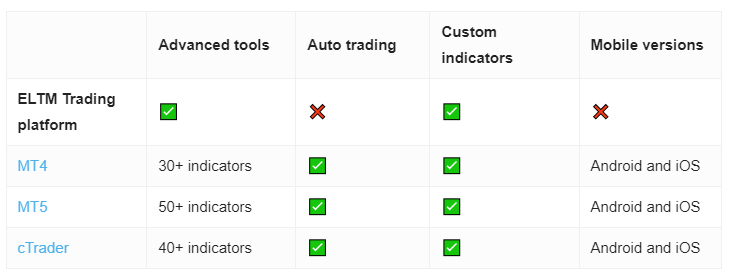

Payment Methods

It was not surprising to find that ELTM Trading only accepts cryptocurrencies as a payment method. This is the preferred option for most financial scammers because cryptocurrencies offer a degree of anonymity and do not allow defrauded individuals to request a refund.

Legitimate brokers typically offer clients a wide choice of transparent payment methods, including bank transfer, credit/debit cards and established e-wallets such as PayPal, Skrill or Neteller. If you’re interested in legitimate brokers that accept digital currency payments alongside conventional methods.

Trading Instruments

ELTM Trading’s trading software includes instruments from all major classes—currency pairs, stocks, commodities, metals, indices, and cryptocurrencies. However, as mentioned, the trading provided by such fraudulent brokers is fictitious. It is in your best interest to invest only through reputable and legitimate companies.

ELTM Trading Spread

We observe a very low spread of 0.9 pips for EUR/USD on the ELTM Trading platform. However, since the trading is not genuine, a seemingly profitable spread is irrelevant. Additionally, ELTM Trading fails to provide detailed information on trading parameters, such as the existence of additional commissions.

ELTM Trading Leverage

ELTM Trading advertises a leverage of 1:100, but their trading platform shows a level of 1:400. Both ratios exceed the limits allowed in most regulated jurisdictions. While high leverage offers the potential for greater profit, it also significantly increases the risk of sudden and substantial losses. Consequently, all leading regulators impose restrictions on leverage for retail traders.

In the EU, UK, and Australia, the maximum permitted leverage is 1:30, and in the US, it is 1:50. These maximum levels apply only to trading major currency pairs, with even stricter limits for more volatile assets. Regulated brokers provide higher leverage solely to professional clients who must meet stringent standards for capital and experience and waive the protections afforded to retail traders. If you don’t qualify as a professional trader but are willing to accept the risks of high-leverage trading, the most viable option is to use the services of an offshore affiliate of an established brand.

Withdrawal Requirements

ELTM Trading does not specify extraordinary conditions for withdrawals. However, scams of this nature often include hidden fees and other tactics that hinder your ability to withdraw funds. These traps are frequently associated with the bonuses they offer.

ELTM Trading Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| False legal details | |

| Blacklisted | |

| Only crypto payments | |

| Risky leverage ratios |