In the fast-moving world of forex trading, you might notice Fidelite because it claims to be a UK-regulated broker. On the surface, they appear reliable and secure, convincing many that they adhere to strict regulatory standards. However, our deep dive into their operations reveals a different story.

We discovered that, despite Fidelite’s claims, they aren’t actually regulated— a significant red flag if you’re considering where to invest. This lack of oversight and accountability makes them a risky choice for traders seeking a safe and trustworthy platform.

If you’re thinking about trading with Fidelite, make sure to read our detailed review to get the full scoop on what’s going on behind the scenes.

Fidelite Limited Regulation

Fidelite might seem like a reputable forex broker with ties to the tightly regulated UK financial market, but it’s important to dig a bit deeper before you jump in. A closer look at their business practices reveals a troubling truth: their claims of UK regulation don’t hold up.

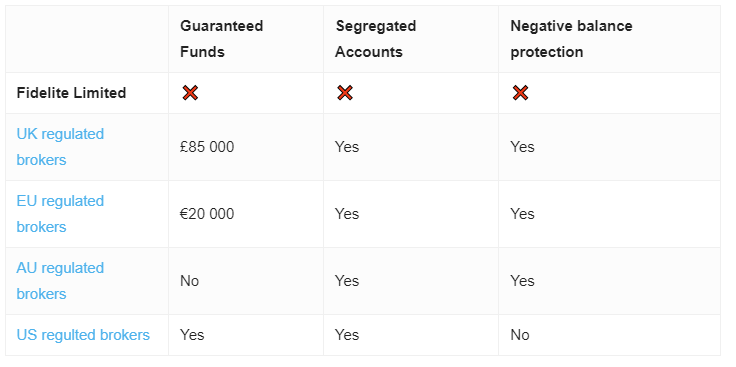

This issue becomes even more serious with an official warning from the UK’s Financial Conduct Authority (FCA). This alert clearly states that Fidelite isn’t authorized to operate within the UK’s jurisdiction. The FCA usually issues warnings following client complaints about dishonest practices, serving as a protective measure to prevent other investors from being misled.

Given these significant red flags, investors should look towards more reliable and legitimately regulated brokers for their trading activities. Choosing a broker that’s properly authorized by a respected regulatory authority, like the FCA, is crucial for the safety of your investments and your overall financial health.

Trading Platform

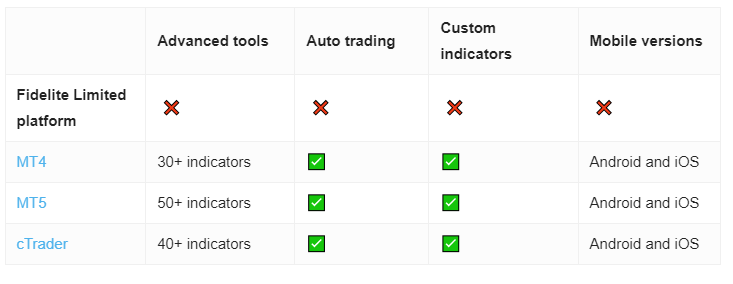

Fidelite doesn’t actually offer a real trading platform; instead, they only provide TradingView-enabled charts, which don’t support actual trading activities.

Have a look:

Luckily, the forex trading world is filled with credible brokers. These companies not only provide access to the renowned MetaTrader platform, but they also emphasize their trustworthiness through strict licensing and regulation. Their strong commitment to investor protection highlights their dedication to maintaining the highest ethical standards in trading practices. This commitment ensures that traders operate in a secure trading environment, fostering trust and transparency within the forex market.

Minimum Deposit

Fidelite’s account offerings come with a wide range of minimum deposit requirements, which could be a concern for potential traders evaluating their options. The deposit structure starts at a manageable $100 for the Beginner account but quickly scales up: $1,500 for the Child account, $8,000 for Standard, $30,000 for Classic, and a hefty $70,000 for the Fabulous account.

While this tiered approach offers variety, it contrasts sharply with the more accessible entry points provided by many well-established brokers in the industry. These brokers often cater to a broader range of traders by offering Micro accounts that traders can open with deposits as small as under $50. This flexibility is particularly appealing to novice traders or those hesitant to make large financial commitments upfront, offering a more gentle introduction to the forex market.

This comparison highlights the importance of carefully evaluating account structures and minimum deposit requirements when selecting a broker, to ensure they match your trading goals and financial capacity.

Payment Methods

Fidelite’s payment methods, as outlined on their official website. They exclusively support cryptocurrency transactions, specifically Bitcoin, Ethereum, Dogecoin, and USDT.

This limitation in payment options could raise concerns among prospective clients who seek transactional versatility. Unlike Fidelite, a broad spectrum of brokers in the market typically embrace a more inclusive approach by accommodating an array of payment methods. These often include traditional options like credit/debit cards, bank transfers, and e-wallets, thereby offering enhanced convenience and accessibility to a diverse clientele. The absence of such flexibility at Fidelite may necessitate careful consideration from users who prioritize a wide range of deposit and withdrawal mechanisms.

Trading Instruments

Fidelite primarily offers trading opportunities in cryptocurrencies, forex, and stocks. For investors looking to diversify their portfolios across a broader range of asset classes, it might be wise to consider other brokers. Seeking out brokers that provide a more extensive selection of markets, including commodities and indices, can better meet the needs of traders aiming for a more comprehensive investment strategy. This approach can enhance portfolio diversification and potentially reduce risk by spreading investments across different types of assets.

Fidelite Limited Spread

Fidelite’s presentation of their spread information has drawn attention due to its lack of specificity. While they assert the provision of ultra-low spreads on their platform, the absence of concrete data or exact figures to substantiate these claims poses a transparency issue. For traders who prioritize clarity and upfront disclosure—particularly regarding trading expenses—this ambiguity can be a significant concern.

In the realm of trading, the openness of spread information is not just a preference but a necessity. It directly influences trading costs, affecting the overall profitability of trading activities. Transparently shared spread details empower traders to make informed decisions, aligning their strategies with cost-effective trading conditions.

Fidelite Limited Leverage

Fidelite does not specify the leverage levels they offer. However, it’s important to note that regulators typically require legitimate forex brokers to cap their offered leverage at safer levels, generally up to 30:1. This regulation aims to protect traders from excessive risk, ensuring a more secure trading environment.

Fidelite Limited Withdrawal Requirements

Lastly, the lack of detailed information on fees and withdrawal conditions on Fidelite’s website raises significant concerns. Transparency in financial dealings, including deposits, withdrawals, and all related charges, is crucial in online trading.

Traders depend on this clarity to manage their finances effectively. Without straightforward disclosure, traders encounter challenges in planning their trading strategies and financial movements, which can negatively impact their overall trading experience and success.

Fidelite Limited Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in the UK | |

| FCA warning | |

| No reliable trading software | |

| Non-transparent trading conditions |