Marketmakers claims to be an award-winning forex broker with nearly twenty years of experience. However, this website serves as a strong reminder to always verify facts before investing your money. In this review, we’ll demonstrate why Marketmakers is simply another online scam and guide you towards reputable brokers for trading in financial markets.

Marketmakers Regulation

If a financial services provider is legitimate, its website will contain clear and detailed information about the company that owns and operates it, its location, and its licenses. Authentic brokers also offer access to a full set of legal documents. While the presence of such information doesn’t guarantee its truthfulness, the absence of it is a strong indicator that you may be dealing with scammers.

The website’s footer claims that the broker is operated by Market Makers Management Ltd., but no contact address or regulatory license details are provided. More concerning is that Marketmakers does not offer access to Terms and Conditions, Customer Agreement, or other binding documents.

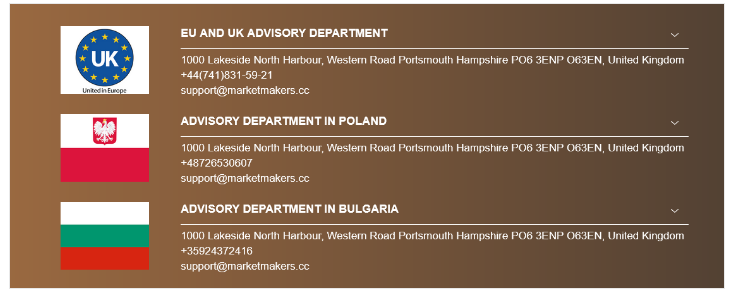

In the “Contacts” section, a UK address is listed, supposedly for “advisory departments” serving the EU, UK, Poland, and Bulgaria.

A check with the financial regulators of the UK, Poland, and Bulgaria reveals that Market Makers Management Ltd is not a licensed broker in any of these countries. In fact, there is no evidence that this company actually exists.

If you plan to invest in financial instruments, be cautious of the numerous fake brokers online. Always thoroughly verify whether the broker you choose has the necessary licenses. Working with a company that is genuinely authorized and supervised by a regulatory institution, such as the UK’s Financial Conduct Authority (FCA) or an EU regulator like the Cyprus Securities and Exchange Commission (CySEC), offers significant benefits.

Trading Platform

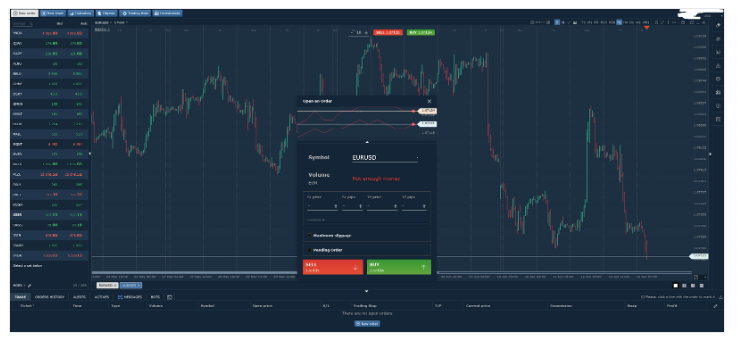

Marketmakers implements web-based trading software. Here is how it looks like:

It’s important to note that having some type of trading software does not guarantee that a broker is genuine. Financial scammers often use rigged trading platforms to deceive victims into thinking their money is being invested, when in reality, the trading is entirely fictitious, and the funds go straight into the scammers’ pockets.

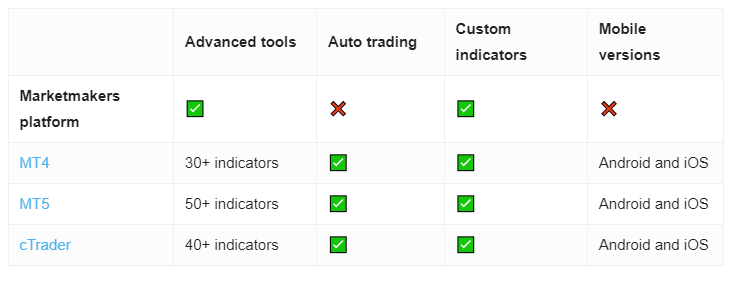

Legitimate brokers provide clients with a wide range of trading software options, including desktop, mobile apps, and web-based platforms. The most widely used platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are considered industry standards due to their extensive features, such as customization options, multiple account usage, custom scripts for automated trading, and backtesting trade strategies.

Minimum Deposit

Marketmakers require an initial deposit of at least 1,000 USD. In comparison, most legitimate brokers require a minimum deposit of 100 USD or often less.

Payment Methods

On the homepage of the website, we see logos of many popular payment methods. However, in the deposit menu, the only options are cryptocurrencies and obscure payment processors that accept only Russian rubles and Central Asian currencies.

Legitimate brokers usually provide clients with a wide range of transparent payment methods, including bank transfers, credit/debit cards, and established e-wallets such as PayPal, Skrill, or Neteller.

Trading Instruments

The Marketmaker trading platform lists currencies, stocks, indices, commodities, and cryptocurrencies. However, as highlighted, the trading on this blatantly fraudulent website cannot be genuine.

Marketmakers Spread

On the trading platform, we observe a spread of about 0.3 pips. This spread suggests that the broker might charge additional commissions per lot traded. However, Marketmakers does not provide any information on these commissions and fees.

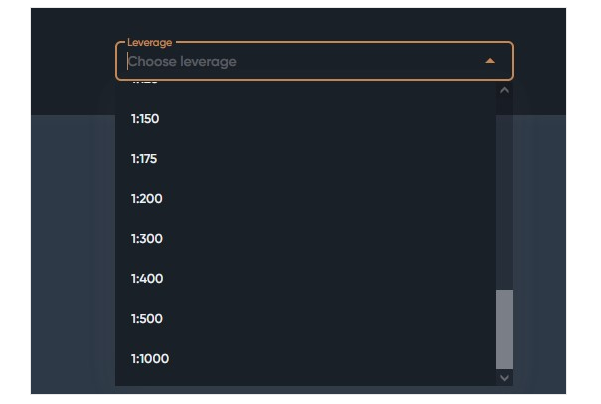

Marketmakers Leverage

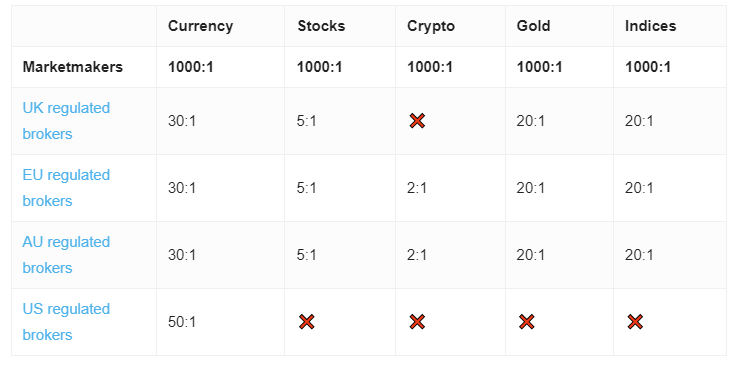

Marketmakers advertises leverage up to 1:100, and you can choose a level up to 1:1000 when registering an account. This is further proof that Marketmakers is not operating legally in the UK and EU, where such high leverage levels are not permitted.

High leverage offers the potential for significant profits but also increases the risk of sudden and excessive losses. Therefore, all leading regulators restrict leverage for retail traders. The FCA, along with EU regulators, limits leverage to 1:30 for trading major currency pairs and to even lower levels for more volatile assets.

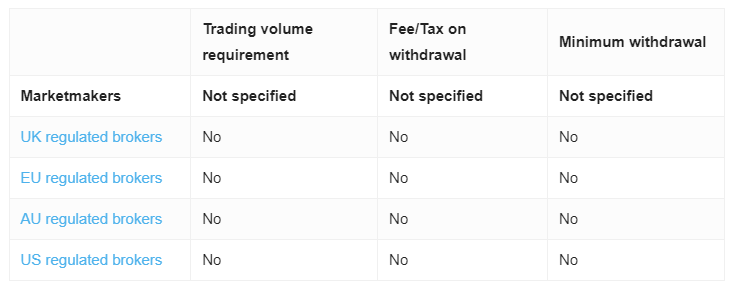

Withdrawal Requirements

The absence of publicly available Terms and Conditions or a Client Agreement suggests that scammers could have set numerous traps, such as hidden fees and withdrawal terms that are impossible to meet.

Marketmakers Pros and Cons

| Pros | Cons |

| Notning to mention | False claims of regulation |

| Fake legal details | |

| No legal documentation | |

| Risky leverage ratios |