Way2Forex presents itself as a legitimate and regulated broker based in the United Kingdom, aiming to attract traders with promises of secure and transparent trading experiences.

However, upon closer inspection, significant discrepancies raise serious concerns about its operations.

Contrary to its claims, Way2Forex operates without any regulatory oversight. This lack of proper regulation is alarming, as it implies that the broker is not subject to the rigorous standards and practices enforced by financial authorities. Consequently, the safety and security of clients’ funds are potentially compromised, and there is a higher risk of unethical trading practices going unchecked.

We encourage you to read our comprehensive review of Way2Forex to gain a true understanding of the broker’s services and the critical issues involved.

Way2Forex Regulation

Way2Forex markets itself as a legitimate and regulated broker based in the United Kingdom, aiming to attract traders with promises of secure and transparent trading experiences.

However, despite Way2Forex’s claims of being headquartered in the United Kingdom and holding a license from the well-known Financial Conduct Authority (FCA), our thorough investigations have revealed that the company is not genuinely regulated by this financial authority.

Furthermore, the FCA has issued a clear warning stating that Way2Forex lacks authorization from them. This lack of proper regulation is alarming, as it indicates that the broker is not subject to the rigorous standards and practices enforced by financial authorities.

Given the serious issues regarding its regulatory status and the inherent risks associated with unregulated brokers, we strongly advise against any involvement with Way2Forex. To protect your hard-earned funds, it is crucial to choose a reputable and regulated broker that prioritizes your safety and provides a secure and satisfying trading experience.

Trading Platform

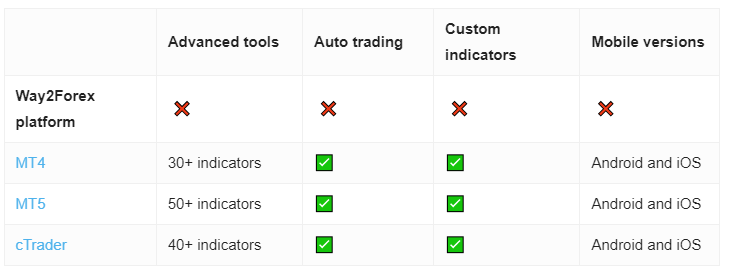

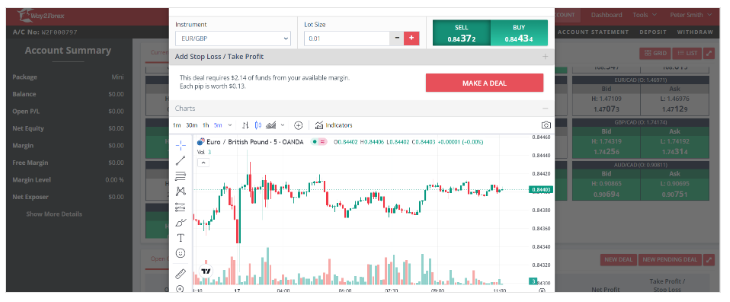

In addition to regulatory issues, Way2Forex fails to offer a genuine trading platform. Our registration and testing revealed that their software lacks essential features and is not worth clients’ time and efforts. Although the platform includes TradingView-enabled charts, it lacks actual trading capabilities, making it ineffective for serious traders.

Here it is:

Given the serious issues regarding its regulatory status, inadequate trading platform, and the inherent risks associated with unregulated brokers, we strongly advise against any involvement with Way2Forex. To ensure the protection of your hard-earned funds and to experience successful and secure trading, it is crucial to choose a reputable broker that offers the widely recognized and highly regarded MetaTrader platforms.

Minimum Deposit

While Way2Forex’s minimum deposit requirement of $10 to open an account may seem affordable, it does not compensate for the broker’s overall unreliability. The low entry cost should not entice traders into a potentially hazardous situation where their funds and personal information are at risk.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

The company’s accepted payment methods are restricted to bank transfer, Mega Transfer, and online payment, which is limited compared to standard payment methods.

Most reputable brokers accept a wider range of options, including credit/debit cards and e-wallets like Skrill and Neteller. This limitation further complicates the process for traders and raises additional concerns about the broker’s legitimacy.

Trading Instruments

According to their website, Way2Forex’s platform offers trading opportunities in Forex, stocks, commodities, indices, and cryptocurrency markets. While this diversity might seem appealing, it is crucial to consider the previously mentioned concerns regarding the broker’s regulatory status and transparency when evaluating their platform.

Way2Forex Spread

We calculated the spreads offered by the company directly from their platform and found the following numbers: 4.3 pips on EUR/USD, 6.4 pips on USD/JPY, and 6.3 pips on GBP/USD. These figures are highly unfavorable compared to the average of 1.5 pips on major pairs offered by most reliable forex brokers.

High spreads can significantly increase trading costs, making it more difficult for traders to achieve profitability.

Way2Forex Leverage

Way2Forex does not furnish details about the leverage options they provide. This lack of transparency can be problematic for traders, as leverage levels are crucial in managing risk and capital. Reputable brokers clearly disclose their leverage offerings to help traders make informed decisions.

Withdrawal Requirements

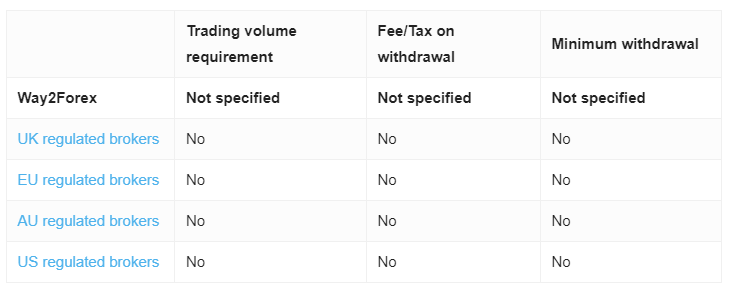

Similarly to their missing leverage options, Way2Forex also lacks transparency in providing specific details about their withdrawal fees and requirements.

This lack of clear information is another major red flag, as it complicates the process of accessing funds and may lead to unexpected charges or difficulties in withdrawing money.

Way2Forex Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in the United Kingdom | |

| FCA warning | |

| No reliable trading software | |

| Non-transparent trading conditions |