Barakah Brokers operates without a license and aims its services towards Russian-speaking individuals. It’s crucial to understand that Barakah Brokers lacks legitimate regulation as a financial services provider. Given its characteristics, we firmly categorize it as one of the numerous scams in this category. This review will thoroughly outline the reasons why it’s advisable to avoid Barakah Brokers and instead opt for reliable and reputable forex brokers.

Barakah Brokers Regulation

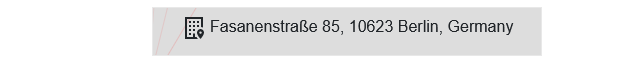

The initial step when assessing a forex broker’s website is to identify the legal entity behind it, its location, and the regulatory framework it operates under. Barakah Brokers, however, maintains complete anonymity, a glaring indicator of its dubious nature. Even within the Terms and Conditions, no company name or relevant jurisdiction is provided. Furthermore, the website is solely accessible in Russian, with only a partial contact address listed in Germany.

The name “Barakah Brokers” does not appear in the register of licensed brokers regulated by the German financial authority BaFin.

Russian financial authorities have taken action by blacklisting Barakah Brokers and cautioning investors that it lacks proper licensing as a broker.

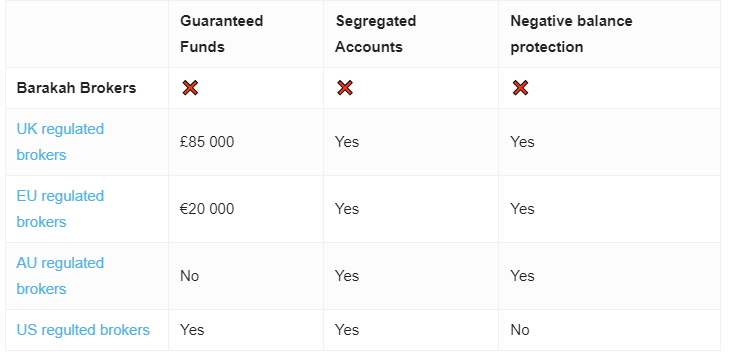

If you’re considering investing in financial instruments, there are far more reliable options available. Depending on your location, it’s advisable to choose a company regulated by reputable institutions such as the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, or an EU regulator like the Cyprus Securities and Exchange Commission (CySEC).

Clients of these brokers benefit from protections such as negative balance protection and the segregation of client funds from the broker’s funds. Moreover, in the EU and the UK, brokers are required to participate in guarantee schemes that cover a certain portion of the trader’s investment in case the broker faces insolvency. These guarantees can amount to up to 20,000 EUR in the EU and 85,000 GBP in the UK. However, the probability of such insolvency is low due to significant net capital requirements imposed by regulators. For instance, companies must maintain EUR 730,000 in the UK and Cyprus, AUD 1,000,000 in Australia, and at least 20 million USD in the United States.

Trading Platform

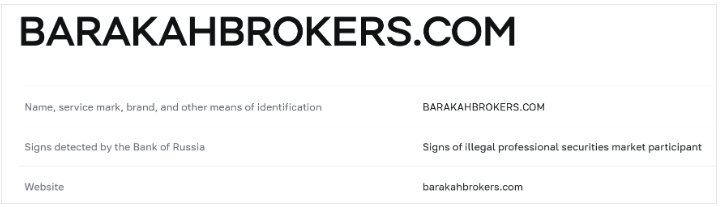

Upon account registration, users gain access to a rather simplistic web trading platform lacking extensive customization features or advanced functionalities. Remarkably, this platform is identical to those utilized by numerous fake brokers we’ve come across. Scammers leverage manipulated trading software to deceive victims into thinking their funds are genuinely being invested and may even show fabricated profits.

Opting for a licensed broker grants you access to established software equipped with advanced features, available across various devices and operating systems. Among the most prevalent trading platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have attained industry-standard status due to their extensive feature sets, encompassing diverse customization options, support for multiple accounts, the ability to create and deploy custom scripts for automated trading, and the capacity for backtesting trade strategies.

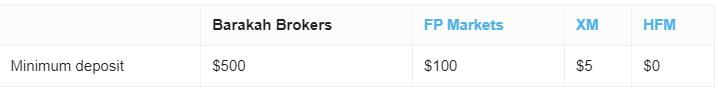

Minimum Deposit

Barakah Brokers mandates a minimum deposit of 500 USD. However, for a fraction of that amount—ten or even a hundred times less—you can open a trading account with some of the prominent brands in the industry.

Payment Methods

Barakah Brokers exclusively provides options for depositing funds through cryptocurrencies and the obscure payment processor PrMoney. This practice is characteristic of financial scammers, as cryptocurrencies offer them a level of anonymity and prevent victims from seeking refunds. In contrast, reputable brokers typically offer clients a diverse selection of transparent payment methods, including bank transfers, credit/debit cards, and established e-wallets such as PayPal, Skrill, or Neteller.

Trading Instruments

Barakah Brokers purportedly provides trading opportunities across all major asset classes. However, given its anonymous and unregulated nature, there’s little justification to trust that this website facilitates genuine trading. Your best course of action is to invest in the financial markets exclusively through duly licensed brokers, ensuring the security and legitimacy of your investments.

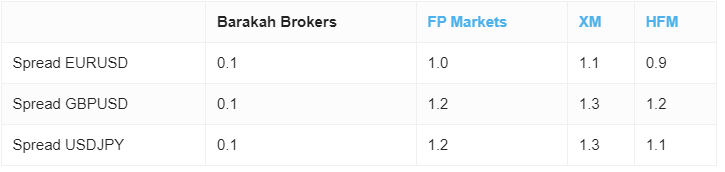

Barakah Brokers Spread

Within the trading platform, a spread of 0.1 pip is observed. Such an exceptionally low spread suggests that the broker likely imposes a commission on trades, typically charged per lot traded. However, Barakah Brokers fails to furnish any details regarding the amount of commissions or other fundamental parameters of trading, raising concerns about transparency and integrity.

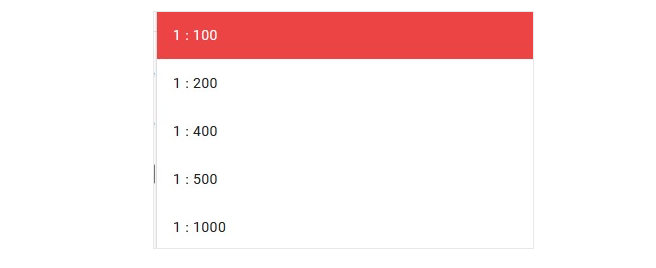

Barakah Brokers Leverage

Offering leverage options ranging from 1:100 to 1:1000 during the account registration process further suggests that Barakah Brokers is not a licensed broker operating under the regulations of Germany or any other reputable jurisdiction.

Trading with high leverage can indeed amplify potential profits, but it also escalates the risk of substantial and sudden losses in equal measure. Recognized regulators impose limits on leverage for retail traders as a protective measure. In regions such as the EU, UK, and Australia, the maximum permissible leverage is typically capped at 1:30, while in the US, it stands at 1:50. Moreover, these restrictions typically apply solely to trading major currency pairs, with even stricter leverage limits for more volatile assets.

If you’re still inclined to engage in high-leverage trading and seek to capitalize on bonuses, promotions, and prize games, your safest bet is to utilize the services of offshore brokers operating under established brands.

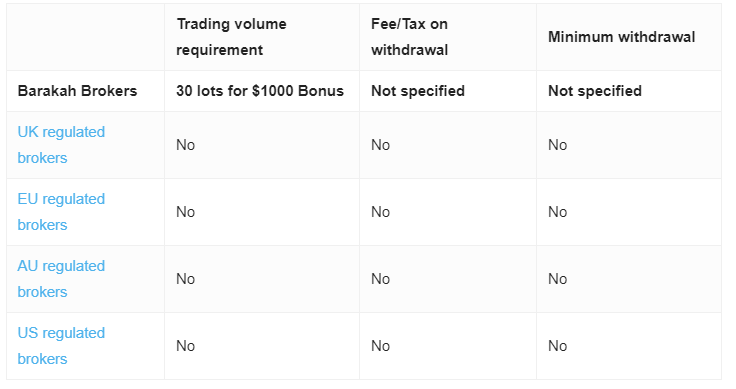

Barakah Brokers Withdrawal Requirements

Accounts that have received bonuses often encounter withdrawal restrictions tied to meeting minimum traded volume requirements. These requirements typically range from 10,000,000 to 30,000,000 currency units for every 1,000 USD bonus, varying depending on the bonus amount. Scammers frequently employ promises of seemingly generous bonuses to ensnare potential victims into agreeing to onerous terms.

Barakah Brokers Pros and Cons

| Pros | Cons |

| Nothing to mention | Anonimous |

| Fake legal details | |

| Blasklisted in Russia | |

| Only crypto payments | |

| Scam bonus terms |