BW Dsux claims to be a regulated financial services provider with accolades like “most honest broker.” However, a simple fact check exposes this as untrue. In this assessment, we’ll demonstrate how to recognize such scams, using BW Dsux as a case study, and direct you towards reputable forex brokers.

BW Dsux Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| BW Dsux | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

The initial aspect to examine on a forex broker’s website is the identity of the legal entity behind it, its location, and the regulatory framework it operates under. While the presence of such information doesn’t guarantee legitimacy, its absence strongly suggests potential fraud.

BW Dsux fails to disclose the operating company behind its brokerage, a glaring indication of fraudulent activity. Even the Customer Agreement lacks a mention of any legal entity. Engaging with a broker without clarity on their identity and terms of service would be a risky move, potentially jeopardizing your funds.

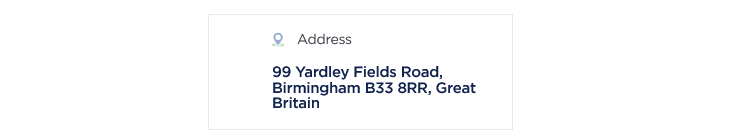

BW Dsux provides a UK contact address:

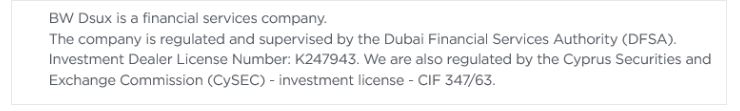

However, contradictory to the lack of disclosed legal entity, the broker’s homepage asserts being licensed by regulators in Dubai and Cyprus:

Elsewhere on the website, it claims that BW Dsux has licenses in even more jurisdictions, including Australia:

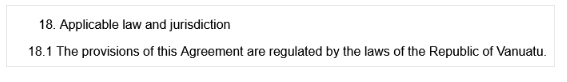

But in the text of the Client Agreement, the applicable jurisdiction referred to is Vanuatu – an offshore zone:

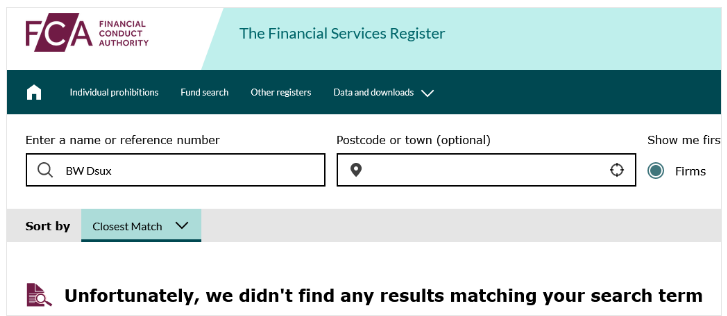

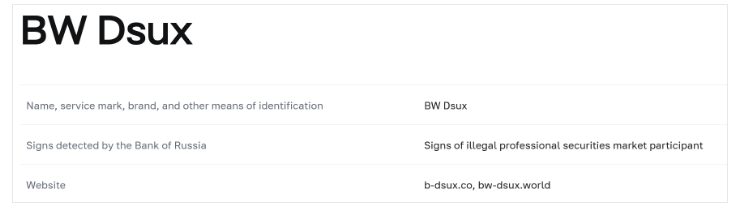

A check of the databases of all the financial regulators listed shows that there is no broker licensed in those jurisdictions using the BW Dsux brand and domains.

The website is predominantly in Russian. Upon checking the Bank of Russia register, a warning is found indicating that BW Dsux is not operating legally.

Trading Platform

BW Dsux utilizes a web-based platform, a common trait shared with numerous similar fraudulent brokers. It’s crucial to understand that the mere presence of a trading platform does not enhance the website’s legitimacy or assure the provision of genuine trading services. Many scammers employ manipulated trading software to deceive victims into believing their funds are being invested legitimately.

Although the platform provides fundamental features for order placement, chart customization, and utilization of technical indicators, it lacks the advanced functionalities found in the industry’s most prevalent trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have become industry standards due to their extensive feature sets, encompassing diverse customization options, multi-account functionality, the ability to create and execute custom scripts for automated trading, and the capability to backtest trade strategies.

Minimum Deposit

BW Dsux mandates a minimum investment of 150 USD. However, for a lower sum, you could open a trading account with a licensed and trustworthy forex broker.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

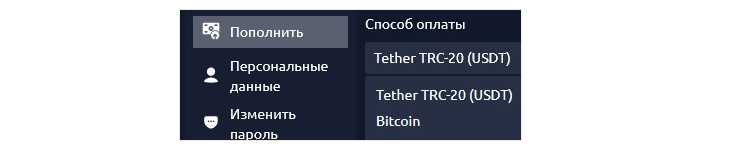

BW Dsux exclusively permits fund deposits through cryptocurrencies. This practice is characteristic of financial scammers, as cryptocurrencies offer them a level of anonymity and prevent victims from seeking refunds.

Reputable brokers usually provide clients with a diverse range of transparent payment options, including bank transfers, credit/debit cards, and well-established e-wallets such as PayPal, Skrill, or Neteller.

Trading Instruments

BW Dsux claims to offer trading in currency pairs, commodities, indices, stocks, metals, and cryptocurrencies. However, as previously mentioned, this trading activity is fictitious. Additionally, brokers legitimately based in the UK are prohibited from offering cryptocurrency trading due to local regulations.

BW Dsux Spread

On the trading platform, we observe an exceptionally tight spread of only 0.1 pip. Such a minimal spread suggests that the broker likely imposes an additional commission. However, without access to essential trading parameters and information, it’s impossible to confirm this or understand other fundamental aspects of trading with the broker.

BW Dsux Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| BW Dsux | 500:1 | 500:1 | 500:1 | 500:1 | 500:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

BW Dsux promotes leverage ranging from 1:100 to 1:500 across various types of trading accounts, indicating further evidence of its lack of regulation.

Trading with such high leverage can potentially lead to increased profits but also escalates the risk of sudden and substantial losses proportionate to the leverage utilized. Major regulatory bodies impose restrictions on leverage for retail traders to mitigate risks. For instance, in the EU, UK, and Australia, the maximum permitted leverage is 1:30, while in the US, it stands at 1:50. These limitations primarily apply to trading major currency pairs, with even stricter leverage caps for more volatile assets.

Regulated brokers typically offer higher leverage solely to professional clients who meet stringent criteria regarding capital and experience, foregoing the protections afforded to retail traders.

If you do not qualify as a professional trader but are willing to undertake the risks associated with high-leverage trading, a more viable option is to engage with the services of an offshore affiliate affiliated with an established brand.

BW Dsux Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| BW Dsux | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

While BW Dsux does not explicitly outline extraordinary conditions for withdrawal, it’s common for such scams to employ hidden fees and other tactics to obstruct clients from retrieving their funds. These traps frequently intertwine with the bonuses offered, creating additional barriers to withdrawal.

BW Dsux Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| False claims of regulation | |

| Blacklisted | |

| Only crypto payments | |

| Risky leverage ratios |