If you’re in search of a dependable forex broker, CavieX doesn’t meet essential standards. The company operates without a valid forex license and is registered in Saint Vincent and the Grenadines, an offshore jurisdiction known for its relaxed regulations compared to reputable financial centers. This absence of strict oversight significantly heightens the risk of potential fraudulent activities.

Our comprehensive review of CavieX provides crucial insights to aid in making an informed decision.

CavieX Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| CavieX | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

As a prudent trader, making well-informed decisions is crucial, and understanding the risks associated with your chosen broker is paramount. In the case of CavieX, their registration in St. Vincent and the Grenadines raises concerns due to the jurisdiction’s relaxed regulations and susceptibility to exploitation by untrustworthy entities. It lacks regulation from any major financial center.

Further amplifying these concerns is an official warning issued by the Comisión Nacional del Mercado de Valores (CNMV) in Spain, which highlights CavieX’s unauthorized status and questionable practices. Such warnings should prompt you to exercise caution and avoid engaging with the company to protect your financial interests.

However, it’s worth noting that the company claims to offer negative balance protection and segregated bank accounts. Negative balance protection is a significant safeguard that ensures traders do not lose more money than they have deposited, even in cases of extreme market volatility. Additionally, CavieX prioritizes the safety of client assets through the segregation of funds. This means that client funds are held in segregated accounts at regulated banks, separate from the company’s operating funds. This arrangement ensures that client money is only used for client trading activities.

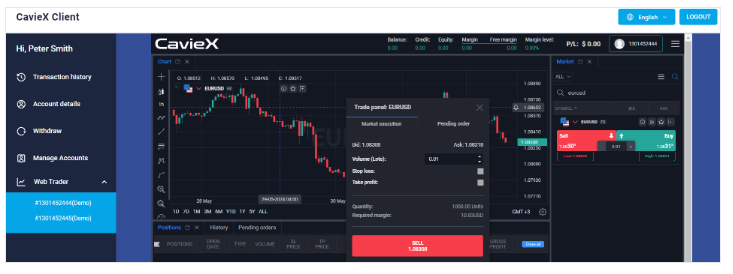

Trading Platform

While CavieX may offer a user-friendly trading platform that’s easy to navigate and accessible on mobile devices, the lack of customer protection is a significant drawback that cannot be ignored. However, it’s worth noting that they do provide a demo account option, allowing traders to test the platform before investing real funds. This can be a valuable opportunity for traders to familiarize themselves with the platform’s features and functionality without risking their capital. Nonetheless, traders should exercise caution and carefully consider the risks associated with trading with a broker that lacks adequate customer protection measures.

Absolutely. For traders aiming to optimize their trading experience, it’s prudent to explore well-regulated brokers that offer industry-standard platforms like MetaTrader. These platforms provide enhanced security and a more robust trading environment, ensuring that your trading activities are both efficient and secure. By choosing a regulated broker and a trusted platform, traders can have greater peace of mind knowing that their funds and personal information are protected, and they can focus on executing their trading strategies effectively.

Minimum Deposit

Indeed, the absence of clear and transparent information regarding CavieX’s minimum deposit requirements for their various account types—such as Active Retail Standard Traders, Professional Traders, VIP, and Corporate Traders—is concerning. This lack of transparency raises questions about the company’s reliability and commitment to providing essential details to potential clients. Clear and upfront information about account types and their associated minimum deposit requirements is vital for traders to make informed decisions about their investments. Without such transparency, potential clients may hesitate to engage with CavieX, as it creates uncertainty and erodes trust in the company’s operations.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

CavieX’s approach to communicating accepted payment methods could potentially raise concerns among its users, particularly those new to forex trading. The company does not clearly list available payment options on its website; instead, it directs users to contact their Account Manager or reach out to the Support Team via email at support@caviex.net for specific details about deposit methods. This lack of direct information on their website may pose several issues:

For many users, especially those who prefer quick and straightforward online transactions, having to initiate personal communication just to obtain basic information about payment options can be inconvenient and frustrating. This extra step might deter potential clients who value efficiency and direct access to information. Ease of access to such essential details is crucial for fostering trust and convenience in the trading process, and the absence of clear communication on payment methods could hinder CavieX’s ability to attract and retain clients who prioritize transparency and efficiency.

Trading Instruments

According to the information provided on their website, CavieX offers clients a diverse selection of tradable assets, including Forex, Stocks, Commodities, Indices, and Cryptocurrencies.

CavieX Spread

CavieX’s trading conditions, particularly the spreads for major currency pairs, raise significant concerns regarding the cost-effectiveness of its forex trading services. Here’s a detailed look at the findings and what they imply for traders:

Spread Analysis for Major Currency Pairs

EUR/USD Spread: The spread for the EUR/USD pair is 2.6 pips, substantially above the industry average of approximately 1.5 pips offered by most established brokers.

GBP/USD Spread: For the GBP/USD pair, the spread is even higher at 3.9 pips, indicating a less competitive pricing structure that could deter traders looking for cost-effective trading options.

USD/JPY Spread: The spread for the USD/JPY pair stands at 3.2 pips, again surpassing the average spread offered by more reliable brokers.

These findings suggest that CavieX’s spreads are notably unfavorable when compared to the broader forex market. High spreads can significantly impact trading costs, particularly for active traders who execute numerous transactions. Traders seeking cost-effective trading options may find CavieX’s pricing structure less favorable compared to other brokers offering more competitive spreads.

CavieX Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| CavieX | Not specified | Not specified | Not specified | Not specified | Not specified |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

CavieX’s approach to disclosing information regarding leverage options may raise potential concerns for traders seeking clarity and transparency in their trading conditions. Unlike many brokers who specify their leverage ratios upfront, CavieX’s policy lacks explicit details. They state only that leverage can be adjusted based on a client’s investment capacity and their ability to minimize margin and stop-out issues.

This lack of upfront disclosure regarding leverage ratios can be problematic for traders who prioritize understanding and managing their risk exposure. Without clear information about leverage levels, traders may find it challenging to make informed decisions about their trading strategies and risk management practices.

Traders considering CavieX should carefully evaluate their tolerance for uncertainty regarding leverage and consider whether the potential benefits of trading with the broker outweigh the risks associated with the lack of transparency in leverage disclosure.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| CavieX | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

CavieX’s handling of information concerning withdrawal policies, especially regarding fees and requirements, raises valid concerns about transparency and may affect the overall trustworthiness of the platform. This lack of detailed disclosure could significantly impact a trader’s decision-making process and overall experience.

Withdrawal policies are a critical aspect of a forex broker’s service. They influence how easily traders can access their funds and understand the costs associated with trading. Without clear and comprehensive information about withdrawal fees, processing times, and any additional requirements, traders may feel uncertain about the reliability and fairness of the platform.

Transparency in withdrawal policies is essential for building trust between the broker and its clients. Traders need to have confidence that they can easily withdraw their funds without encountering unexpected fees or delays. Therefore, CavieX should prioritize providing clear and detailed information about their withdrawal policies to ensure transparency and enhance the overall trading experience for their clients.

CavieX Pros and Cons

| Pros | Cons |

| None | Unregulated in any major financial jurisdiction |

| CNMV warning | |

| Offshore registration | |

| Non-transparent trading conditions | |

| Non-transparent deposit/withdrawal methods |