To safeguard your financial well-being and prevent potential fraud, it’s vital to be cautious when dealing with CrpTrade, a forex broker operating without regulation and anonymously.

Our thorough evaluation offers important information about CrpTrade’s activities, empowering you to make informed choices before investing any money.

CrpTrade Regulation

When evaluating CrpTrade, it’s crucial to take heed of various red flags that may signal potential risks. Firstly, the absence of essential contact details on their website raises doubts about their transparency and legitimacy. Additionally, CrpTrade operates without proper regulation or oversight from any established financial regulatory body, further raising concerns about their practices.

These concerns are exacerbated by a public alert from the Commissione Nazionale per le Società e la Borsa (CONSOB) in Italy, which has highlighted CrpTrade’s unauthorized activities in the country and their use of deceptive tactics.

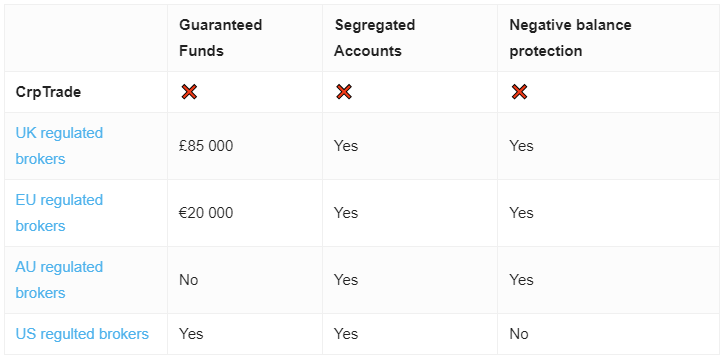

For your financial security, it’s strongly advised to steer clear of unregulated firms and instead opt for brokers holding valid forex licenses from reputable authorities in jurisdictions like the UK, Australia, the EU, or the US. These licenses ensure that brokers adhere to rigorous regulatory standards aimed at safeguarding investors.

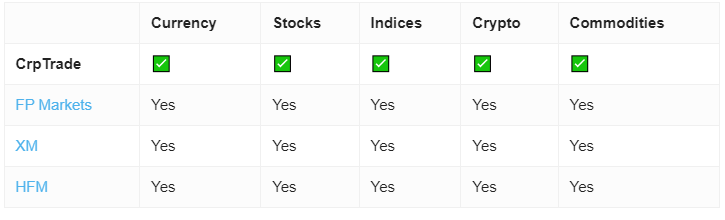

To facilitate a safer decision-making process, consider referring back to the provided table listing some of the most trustworthy and well-regulated brokers in the market. Prioritizing these options can help protect your investments from unregulated entities such as CrpTrade.

CrpTrade Trading Platform

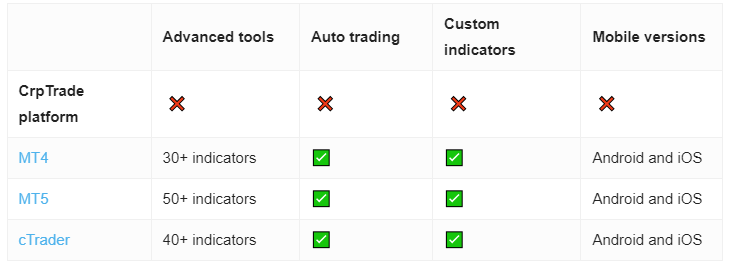

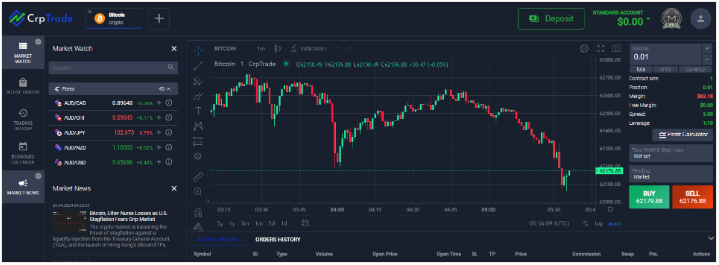

The web-based trading platform offered by CrpTrade is worrying due to its lack of essential functionality crucial for effective trading. The software seems to be merely superficial, lacking the necessary support for actual trading activities. This deficiency serves as a major warning sign for individuals seeking to engage in serious trading.

To safeguard your funds and ensure a robust trading experience, it’s advisable to select a reputable broker paired with dependable trading software. Industry-standard platforms like MetaTrader 4 or MetaTrader 5 are highly recommended options. Renowned for their extensive features, these platforms offer advanced charting tools and a diverse range of technical indicators. Opting for such platforms can establish a more reliable and efficient trading environment, bolstering your capacity to execute and oversee trades effectively.

Minimum Deposit

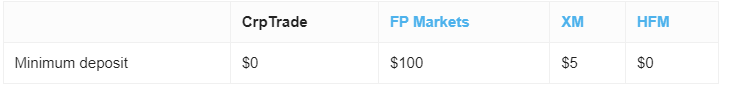

CrpTrade promotes various account types with varying minimum deposit requirements, which might seem attractive initially but merit closer examination due to concerns surrounding the broker. These account tiers range from a “Main” account with no initial deposit requirement to higher-tier accounts demanding significant investments:

- Bronze: $2,500 minimum deposit

- Silver: $10,000 minimum deposit

- Gold: $25,000 minimum deposit

- Platinum: $50,000 minimum deposit

- VIP: $100,000 minimum deposit

These structured account options suggest an approach tailored to different trader levels. However, given the absence of regulatory oversight and issues with the trading platform, potential investors should exercise caution. The high minimum deposit requirements for the upper tiers could entail substantial financial risks, particularly if the broker’s legitimacy and ability to offer secure and efficient trading conditions are uncertain. Always ensure that any broker you consider is regulated and reliable before committing significant funds.

Payment Methods

CrpTrade reportedly provides a limited array of payment methods, primarily Credit/Debit cards and cryptocurrencies. This restriction may hinder traders’ flexibility in managing their funds and raise concerns about platform accessibility and convenience.

Considerations for Limited Payment Methods:

- Credit/Debit Cards: While these are known for their convenience and quick transactions, relying solely on them may be restrictive if traders typically prefer or require additional payment options for withdrawals and deposits.

- Cryptocurrencies: Supporting cryptocurrency transactions can attract traders interested in digital currencies. However, the volatile nature of cryptocurrencies, coupled with their semi-anonymous features, could introduce additional risks and complexities, especially within a platform lacking clear regulatory compliance.

Given the limited payment options and the uncertainties surrounding CrpTrade’s regulatory status and platform functionality, traders should exercise caution. It’s advisable to opt for brokers offering a broader range of reliable and recognized payment methods to ensure flexibility and security in financial transactions.

Trading Instruments

Reportedly, CrpTrade’s trading software provides a diverse array of trading instruments, encompassing Stocks, Forex, Indices, Cryptocurrencies, Commodities, and Metals.

CrpTrade Spread

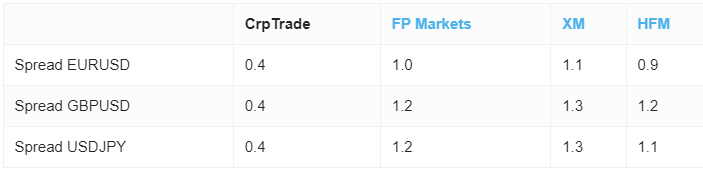

The analysis suggesting that CrpTrade offers relatively low spreads for major currency pairs could initially attract Forex traders. For instance, spreads as narrow as 0.4 pips for popular pairs like EUR/USD, GBP/USD, and USD/JPY are competitive and can potentially decrease trading costs, thus boosting profitability.

However, the absence of regulatory oversight, as previously noted, poses significant risks that may outweigh the benefits of low spreads. Without proper regulation, the safety of funds and fair trading practices cannot be guaranteed. Moreover, even if the spreads are appealing, the overall reliability of the trading platform—including factors like execution speed, downtime, and available features—is critical.

Considering these factors, while CrpTrade’s low spreads on major currency pairs may appear advantageous, it’s essential for traders to conduct thorough due diligence and assess all aspects of the broker’s services and reputation before engaging in trading activities.

CrpTrade Leverage

CrpTrade’s offer of high leverage, reaching up to 1000:1, may indeed seem appealing to traders aiming for substantial profit potential with relatively small capital investments. However, this heightened leverage level carries significant risks, especially when provided by a broker lacking negative balance protection.

It’s important to note that well-regulated brokers in jurisdictions such as the EU and the UK are obligated to limit leverage to 30:1 for retail clients. This regulatory measure is intended to safeguard traders from the risks associated with excessive leverage. The fact that CrpTrade provides leverage up to 1000:1, far surpassing these established limits, suggests that it operates beyond the confines of these stringent regulatory frameworks.

CrpTrade Withdrawal Requirements

The option to request a withdrawal of any remaining balance from your trading account without limitations is undoubtedly a valuable feature for traders, providing them with significant control over their funds. However, it’s important to note that the broker does not specify whether any withdrawal fees apply.

CrpTrade Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Anonymous broker | |

| CONSOB warning | |

| No reliable trading software | |

| Non-transparent withdrawal fees |