CryptoAdviser presents itself as a trustworthy brokerage firm located in the United Kingdom, yet its outward image may not reflect its true nature. In actuality, the company operates without any regulatory supervision, posing serious concerns regarding the safety of client investments and the transparency of their trading services.

To safeguard your financial assets, it is wise to steer clear of any involvement with CryptoAdviser.

In the realm of trading, it’s crucial to emphasize the importance of partnering with a regulated broker dedicated to transparency.

These standards are crucial for ensuring a secure and dependable trading environment.

CryptoAdviser Regulation

Despite claiming regulatory compliance in the UK, CryptoAdviser operates without any regulatory oversight in any jurisdiction, including the UK. Adding to the concern, Italy’s respected financial regulator, the Commissione Nazionale per le Società e la Borsa (CONSOB), has publicly warned against CryptoAdviser’s fraudulent activities, identifying the firm as an unauthorized entity engaged in deceitful practices. This authoritative warning highlights the significant risks associated with interacting with CryptoAdviser.

In summary, the risks associated with CryptoAdviser are significant and should be treated seriously.Prioritizing the safety of your investments is paramount. Dealing with unregulated and unauthorized entities like CryptoAdviser compromises this safety. Ensuring the security and integrity of your financial dealings requires conducting transactions with entities that are properly regulated and authorized.

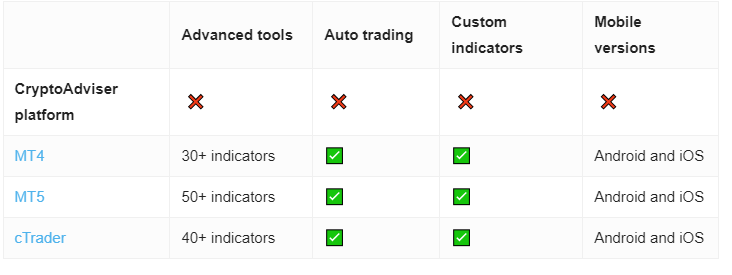

CryptoAdviser Trading Platform

CryptoAdviser offers a simplistic web-based trading platform, lacking the advanced trading functionalities found on more sophisticated platforms like MetaTrader.

Have a look:

Therefore, a wiser strategy would involve seeking a reputable forex broker that not only provides an efficient and user-friendly trading environment but also allows the testing of strategies through demo accounts before committing financially.

It’s crucial to bear in mind that the market offers numerous trustworthy brokers who grant access to respected platforms like MetaTrader. These brokers adhere to rigorous licensing and regulatory criteria, guaranteeing the safety and security of investor interests. Partnering with such brokers can greatly improve the trading experience while protecting your investments.

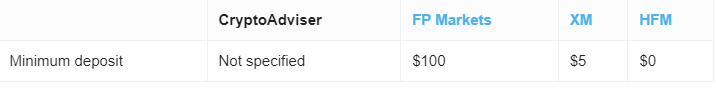

Minimum Deposit

CryptoAdviser presents potential clients with a range of account options, including Standard, Silver, Gold, and Platinum accounts. However, the company does not disclose the minimum deposit requirements for each account type, leaving potential investors uncertain about the financial commitment required to begin trading.

It’s worth noting that in the forex industry, a standard initial deposit typically falls below $250. The lack of transparency from CryptoAdviser regarding their account deposit requirements may raise concerns for prospective clients seeking clear and upfront financial information. Traders should take this into account when assessing the credibility and appropriateness of the broker for their trading requirements.

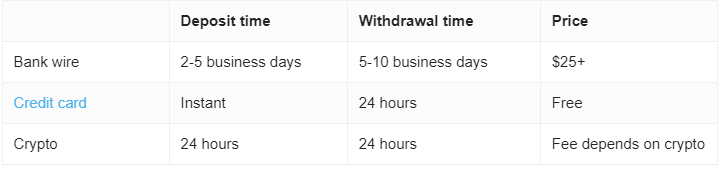

Payment Methods

CryptoAdviser offers support for various payment methods, encompassing cryptocurrencies like Bitcoin, wire transfers, and credit/debit cards (Visa and Mastercard). This assortment of payment options holds significance for traders who value having multiple avenues for managing their investment endeavors.

This array empowers traders to select the payment method that aligns with their financial management preferences, providing flexibility in funding their accounts or withdrawing returns. This flexibility can be especially attractive in a dynamic trading setting where the smooth execution of transactions plays a pivotal role in shaping overall investment strategies.

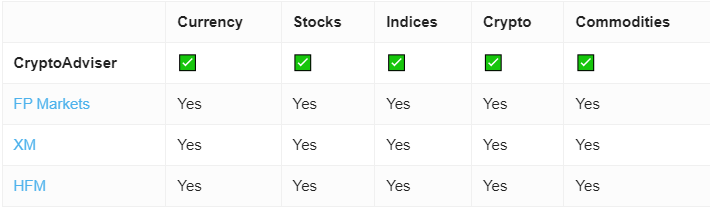

Trading Instruments

Additionally, as indicated on their website, CryptoAdviser presents a comprehensive selection of investment classes, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies. This extensive array of options enables traders to diversify their investment portfolios across multiple asset types, potentially mitigating risk and optimizing returns.

The availability of such diverse offerings is advantageous for traders seeking to participate in various markets through a unified platform. This enriches their trading journey by granting access to global financial markets, thereby enhancing their overall trading experience.

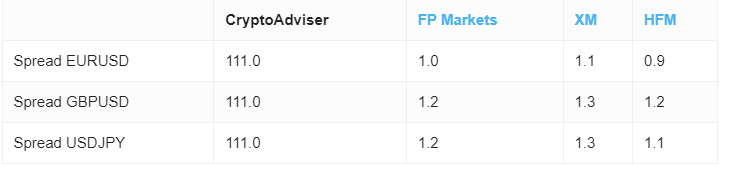

CryptoAdviser Spread

After conducting thorough analysis, we discovered that CryptoAdviser’s spreads are unusually high, with figures such as 111.0 pips on major currency pairs like EURUSD, GBPUSD, and USDJPY. Such inflated spreads deviate significantly from industry standards, where average spreads on these major pairs typically hover around 1.5 pips. This substantial disparity raises significant doubts about the legitimacy of the platform.

The significant variance in spreads suggests that the platform may lack authenticity and could potentially be designed to exploit unsuspecting traders. Therefore, investors should exercise caution and conduct thorough research before engaging with platforms displaying such irregularities.

CryptoAdviser Leverage

Furthermore, CryptoAdviser provides a notably high leverage of up to 500:1, indicating that the company is likely not regulated in the United Kingdom. Regulatory standards typically mandate legitimate brokers in the UK to limit their leverage to 30:1. While this elevated leverage may amplify profit potential, it also significantly heightens the risk of substantial losses, a factor that may raise red flags for individuals familiar with the stringent leverage restrictions imposed by reputable regulatory bodies.

The absence of detailed information concerning leverage—a fundamental aspect of trading that profoundly influences both potential gains and risks—complicates the evaluation of CryptoAdviser’s trading conditions and competitiveness.

Traders seeking to formulate a thorough and well-informed trading strategy should carefully weigh the lack of transparency regarding such a pivotal trading parameter when assessing the suitability of CryptoAdviser as a trading partner.

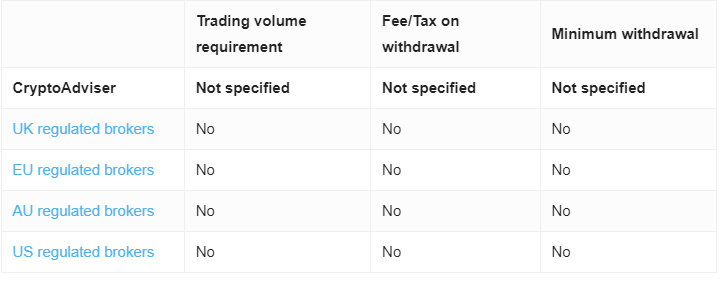

CryptoAdviser Withdrawal Requirements

Finally, although the website indicates that it typically processes withdrawal requests within a few days, the lack of detailed information regarding fees and minimum withdrawal amounts may lead to unexpected costs or limitations that traders are not prepared for.

For individuals contemplating trading with CryptoAdviser, this deficiency in clear and upfront financial information should be a significant factor to consider, as it influences the overall convenience and practicality of withdrawing profits from the platform.

CryptoAdviser Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in the UK | |

| CONCOB warning | |

| No reliable trading software | |

| Non-transparent trading conditions |