The ES Invests website claims to be a gateway to global trade, but a simple fact check reveals it is not a licensed forex broker. It is merely another online scam preying on inexperienced traders. In this review, we will guide you on how to distinguish these scams from legitimate financial service providers.

ES Invests Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| ES Invests | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

ES Invests fails to disclose the company behind the website. Even the legal documents lack a company name, contact address, or applicable jurisdiction.

Legitimate forex brokers provide transparent and detailed information about the owning and operating entity, including its location, licenses, and regulatory oversight. The absence of such details or their improper presentation is a clear red flag indicating a potential scam.

Furthermore, the website sporadically displays a different brand name, Investrpt Capita, suggesting it may be a leftover from another project by the same scammers inadvertently included on the ES Invests site.

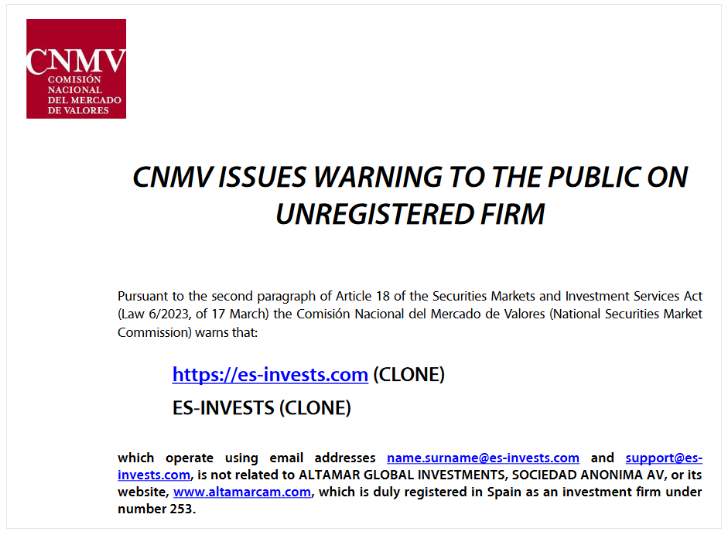

As the website is available in English and Spanish, we checked the register of the Spanish financial regulator CNMV. There, we found a warning that ES Invests is a scam.

Under no circumstances should you trust your money to such anonymous websites full of false and contradictory information. Instead, you can turn to one of the many companies that really work under the supervision of respected regulatory bodies like Cyprus Securities and Exchange Commission (CySEC) or Financial Conduct Authority (FCA) in the UK.

As their customer you will enjoy a number of guarantees including negative balance protection and guarantee for your funds if the broker goes bankrupt, which goes up to EUR 20,000 in EU and 85,000 GBP in the UK. Regulations in the UK and EU include some important measures designed to improve investor protection and promote market integrity and transparency, such as transaction reporting. Regulated brokers are also required to segregate their operational funds from the client’s money.

Trading Platform

| Advanced tools | Auto trading | Custom indicators | Mobile versions | |

| ES Invests platform | ✅ | ❌ | ✅ | ❌ |

| MT4 | 30+ indicators | ✅ | ✅ | Android and iOS |

| MT5 | 50+ indicators | ✅ | ✅ | Android and iOS |

| cTrader | 40+ indicators | ✅ | ✅ | Android and iOS |

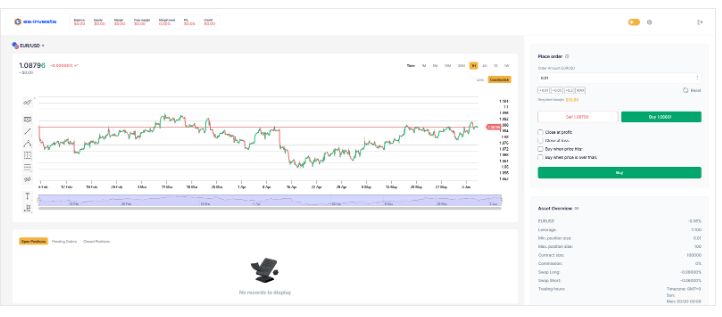

ES Invests claims to offer the industry standard MT4 platform (MetaTrader 4). But after registering an account we get access to a web trading platform that is not MT4.

Minimum Deposit

The descriptions of several account types on the ES Invests website indicate an unreasonably high minimum deposit of 12,500 EUR. In contrast, you can open a trading account with a licensed and reputable forex broker for as little as 50 or even 5 EUR/USD.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

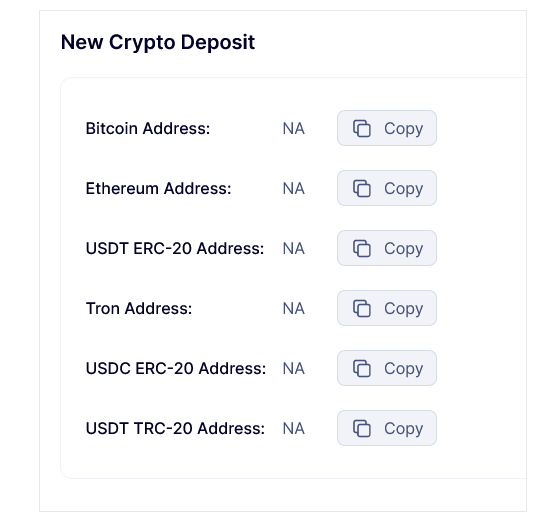

We were not surprised to find that the only payment method accepted by ES Invests is cryptocurrencies. This is the preferred payment method for most financial scammers because cryptocurrencies offer a degree of anonymity and do not allow the defrauded person to request a refund.

Legitimate brokers typically provide clients with a wide range of transparent payment options, including bank transfers, credit/debit cards, and established e-wallets such as PayPal, Skrill, or Neteller. If you’re interested in legitimate brokers that accept digital currency payments alongside conventional methods, ensure they also offer these standard, reputable payment options.

Trading Instruments

ES Invests advertises trading in forex, cryptocurrencies, stocks, indices, and commodities. However, given its anonymity and lack of regulation, there is no good reason to believe that this website offers real trading services.

ES Invests Spread

ES Invests advertises a spread starting at 2.8 pips for a starter account. This is double the industry average and very unprofitable for the trader.

ES Invests Leverage

| Currency | Stocks | Crypto | Gold | ||

| ES Invests | 400:1 | 400:1 | 400:1 | 400:1 | 400:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

ES Invests offers leverage between 1:100 and 1:400 for different account types, which is much higher than what regulated brokers typically offer. While high leverage can lead to higher profits, it also significantly increases the risk of sudden and substantial losses. Leading regulators limit leverage for retail traders to protect them. In the EU, UK, and Australia, the maximum permitted leverage is 1:30, and in the US, it is 1:50. These limits apply primarily to major currency pairs, with even stricter limits for more volatile assets.

Regulated brokers offer higher leverage only to professional clients who must meet strict standards for capital and experience, and who must forgo the protections provided to retail traders.

If you don’t qualify as a professional trader but are willing to take the risk of high-leverage trading, your most viable option is to use the services of an offshore affiliate of an established brand.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| ES Invests | Lots+Bonus/4 | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

After using a bonus, the account can only make withdrawals after meeting the minimum volume requirements. These requirements peculiarly word the number of lots as equal to the bonus amount divided by four. This is a typical scam tactic designed to obstruct any withdrawal attempts.