Finance24 Base claims to be a reputable broker registered in the United States, presenting an image of legitimacy. However, our investigation has revealed that the company operates without any regulatory oversight, which poses substantial risks to clients’ funds and raises doubts about the transparency of their trading activities.

Due to the lack of regulatory supervision, we strongly discourage engaging in transactions with Finance24 Base to protect your financial assets. Exercise caution and avoid doing business with entities that lack proper regulatory authorization, as this helps safeguard your hard-earned funds from potential risks and uncertainties.

Finance24 base Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Finance24 base | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

Finance24 Base misleads clients by asserting regulatory compliance in the United States, despite lacking regulation in any jurisdiction, including the U.S.

Additionally, the company falsely claims authorization by the UK’s Financial Conduct Authority (FCA).

Our investigation also uncovered that Italy’s esteemed Commissione Nazionale per le Società e la Borsa (CONSOB) identified Finance24 Base’s unauthorized services within their jurisdiction. In response, CONSOB issued a stern warning, categorizing Finance24 Base as an unauthorized entity operating outside the law.

These warnings are serious and aim to protect traders from potential financial harm.

Engaging with Finance24 Base involves significant risks that should not be ignored. Protect your financial security by refraining from any business transactions with unregulated and unauthorized entities like Finance24 Base.

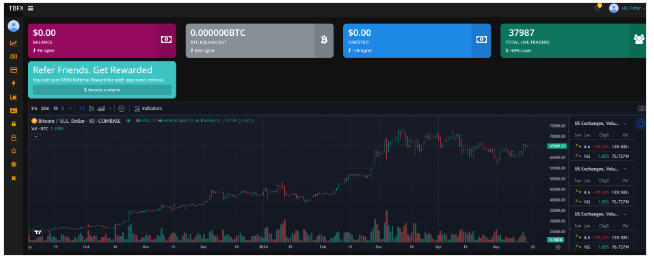

Finance24 Base Trading Platform

Given the overall lack of reliability associated with Finance24 Base, it is unsurprising that they fail to offer a dependable trading platform. Instead of providing a comprehensive trading solution, Finance24 Base merely offers TradingView-enabled charts that do not support real trading activities. This is a significant drawback for traders seeking a robust and dependable trading environment.

Minimum Deposit

Moreover, it offers a range of account types tailored to suit diverse trader preferences, each with different minimum deposit requirements: $1000 for the Starter Plan, $10,000 for the Master Plus Plan, $20,000 for the Premium Plan, and $50,000 for the Ultimate Plan.

In contrast, most reputable forex brokers typically require deposits of up to $250, highlighting a significant difference in minimum deposit requirements between Finance24 Base and industry standards.

Payment Methods

Finance24 Base facilitates payment transactions through cryptocurrencies such as Bitcoin and Ethereum, adding another layer of concern regarding the company’s reliability. Cryptocurrencies are inherently untraceable, anonymous, and irreversible, posing potential risks for traders.

Unlike standard payment methods like credit/debit cards and bank transfers, which offer more established security measures and recourse mechanisms, using cryptocurrencies introduces heightened uncertainty and vulnerability to fraudulent activities. This divergence in payment options underscores the importance of exercising caution when considering transactions with Finance24 Base, particularly given the risks associated with cryptocurrency transactions.

Trading Instruments

According to their website, Finance24 Base purportedly offers trading in Forex, cryptocurrencies, and binary options. However, it’s important to note that due to the absence of a real trading platform, none of these trading options are actually available to traders.

Spread

Furthermore, our investigation did not uncover any information regarding the spreads offered by the company. This lack of transparency regarding spreads is concerning, as it prevents traders from fully understanding the costs associated with their trades. The absence of this crucial detail raises additional red flags about the company’s transparency and reliability.

Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Finance24 base | Not specified | ❌ | Not specified | ❌ | ❌ |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

Similarly, no details are available regarding the leverage offered by this scam broker. This lack of information about leverage limits traders’ ability to assess their risk exposure and effectively manage their trading positions. Leverage plays a significant role in forex and CFD trading, amplifying both potential profits and losses. Therefore, comprehensive details about leverage are essential for traders to make informed decisions and tailor their trading strategies accordingly.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Finance24 base | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Finally, it’s worth noting that Finance24 Base’s website lacks any information about withdrawal fees or minimum withdrawal amounts. This absence of crucial details raises concerns about transparency and leaves traders uncertain about the potential costs associated with withdrawals. Without clear guidance on withdrawal fees or minimum amounts, traders may face unexpected charges or restrictions when accessing their funds, impacting their overall trading experience.

Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in the US | |

| CONSOB warning | |

| No reliable trading software | |

| High minimum deposit requirements |