In the complex realm of forex trading, Forex eze positions itself as a broker regulated in the UK, enticing investors with assurances of reliability and safety. At first glance, it seems to meet the strict regulatory requirements expected of a trustworthy financial platform. However, upon closer examination, a troubling truth emerges.

Contrary to their assertions, Forexeze lacks any regulation, a revelation that raises serious doubts about their credibility. Their operations are veiled in secrecy, a significant warning sign suggesting potential hazards to investors’ capital. This absence of openness and responsibility renders Forexeze a risky option for traders seeking a stable and transparent trading environment.

For those contemplating Forex eze for trading, it’s imperative to thoroughly review our detailed analysis of the broker to grasp the full extent of the associated risks.

Forex Eze Regulation

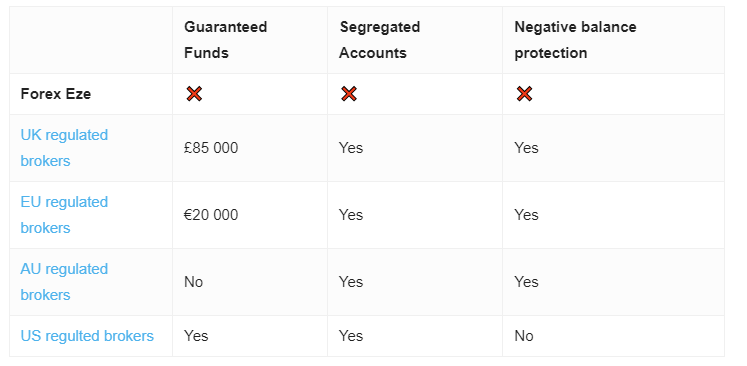

Primarily, despite Forexeze’s assertions of being based in the United Kingdom and holding a license from the esteemed Financial Conduct Authority (FCA), our thorough investigations have unearthed the truth that the company isn’t actually regulated by this financial authority.

Moreover, our examination has uncovered a direct warning issued by the FCA, clearly stating that Forexeze lacks authorization from them.

To safeguard your invested funds, we strongly discourage any engagement with Forex eze. Instead, we advocate selecting a reputable and regulated broker that places emphasis on your security and delivers a dependable and rewarding trading environment.

Forex Eze Trading Platform

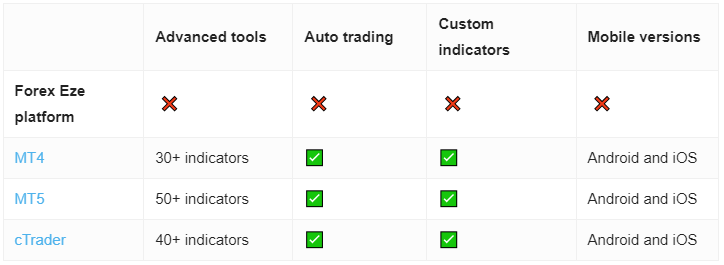

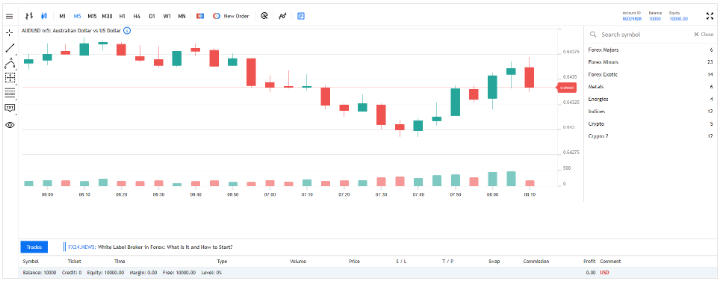

Considering the absence of regulation, it’s no wonder that the company also lacks an authentic trading platform; indeed, their web-based platform barely functions.

Let’s examine it more closely:

Thankfully, the forex trading arena boasts numerous reputable brokers. These companies not only offer access to the highly regarded MetaTrader platform but also bolster their credibility through rigorous licensing and regulation. Their steadfast dedication to safeguarding investors underscores their commitment to ethical trading standards. This fosters a secure and transparent environment for traders, cultivating trust and reliability within the forex market.

Minimum Deposit

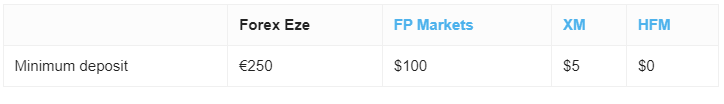

Forexeze presents a selection of account types with different minimum deposit thresholds, a factor that might raise concerns for prospective traders weighing their options. The minimum deposits span from a manageable €250 for the Basic account to higher sums such as €5,000 for Intermediate, €25,000 for Advanced, and €50,000 for Expert accounts.

This tiered setup offers diversity but contrasts with many established brokers in the industry, which offer more accessible entry points. These brokers often permit traders to open Micro accounts with deposits as low as under $50, catering to a broader range of financial capacities. Such adaptability is especially attractive to novice traders or those reluctant to commit to large financial stakes initially, facilitating a more accessible introduction to the forex market.

This clear distinction underscores the importance of thoroughly assessing account structures and minimum deposit requirements when choosing a broker, to ensure they align with your trading objectives and financial circumstances.

Payment Methods

Forexeze’s listed payment methods on their official website are limited, comprising credit/debit cards (Visa and Mastercard), WebMoney, and Bitcoin for cryptocurrency transactions. This constrained range of payment options might raise concerns for potential clients seeking transactional flexibility.

In contrast to Forex eze, many brokers in the market offer a more comprehensive array of payment methods. These typically include traditional bank transfers and e-wallets like PayPal, Skrill, and Neteller, offering increased convenience and accessibility to a diverse clientele. The absence of such versatility at Forex eze may necessitate careful consideration from users who prioritize having a broad spectrum of deposit and withdrawal options.

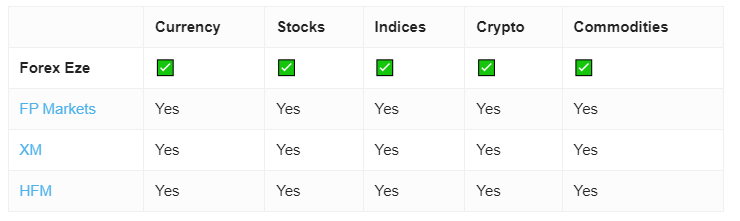

Trading Instruments

Forexeze presents trading opportunities across several key areas: Forex, Commodities, Shares, Indices, and Cryptocurrencies. However, given the array of red flags discussed earlier, such as their lack of regulation and the limited functionality of their trading platform, we strongly advise against engaging with Forexeze.

For those seeking a secure and reliable trading environment, selecting a more trustworthy forex broker is imperative. A reputable broker should provide extensive market access, transparent operations, and strict regulatory adherence, thereby safeguarding the integrity of your investments.

Hence, we recommend thoroughly scrutinizing potential brokers, paying close attention to their regulatory status, the breadth of their market offerings, and the flexibility of their trading platforms. This ensures alignment with your investment objectives and offers the necessary assurances for a secure trading experience.

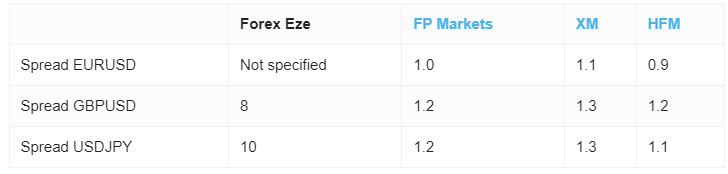

Forex Eze Spread

Forexeze advertises spreads that are notably wider than the industry average, citing figures such as 8 pips on GBP/USD and 10 pips on USD/JPY.

In trading, transparency regarding spreads isn’t just preferable; it’s essential. Spreads directly impact trading costs and can significantly influence the profitability of trading activities. When a broker openly shares detailed spread information, it empowers traders to make informed decisions, enabling them to align their strategies with more cost-effective trading conditions.

Given the higher spreads offered by Forexeze, traders should exercise caution, as such costs can eat into potential profits. It’s important for traders to compare these conditions with those of other brokers and consider how spreads might affect their overall trading strategy, especially if they engage in frequent trading or trade in large volumes. Selecting a broker that offers tighter spreads is crucial for minimizing costs and maximizing returns.

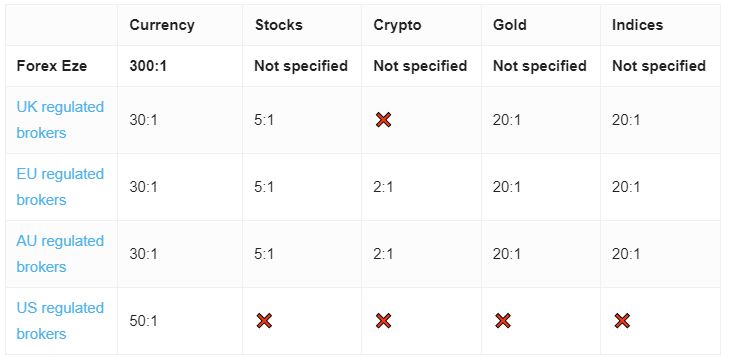

Forex Eze Leverage

Forexeze promotes an exceptionally high leverage of up to 300:1, a feature that may appeal to traders aiming to maximize their trading potential. However, such offers should be approached with utmost caution.

This level of leverage, while enticing, clearly indicates that Forexeze does not adhere to regulatory standards set by authorities such as those in the United Kingdom, where regulated brokers are mandated to restrict leverage to a maximum of 30:1. These regulations are crafted to shield traders from the substantial risks linked with high leverage trading, including the potential for significant losses stemming from relatively minor market movements.

Regulations that limit leverage aim to foster responsible trading practices and safeguard investors’ interests by curbing excessive risk-taking. Traders should exercise caution when dealing with brokers that offer leverage ratios far exceeding those permitted by regulators in their jurisdiction, as this often signifies a lack of adequate regulatory oversight and heightens the risk to investor funds.

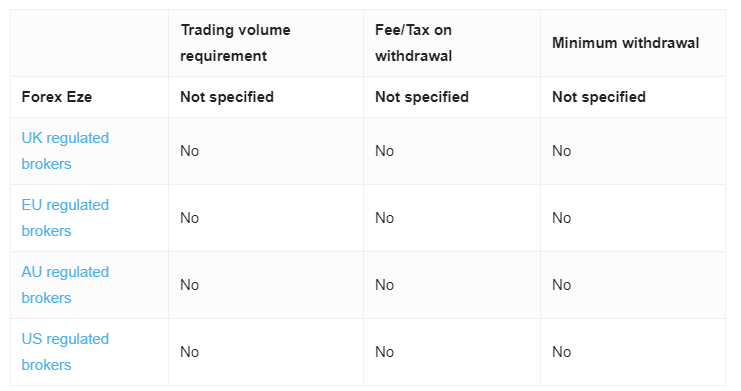

Forex Eze Withdrawal Requirements

At Forexeze, any bank transfer request below $300 incurs an administrative charge of $30. Forexeze imposes this fee to cover the transactional and administrative costs associated with smaller withdrawals.

Comprehending the fee framework for withdrawals is essential for sound financial planning and can profoundly affect overall trading profitability, particularly for individuals trading in smaller amounts. Traders should consistently review the terms and conditions linked with their accounts to optimize their withdrawal timings and amounts.

Forex Eze Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in the UK | |

| FCA warning | |

| No reliable trading software | |

| Non-transparent trading conditions |