Free Trade CFD promotes itself as a “specialist in global forex trading,” yet upon closer examination, several inconsistencies emerge on its website. This evaluation aims to demonstrate why entrusting your funds to Free Trade CFD might not be advisable and suggests alternative, more reliable forex and CFD brokers.

Free Trade CFD Regulation

The primary aspect to examine on a forex broker’s website is its legal entity, location, and regulatory oversight. Licensed entities are obliged to furnish comprehensive legal documentation. However, Free Trade CFD’s website lacks such information – even its Terms and Conditions fail to disclose a company name, regulatory license details, or contact address.

While the Terms and Conditions indicate Cyprus as the governing jurisdiction, a website devoid of such essential details cannot legally operate in a regulated jurisdiction. Notably, there is no registered broker under this name nor associated with this domain in the Cyprus Securities and Exchange Commission (CySEC) database.

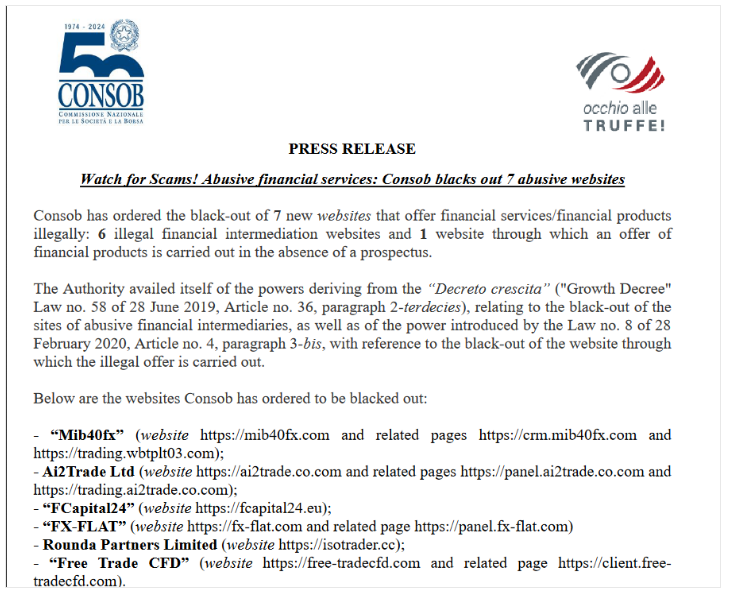

Additionally, Italy’s financial regulator, CONSOB, has blacklisted Free Trade CFD.

Before entrusting your funds to financial instruments, it’s crucial to ensure you’re dealing with a licensed intermediary and not one of the many online scammers.

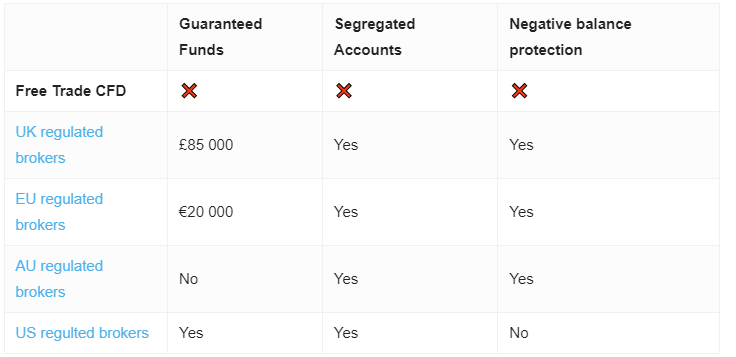

Trading through a licensed broker in the EU offers numerous advantages for retail traders. These brokers are obligated to maintain a minimum net capital of at least EUR 730,000, ensuring financial stability and a serious, long-term approach. Clients’ deposited funds are kept separate from the broker’s operational funds in segregated bank accounts, safeguarding clients’ money in case of unforeseen events like bankruptcy.

Furthermore, all brokers licensed in Cyprus and other EU countries are members of the Investor Compensation Fund, which can provide coverage of up to EUR 20,000 per person in the event of broker insolvency. EU forex brokers are also mandated to regularly report their clients’ transactions, a measure aimed at enhancing investor protection, market integrity, and transparency.

Trading Platform

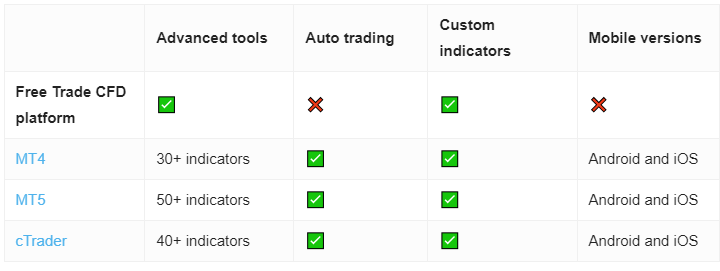

Free Trade CFD employs a web trading platform that appears standard at first glance. However, it’s worth noting that financial scammers frequently utilize manipulated trading platforms to deceive their targets into believing their funds are being invested. In reality, such trading activity is entirely fabricated, with the funds diverted directly into the scammers’ pockets.

Reputable brokers provide clients with a diverse array of trading software options, encompassing desktop, mobile apps, and web-based platforms. Among the most prevalent platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Renowned for their extensive feature sets, these platforms have become industry standards. They provide various customization options, support multiple accounts, enable custom script deployment for automated trading, and facilitate trade strategy backtesting.

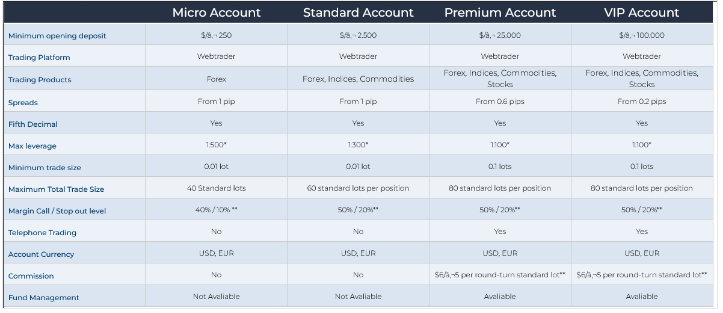

Minimum Deposit

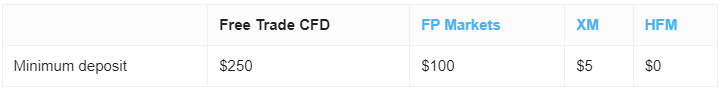

Free Trade CFD’s 250 EUR/USD minimum deposit aligns with industry standards, but it’s possible to open an account with licensed brokers for that amount. Leading industry brands offer Micro and Cent accounts with lower entry thresholds, ideal for novice investors.

Exploring alternatives beyond Free Trade CFD ensures finding the best investment fit for one’s needs and budget.

Payment Methods

Free Trade CFD exclusively accepts cryptocurrency deposits, which is a characteristic often associated with financial scammers.

Scammers favor cryptocurrencies for payments due to anonymity and lack of refund recourse for victims.

Trading Instruments

It promotes trading in forex, indices, cryptocurrencies, and commodities. With its opacity and anonymity, trusting this website for genuine trading is unwarranted. It’s advisable to exercise caution and engage exclusively with licensed and reputable brokers when participating in financial markets.

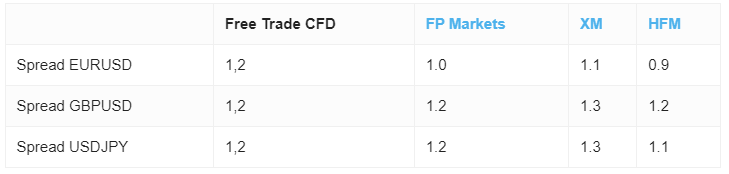

Free Trade CFD Spread

In the trading platform, there’s a typical spread of 1.2 pips visible. Free Trade CFD doesn’t disclose any additional commissions. However, when there’s uncertainty about the authenticity of the trades, the apparent profitability becomes irrelevant.

Free Trade CFD Leverage

Free Trade CFD provides leverage ranging from 1:100 to 1:500 across various account types. This offering serves as evidence that the website is not regulated by a European Union-based authority. While high leverage can amplify potential profits, it also escalates the risk of abrupt and substantial losses. Recognizing this, major regulators impose limitations on leverage for retail traders to mitigate risk.

ESMA and EU regulators cap leverage: 1:30 for major pairs, 1:20 for others, 1:10 for commodities, 1:2 for cryptocurrencies.

Furthermore, Free Trade CFD’s claim to offer bonuses is another indication of its lack of regulation. Regulated brokers are prohibited from providing bonuses and promotions due to regulatory constraints. Scammers often exploit promises of seemingly generous bonuses to ensnare potential victims with onerous terms. Free Trade CFD fails to provide clear information regarding the conditions attached to its bonuses.

For high leverage trading and bonuses, consider offshore divisions of reputable brands for safety.

Free Trade CFD Withdrawal Requirements

Free Trade CFD doesn’t outline any exceptional withdrawal conditions. However, scams of this nature often involve unexpected fees and other tactics designed to obstruct the withdrawal process. Frequently, these traps are intertwined with the bonuses offered, making it challenging for individuals to retrieve their funds.