Future Invest Limited attempts to portray itself as a regulated forex broker, purportedly offering a safe entry point for individuals venturing into financial markets. However, upon closer examination, it becomes evident that this platform is merely another online scam preying on those with limited understanding of financial trading. This assessment aims to highlight the unreliability of Future Invest Limited and guide readers towards reputable alternatives in the financial services sector.

Future Invest Limited Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Future Invest Limited | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

Genuine forex brokers typically offer transparent and comprehensive information regarding their legal entity, including its location, licenses, and regulatory oversight. The absence or misrepresentation of such details often indicates a potential scam.

Nowhere does the website or its legal documentation specify the location of the Future Invest Limited company. In fact, our investigation uncovered no evidence supporting the existence of such a legal entity.

The homepage claims that Future Invest Limited is authorized and regulated under the European Financial Security, but there is no indication of this.

The website of Future Invest Limited includes a link to a supposed regulatory body, but upon scrutiny, it becomes apparent that no such institution exists, and the licenses displayed are fraudulent.

While the European Union countries adhere to a unified financial regulatory framework, there isn’t a single regulator responsible for licensing forex brokers. Instead, brokers must obtain licenses from national regulators to operate within the EU.

Future Invest Limited not only lacks such a license but has also been blacklisted by the Italian financial regulator CONSOB.

Trading through a licensed broker in the EU offers several advantages for retail traders. These brokers must adhere to the requirements set by the European Securities and Markets Authority (ESMA), including maintaining a minimum net capital of EUR 730,000 to ensure financial stability and a commitment to long-term operations. Moreover, client funds are kept separate from the broker’s operational funds in segregated bank accounts, ensuring that clients’ funds are protected in the event of issues such as broker bankruptcy.

Trading Platform

Future Invest Limited advertises an innovative and sophisticated web trading platform. However, upon registration, users are provided access to a rather rudimentary web trading platform lacking extensive customization options or advanced features. Remarkably, this platform closely resembles those utilized by numerous fraudulent brokers previously encountered. This pattern suggests that scammers are using manipulated trading software to deceive victims into believing their funds are genuinely being invested, potentially leading them to believe they are generating profits.

Although the platform offered by Future Invest Limited allows users to execute orders, its functionality pales in comparison to the robust capabilities of MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The prominence of MT4 and MT5 as industry standards is no accident. These platforms provide an extensive array of features, including diverse customization options, support for multiple accounts, the ability to create and deploy custom scripts for automated trading, and facilities for backtesting trading strategies.

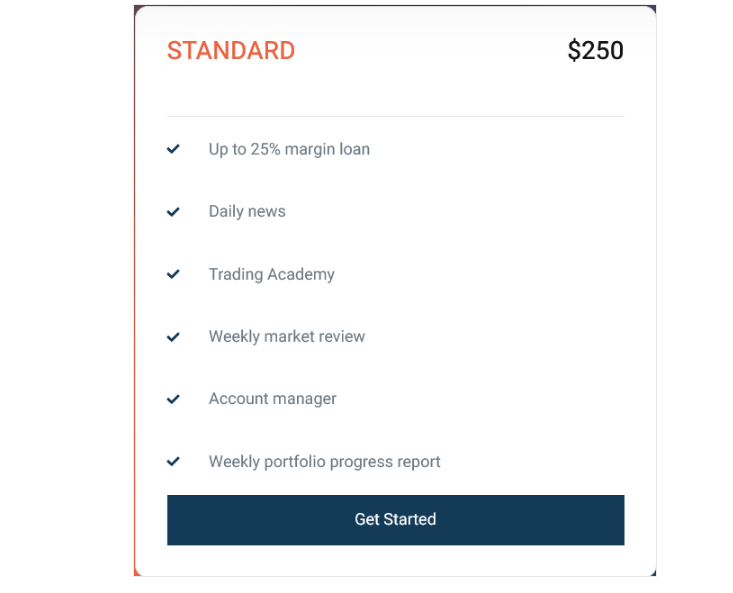

Minimum Deposit

Future Invest Limited sets a minimum deposit requirement of 250 USD, aligning with the industry standard. However, it’s worth noting that with this amount, one could opt to open a trading account with a reputable and fully licensed forex broker. Several prominent brands in the industry provide Micro and Cent accounts tailored for novice investors, featuring exceptionally low entry thresholds. These options offer a more secure and regulated environment for individuals looking to enter the world of forex trading without significant financial commitment.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

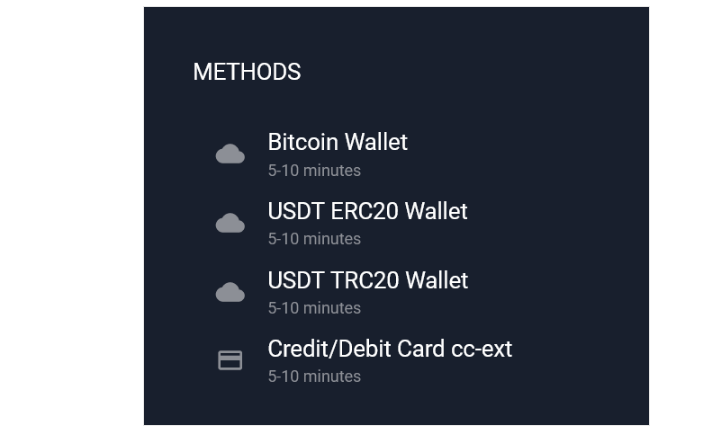

While Future Invest Limited presents users with a choice between cryptocurrencies and credit/debit cards for deposits, it’s important to highlight that we haven’t been able to verify the availability of the latter option.

Scammers often favor cryptocurrencies due to the lack of refund options associated with these transactions. While there are legitimate brokers that accept digital currencies like Bitcoin, they typically offer a range of transparent payment methods including credit/debit cards, bank transfers, and popular e-wallets such as PayPal, Neteller, or Skrill. This diversity in payment options underscores their commitment to transparency and provides users with additional avenues for financial transactions.

Trading Instruments

While Future Invest Limited boasts an extensive range of trading options, including 40 currency pairs, over 200 CFDs on stocks, more than 80 cryptocurrencies, as well as indices, metals, and other commodities, it’s crucial to emphasize that there’s no evidence to suggest the authenticity of this trading platform. It’s advisable to invest in the financial markets solely through reputable and established forex brokers to safeguard your interests and ensure a secure trading environment.

Future Invest Limited Spread

When visiting the website of a legitimate broker, you’ll typically encounter a range of trading account options tailored to investors with varying preferences. These accounts are accompanied by detailed descriptions of trading parameters, encompassing minimum deposit requirements, order execution methods, available financial instruments, leverage ratios, spreads, swap rates, commissions, and more.

However, the Future Invest Limited website noticeably lacks such comprehensive information.

In the trading platform provided by Future Invest Limited, a spread of 0.4 pips is observable, but crucial details regarding potential additional trading commissions remain undisclosed. This lack of transparency regarding trading costs and fees raises concerns about the integrity and reliability of the platform.

Future Invest Limited Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Future Invest Limited | 10:1 | 10:1 | 10:1 | 10:1 | 10:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

In the trading platform, we see a leverage of 1:10, which is actually lower and more restrictive than allowed by EU financial regulations.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Future Invest Limited | Bonus+Deposit x25 | Not specified | $500 |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Future Invest Limited fails to disclose withdrawal fees explicitly, which suggests the potential presence of hidden fees and obstacles to withdrawing funds. The minimum withdrawal amount ranges between 100 USD and 500 USD, contingent on the chosen payment method. However, crucially, the documentation neglects to specify the minimum withdrawal amount when utilizing cryptocurrencies, which constitutes the primary payment method offered by this dubious broker.

Furthermore, if an account has received a bonus, it must attain a minimum traded volume equal to 25 times the combined sum of the deposit and bonus before withdrawals can be processed. This requirement further complicates the withdrawal process and underscores the potential risks associated with engaging with Future Invest Limited.

Pros and Cons

| Pros | Cons |

| Notning to mention | False claims of regulation |

| Fake legal details | |

| Blacklisted by the CONSOB | |

| No clarity ot trading cost | |

| Scam bonus terms |