Invotrade claims to be a renowned forex broker with a worldwide presence. However, a simple fact-check reveals a lack of solid evidence to back up these assertions. In reality, there is no indication that Invotrade is anything other than another online scam. In this review, we’ll explain why it’s wise to avoid this website and guide you towards more reputable brokers.

Invotrade Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Invotrade | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

If a financial services provider is legitimate, its website will clearly display detailed information about the company that owns and operates it, including its location and licenses. Authentic brokers also offer access to comprehensive legal documentation. While the presence of such information doesn’t ensure its accuracy, its absence is a strong indicator that you may be dealing with scammers.

Invotrade fails to disclose the company behind its website and does not provide access to Terms and Conditions, Customer Agreement, or any other documentation. If you don’t know exactly who you are dealing with and the terms of the deal, investing your money would be a significant mistake.

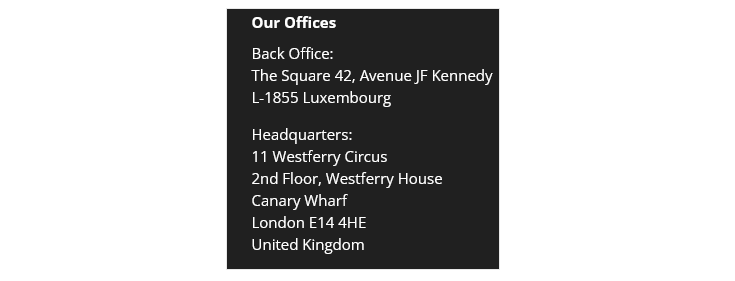

Due to this lack of transparency, it is evident that Invotrade’s claims of having its headquarters in the UK and an office in Luxembourg are false.

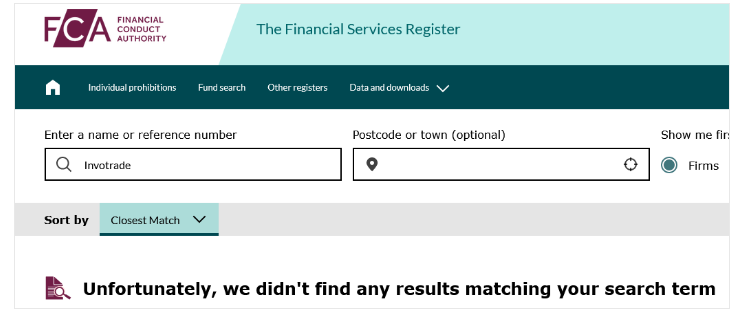

A review of the registers of the relevant financial regulators confirms that there is no licensed broker operating under the Invotrade brand and domain.

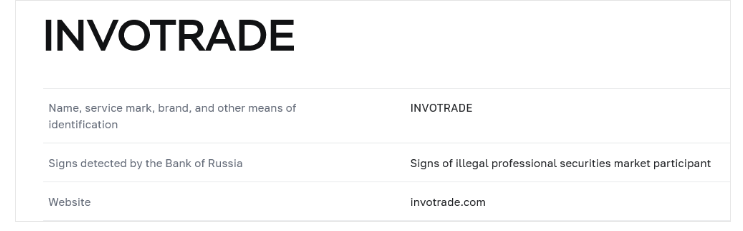

The financial authorities in another country, Russia, have issued a warning that Invotrade is not a licensed financial services provider.

Before investing in financial instruments, it is crucial to ensure you are dealing with a licensed intermediary rather than one of the many online scammers.

Depending on your location, it is advisable to choose a company regulated by institutions such as the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), or an EU regulator like the Cyprus Securities and Exchange Commission (CySEC).

Trading Platform

Invotrade offers web-based trading software. Here is how it looks like:

While the platform provides basic features for placing orders, customizing charts, and applying technical indicators, it lacks the advanced functionality found in the industry-standard trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 and MT5 are renowned for their extensive range of features, including customization options, multiple account usage, and the ability to design and implement custom scripts for automated trading and backtesting trade strategies.

It is important to note that the presence of a trading platform does not validate the legitimacy of a website or ensure that the broker offers real trading. Many scammers use rigged trading software to deceive victims into believing their money is being invested.

Minimum Deposit

Invotrade does not specify a minimum deposit. In contrast, leading brands in the industry provide starter accounts for beginner traders with a very low minimum deposit. There is no good reason to take risks with shady brokers.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

At the time of writing this review, the deposit menu was not active, preventing us from determining the available payment methods.

Experience shows that fake brokers often advertise conventional payment methods but actually direct potential victims towards cryptocurrency transactions. This approach ensures their anonymity and deprives defrauded clients of the option to request a refund or chargeback.

Legitimate brokers typically provide a wide range of transparent payment methods, including bank transfers, credit/debit cards, and established e-wallets such as PayPal, Skrill, or Neteller.

Trading Instruments

Invotrade’s trading platform includes stocks, currencies, indices, commodities, and cryptocurrencies. However, as previously noted, this trading is undoubtedly fake. Additionally, the FCA prohibits brokers truly based in the United Kingdom from offering retail clients crypto CFDs trading.

Invotrade Spread

In the trading platform we see a spread of 0.1 pip. Such a spread implies the presence of additional trading commissions. However, Invotrade does not provide any information about the price paid by the trader.

Invotrade Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Invotrade | 100:1 | 100:1 | Not specified | 100:1 | 100:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

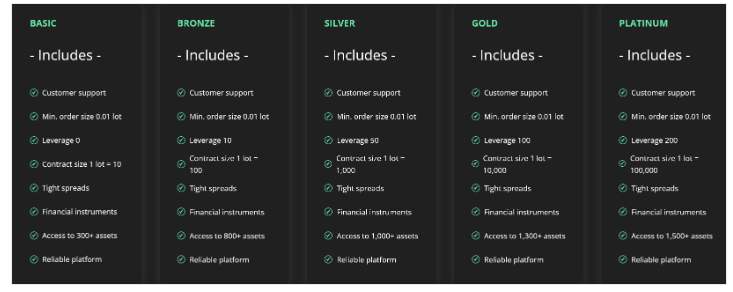

Invotrade claims to offer leverage ranging from 0 to 1:200 for different account types. However, a UK-licensed broker cannot offer such high levels of leverage. The FCA, similar to EU regulators, limits leverage to 1:30 for major currency pairs and even lower levels for more volatile assets. Australia follows the same rules. In the US, the maximum leverage limit is slightly higher at 1:50.

Regulated brokers provide higher leverage exclusively to professional clients, who must meet stringent standards for capital and experience, and forego the protections enjoyed by retail traders.

If you don’t meet the criteria to be classified as a professional trader but are inclined to engage in high-leverage trading, the most viable option is to utilize the services of an offshore affiliate of a reputable brand.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Invotrade | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

The lack of a publicly available Terms and Conditions or Client Agreement means that scammers may have set many traps such as hidden fees and impossible-to-meet withdrawal terms.

Invotrade Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| False legal details | |

| No legal documentation | |

| Blacklisted |