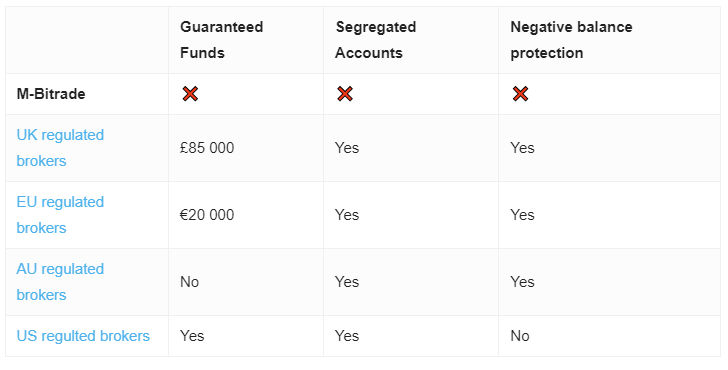

M-Bitrade presents itself as a regulated broker in the UK, implying reliability and adherence to legal standards. However, it operates without proper regulatory oversight, contradicting these assertions. This lack of supervision raises significant doubts about the safety of client funds and the transparency of M-Bitrade’s trading activities. Due to these risks, it is advisable to be cautious and refrain from engaging in any financial dealings with M-Bitrade in order to safeguard your investments.

M-Bitrade Regulation

Primarily, M-Bitrade asserts its UK headquarters and accreditation by the prestigious Financial Conduct Authority (FCA). Yet, thorough inquiries uncover these claims as deceptive, as the company lacks regulation by the FCA. Moreover, the FCA has explicitly cautioned against M-Bitrade, emphasizing its lack of authorization within their jurisdiction.

In light of these revelations, engaging with M-Bitrade entails considerable hazards to fund security and trading transparency. To safeguard your investments, it’s highly advisable to opt for a reputable, regulated broker that ensures safety and provides a transparent, satisfactory trading platform.

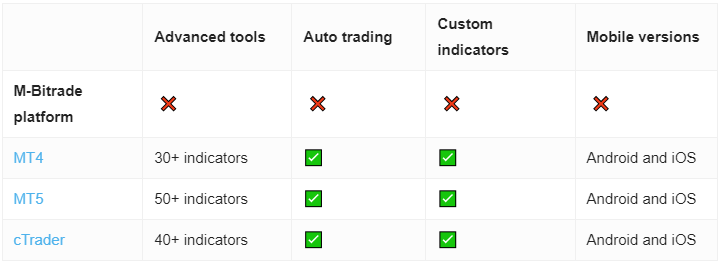

M-Bitrade Trading Platform

Additionally, M-Bitrade lacks a legitimate trading platform. Our registration experience with them revealed a requirement for traders to deposit funds before accessing their claimed trading software. This practice raises significant doubts about the integrity of their operations.

To protect your finances, it’s crucial to steer clear of this disreputable company. In essence, for a secure and prosperous trading journey, we highly recommend opting for a trustworthy broker offering access to the widely recognized and esteemed MetaTrader platforms. This decision guarantees both the security of your investments and a dependable trading atmosphere.

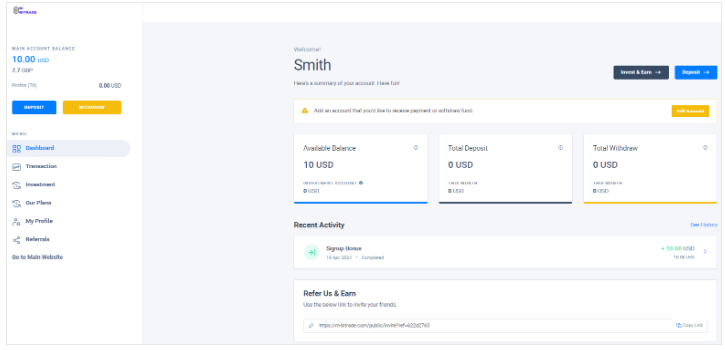

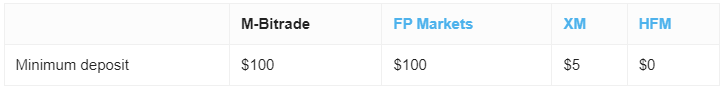

Minimum Deposit

M-Bitrade offers a range of account types tailored to accommodate traders with varying levels of experience and investment objectives. The “Newbie” account, designed for novices, has a minimum deposit requirement of $100, making it the most accessible option. For more seasoned traders, the “Superior” account mandates a $500 deposit, while the “Meta Trade” account targets serious traders with a $5,000 deposit requirement. For highly committed traders, the “Mining,” “Executive,” and “Long Term” accounts each demand a significant $10,000 deposit.

These account options appear to offer a structured portfolio that could cater to diverse trading needs and financial capacities. However, it’s essential to highlight that M-Bitrade lacks both a genuine trading platform and a legitimate forex license. Consequently, despite the array of accounts, it’s advisable to refrain from depositing funds with this company. This precaution is crucial to safeguard your investments from potential risks associated with unauthenticated trading platforms.

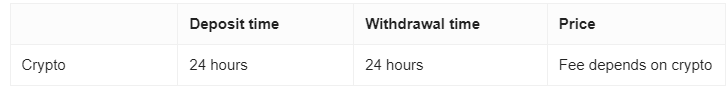

Payment Methods

Furthermore, M-Bitrade exclusively relies on cryptocurrency payments. Although this method is favored for its seamless transfer process, it poses notable concerns due to its lack of security, traceability, and inherent anonymity. Transactions conducted with cryptocurrencies can be notably risky as they lack the same protective measures as traditional banking methods, which can complicate fund recovery in case of disputes. Consequently, the exclusive utilization of cryptocurrencies for deposits and withdrawals markedly heightens the risk of fraud and financial detriment.

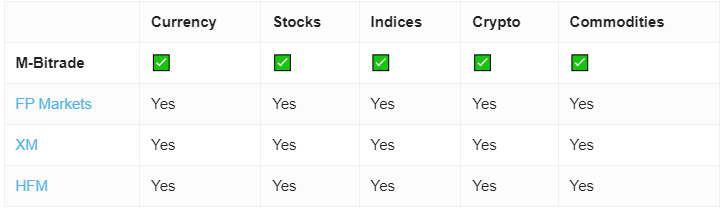

Trading Instruments

According to their website, M-Bitrade’s platform purportedly offers trading opportunities across a diverse spectrum of markets, including Cryptocurrencies, Forex, Stocks & ETFs, Options, Metals, and Futures. This extensive range of options may appear attractive to potential investors seeking a comprehensive trading platform.

However, it’s essential to weigh the earlier concerns regarding M-Bitrade’s regulatory status and transparency. The absence of adequate regulatory oversight and their questionable operational practices can entail significant risks. When making investment decisions, always prioritize the security and reliability of a trading platform. Opt for entities that are fully regulated and transparent in their operations to safeguard your investments.

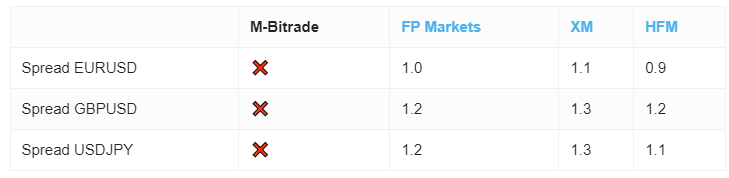

M-Bitrade Spread

We couldn’t ascertain specific details about the spreads offered by M-Bitrade. This lack of transparency regarding their trading conditions is worrisome since spreads play a crucial role in forex and stock trading, impacting profitability significantly. Potential traders should exercise caution when considering a platform that doesn’t provide upfront and clear information about its trading costs.

This lack of transparency serves as another warning sign when evaluating the safety and integrity of M-Bitrade as a trading partner. When selecting a broker, it’s vital to choose one that offers transparent and detailed information about all trading fees and conditions to ensure fair and transparent trading.

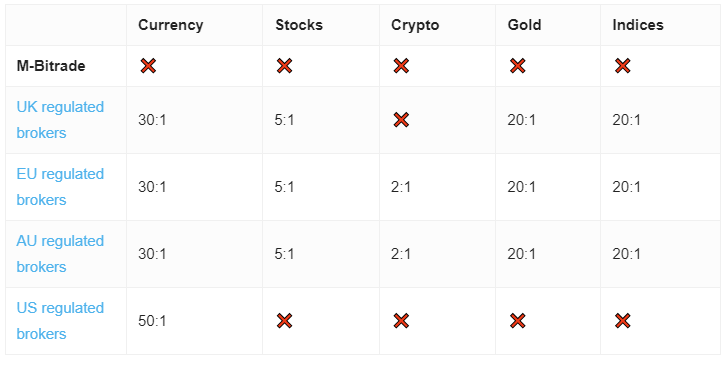

M-Bitrade Leverage

Similarly, M-Bitrade fails to provide specific information regarding the leverage options available on their platform. This omission raises significant concerns for traders who rely on leverage to amplify their trading capacity and potentially increase returns. Leverage is a fundamental tool in trading that can magnify both gains and losses, and the absence of clear, accessible information about leverage limits and policies can disadvantage traders.

The lack of detailed disclosures about leverage and spreads makes it challenging for traders to make informed decisions and effectively manage risks. When choosing a broker, it’s crucial to select one that is transparent about all aspects of trading conditions, including leverage options. This ensures that you can tailor your trading strategies with a clear understanding of the risks and capabilities provided by your broker.

M-Bitrade Withdrawal Requirements

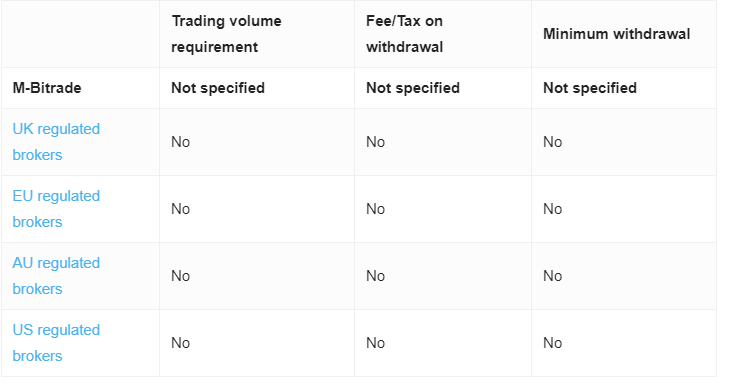

Finally, M-Bitrade’s lack of transparency regarding their withdrawal fees and requirements presents another significant concern. This lack of clarity can result in unexpected costs for traders and complicate the process of withdrawing funds from the platform. Transparent communication about withdrawal policies, including any potential fees and procedural requirements, is crucial for establishing trust and reliability in a trading platform.

When a broker fails to provide clear information about the costs and conditions for withdrawals, it not only hampers a trader’s ability to plan financially but also raises concerns about the liquidity and ethical standards of the platform. Therefore, traders are advised to seek brokers that openly and clearly disclose all relevant details regarding account management policies. This ensures that all financial transactions are conducted under fair and predictable terms, safeguarding the interests of the investor.