When selecting a reliable forex broker, it’s crucial to thoroughly assess MIB40FX according to your requirements. Despite MIB40FX’s assertion of regulatory compliance in recognized jurisdictions like Cyprus and the European Union, it’s vital to note that the company does not currently possess a valid forex license for operation in these regions or elsewhere.

This detail holds significant relevance for individuals contemplating utilizing MIB40FX for their trading endeavors. We strongly recommend perusing our detailed assessment of MIB40FX before making any investment decisions. This step is fundamental in safeguarding your capital and ensuring the safety of your investments. In the forex market, where the protection of your funds is paramount, being well-informed about a broker’s regulatory standing is indispensable.

Mib40fx Regulation

MIB40FX presents itself as a prominent broker in Europe with Cyprus as its stated operational hub. However, our thorough investigation, which involved consulting the Cyprus Securities and Exchange Commission (CySEC) – the regulatory body for forex brokers in Cyprus, has conclusively revealed that the company lacks a valid forex license for this jurisdiction.

Adding to our concerns, the Commissione Nazionale per le Società e la Borsa (CONSOB) in Italy, responsible for overseeing securities activities, has issued a clear cautionary statement. CONSOB has identified MIB40FX as an unauthorized entity, flagging its operation as a direct breach of legal standards.

In light of these significant discoveries, it is evident that MIB40FX is not compliant with regulatory requirements and poses substantial risks. To safeguard your finances and investment ventures, we strongly advise against engaging with MIB40FX.

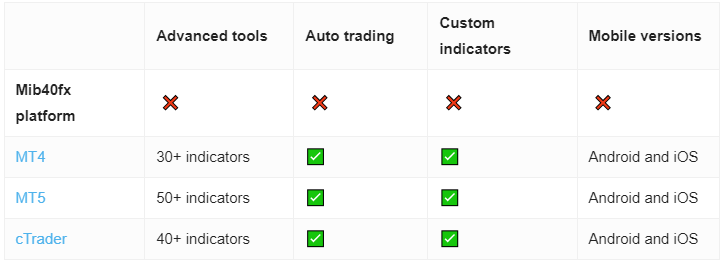

Trading Platform

The trading software provided by MIB40FX is notably deficient, offering users a platform that is essentially non-operational and misleading. This crucial deficiency renders the platform incapable of supporting genuine trading activities, serving as a significant obstacle for traders seeking a reliable and comprehensive trading environment.

Have a look:

Considering the significant technical constraints and the general unreliability of such platforms, it is prudent to steer clear of them. Instead, prioritizing established and reputable trading platforms like MetaTrader is essential. Renowned for its robust performance and comprehensive features, MetaTrader guarantees the safety of your investments and delivers an enhanced trading experience, making it the preferred option for serious traders.

Minimum Deposit

MIB40FX offers various account options, including Micro, Standard, Premium, and VIP accounts, each with specific features and requirements tailored to different traders. The minimum deposit amounts for these accounts vary significantly, starting at $200 for a Micro account, rising to $500 for a Standard account, $25,000 for a Premium account, and reaching $100,000 for a VIP account.

In contrast, reputable brokers typically set their minimum deposit requirements at or below $200, making MIB40FX’s higher thresholds noteworthy. Therefore, we recommend traders exercise caution and consider avoiding investing with this broker, opting instead for more reputable and transparent platforms to meet their trading needs.

Payment Methods

MIB40FX solely relies on credit and debit card payments for its payment processing, a restriction that warrants careful consideration for individuals contemplating financial transactions with the broker.

The absence of alternative payment methods, such as bank transfers, e-wallets, or cryptocurrency options, considerably limits the flexibility and convenience that traders often seek. This constraint may not align with the preferences of all investors, particularly those who prioritize enhanced security, privacy, or lack access to credit or debit cards.

It is imperative to evaluate this limitation in light of your personal or business trading strategies and payment preferences before opting to engage with MIB40FX.

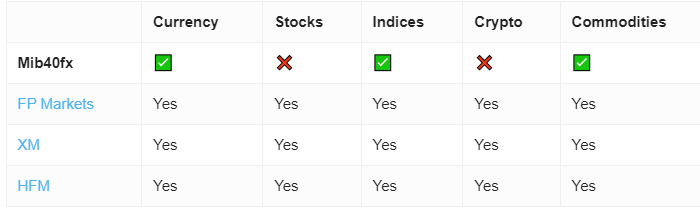

Trading Instruments

While MIB40FX claims to provide trading opportunities across various asset classes, including Forex, Commodities, and Indices, the serious doubts surrounding the company’s regulatory adherence and trustworthiness cast doubt on the availability of these trading options as advertised.

This discrepancy calls into question the authenticity of the trading environment purportedly offered by MIB40FX, indicating that prospective traders may not have genuine access to these markets through their platform. It is essential for investors to take these concerns into account when assessing the legitimacy and operational integrity of MIB40FX’s offerings.

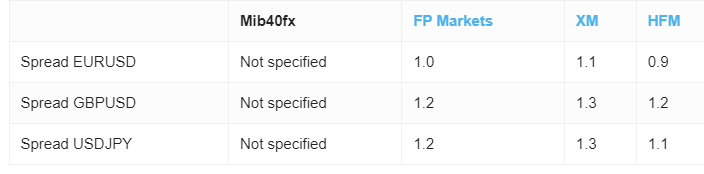

Mib40fx Spread

The company promotes competitive average spreads on major currency pairs, advertising rates as low as 1 pip on Micro and Standard accounts, 0.6 pips on Premium accounts, and notably minimal 0.2 pips on VIP accounts.

However, it is crucial to assess these claims in light of broader concerns regarding the company’s regulatory compliance and reliability. While attractive spreads are significant for traders, their value is substantially diminished if there are doubts about the platform’s credibility and its ability to provide a secure trading environment.

Therefore, while the spread offerings may appear appealing, potential users should carefully consider these benefits in relation to the risks associated with the company’s regulatory status and overall trustworthiness.

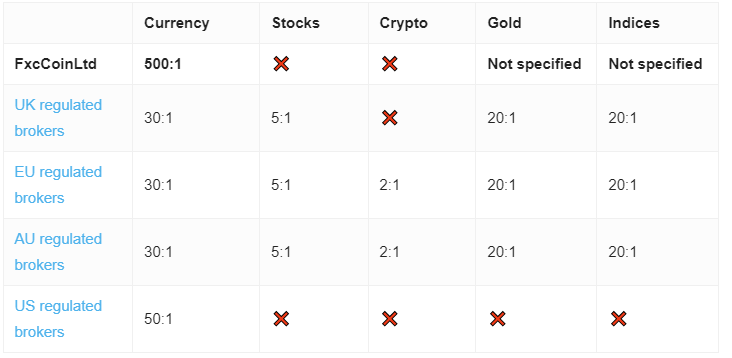

Mib40fx Leverage

MIB40FX promotes remarkably high leverage ratios, reaching up to 500:1, which intensifies concerns regarding its regulatory status. Such excessive leverage levels contradict the stringent regulatory standards in jurisdictions like Cyprus, where forex brokers are mandated to cap leverage at 30:1 for retail clients.

This inconsistency is a clear indication that MIB40FX operates beyond the regulatory frameworks established to safeguard investors, emphasizing a substantial risk for traders contemplating this platform. It underscores the importance of conducting comprehensive research into a broker’s regulatory compliance and the protections available to traders under such regulations before participating in trading activities.

Mib40fx Withdrawal Requirements

The information provided on MIB40FX’s website regarding withdrawal methods lacks transparency, particularly regarding the fees associated with deposits and withdrawals. The absence of clear details on the specific amounts of these fees introduces an element of uncertainty for potential users.Additionally, the company mentions that withdrawal requests are typically processed within 2-5 business days of receipt. While this processing timeframe is standard in the industry, the lack of explicit information on fees makes it challenging for traders to fully comprehend the financial implications of engaging with MIB40FX. This ambiguity can raise concerns for those seeking transparency and predictability in their trading costs. It underscores the importance of brokers being clear and forthcoming about all potential charges that traders may encounter.