MVProfit asserts its authorization in Switzerland, yet it lacks a valid forex license, a significant concern within the forex industry. Having proper licensing is imperative as it signifies adherence to stringent standards for financial stability and safeguarding customer interests.

The absence of this license from MVProfit serves as a glaring red flag, indicating potential risks associated with trading through their platform. Regulatory requirements are in place to ensure the protection of traders’ capital, and MVProfit’s lack of compliance raises doubts about their reliability.

A prudent decision would be to steer clear of MVProfit and instead opt for brokers possessing the necessary licenses and a reputable track record. Partnering with such brokers ensures a secure and transparent trading environment, essential for safeguarding investments and fostering a positive trading journey.

MVProfit Regulation

Our thorough examination has revealed that MVProfit, despite presenting itself as a reputable Swiss broker, fails to adhere to the rigorous regulations outlined by the Swiss Financial Market Supervisory Authority (FINMA). Specifically, MVProfit lacks a valid forex license issued by FINMA.

A similar cautionary notice issued by the Australian Securities and Investments Commission (ASIC) in Australia compounds this situation, identifying MVProfit as an unauthorized broker. Such advisories carry significant weight and often stem from instances where traders have suffered adverse outcomes due to the actions of dishonest firms.

In light of these findings, it is strongly advised that individuals refrain from engaging with MVProfit. For those seeking a secure and dependable trading platform, exploring alternative options is recommended.

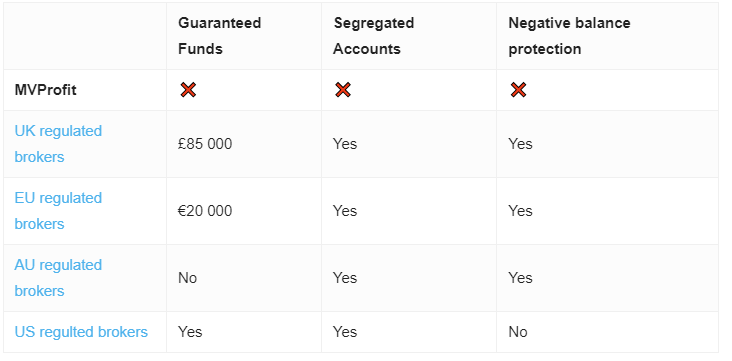

We encourage consulting the comprehensive comparison provided earlier to identify a broker that not only holds authorization but also demonstrates a commitment to upholding the highest standards of regulatory compliance and safeguarding trader interests.

Trading Platform

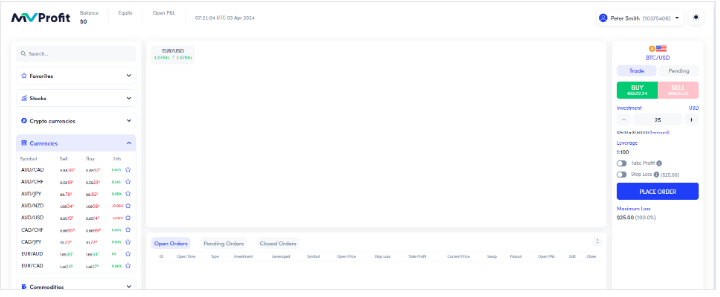

MVProfit’s web-based trading platform exhibits notable deficiencies in reliability and functionality, particularly evident in its struggle to generate trading charts—a fundamental feature crucial for any trading software. This inadequacy casts doubt on the company’s overall reliability and substantially heightens the risk of financial losses for investors.

Take a look:

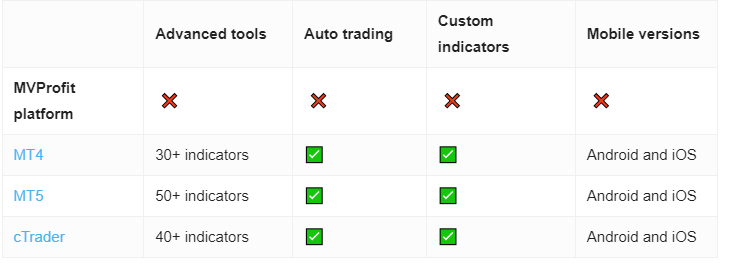

Considering the significant risks linked with unreliable trading platforms, it’s wise to select a broker offering established and industry-recognized trading platforms such as MetaTrader (MT). Renowned for their dependable performance, comprehensive analytical tools, and robust features, these platforms provide a secure and efficient trading environment. They assist traders in navigating the markets more effectively and with enhanced peace of mind.

Minimum Deposit

MVProfit imposes unusually high minimum deposit requirements, ranging from $2,500 for Basic and Silver accounts to $10,000 for a Gold account.

Given MVProfit’s questionable reputation, it is prudent for investors to avoid depositing any funds with them. The adage “better safe than sorry” is especially relevant in financial investments.

It is recommended to seek out brokers with a more reliable and trustworthy track record to ensure the safety and potential profitability of your investments.

Payment Methods

MVProfit sets itself apart from most reputable brokers by exclusively offering cryptocurrency as its payment method. This departure from the industry standard, where brokers typically provide a diverse range of payment options such as credit/debit cards, bank transfers, and various e-wallets, caters to the preferences and needs of a broad spectrum of traders.

However, relying solely on cryptocurrency payments can be seen as a restrictive practice, potentially deterring investors who prefer or rely on more traditional or varied payment methods. Additionally, this limitation raises concerns regarding transparency and the ease of tracking transactions, both of which are crucial elements of financial security and customer trust.

Given the significance of flexible and accessible payment solutions in the trading experience, MVProfit’s restrictive payment policy may pose a considerable drawback for many prospective clients.

Trading Instruments

MVProfit promotes an extensive array of trading instruments, encompassing Forex, Commodities, Indices, Cryptocurrencies, and Stocks, aiming to cater to a wide range of trading preferences and facilitating portfolio diversification across multiple markets.

However, MVProfit’s credibility issues as a forex broker and the deficiencies of their trading platform significantly hinder the practical benefits of this diversity. These platform limitations could severely impede traders’ ability to effectively utilize the available instruments, potentially impacting trading performance and outcomes.

Traders benefit from choosing a broker offering diverse instruments, reliable platforms, and a solid reputation for trustworthiness and regulatory compliance Opting for a reputable broker ensures a more secure and productive trading environment, crucial for achieving success in the diverse and dynamic world of online trading.

MVProfit Spread

MVProfit’s assertion of offering some of the industry’s tightest spreads prompted an investigation into the actual spreads on key currency pairs. The examination uncovered that the spreads for EURUSD, GBPUSD, and USDJPY averaged around 4 pips on their platform. This figure starkly contrasts with the more competitive market average of approximately 1.5 pips offered by most reputable brokers.

Such significantly higher spreads not only call into question MVProfit’s claim but also have financial implications for traders, as spreads are a critical factor in trading costs. Lower spreads typically translate to lower trading costs, directly impacting profitability. The disparity between MVProfit’s advertised spreads and the observed reality on their platform suggests a potential misalignment with industry standards, indicating that traders might find more favorable trading conditions elsewhere.

In light of this information, traders are encouraged to conduct thorough research and consider brokers known for their transparency and competitive spreads to enhance their trading efficiency and potential for success.

MVProfit Leverage

MVProfit’s leverage ratio of 100:1 serves as further evidence of its non-compliance with Swiss regulatory standards.

In Switzerland, regulatory authorities enforce a maximum leverage cap of 30:1 for traders, a measure designed to mitigate financial risk and encourage responsible trading practices.

MVProfit Withdrawal Requirements

The lack of clear and transparent information regarding withdrawal fees and requirements from MVProfit exacerbates the concerns surrounding their operations. In forex trading, transparency about financial transactions, including the details of deposit and withdrawal processes, is crucial for fostering trust between a broker and its clients.

This ambiguity can result in unexpected costs for traders and complicate the management of their funds, impacting their overall trading experience and financial planning.