Onyx TCS aims to convince us that it embodies a trustworthy, multi-regulated forex broker, ensuring peace of mind with our finances. However, rather than representing authenticity, this website appears to be a common online scam preying on inexperienced individuals seeking passive income. In this evaluation, we will outline methods for fact-checking to ascertain a broker’s legitimacy.

Onyx TCS Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Onyx TCS | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

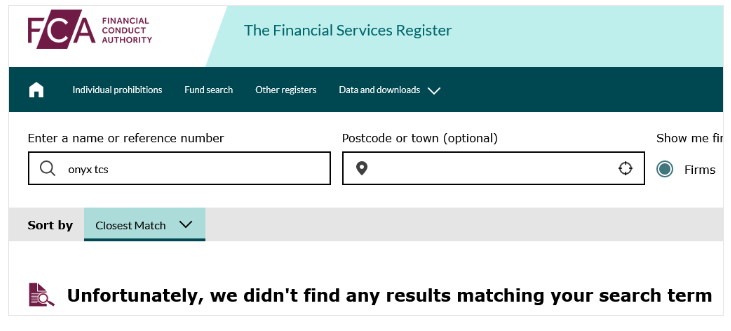

Onyx TCS asserts its UK base and purported licenses from various jurisdictions including Cyprus, South Africa, and Dubai. However, crucial details like the company name or regulatory licenses are conspicuously absent. This lack of transparency serves as a significant warning sign indicating potential fraudulent activity. Authentic forex brokers typically furnish comprehensive information regarding the legal entity behind their operations, including their location, licenses, and regulatory oversight.

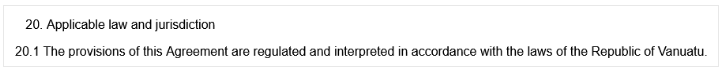

The absence of a company name in the Customer Agreement is notable, with the document citing the offshore jurisdiction of Vanuatu as the applicable legal framework. This choice of jurisdiction raises concerns, as Vanuatu is often associated with lax regulatory standards. The lack of clear identification further undermines the credibility of Onyx TCS, as reputable brokers typically provide transparent details about their corporate entity and the regulatory environment in which they operate.

Financial regulators’ reviews reveal no licensed Onyx TCS broker in mentioned jurisdictions. The website, available only in Russian, lacks legitimacy. Russian authorities caution against Onyx TCS, signaling its unlawful operations. These findings stress the need for caution when dealing with such entities.

When delving into financial investments, it’s vital to watch out for online scams by verifying brokers’ licenses. Partnering with authorized firms overseen by regulatory bodies like CySEC or the FCA offers benefits such as balance protection and fund reimbursement in case of insolvency, up to EUR 20,000 in the EU and £85,000 in the UK. Regulations in these regions prioritize investor protection, market integrity, and transparency through measures like transaction reporting and fund segregation.

Trading Platform

| Advanced tools | Auto trading | Custom indicators | Mobile versions | |

| Onyx TCS platform | ✅ | ❌ | ✅ | ❌ |

| MT4 | 30+ indicators | ✅ | ✅ | Android and iOS |

| MT5 | 50+ indicators | ✅ | ✅ | Android and iOS |

| cTrader | 40+ indicators | ✅ | ✅ | Android and iOS |

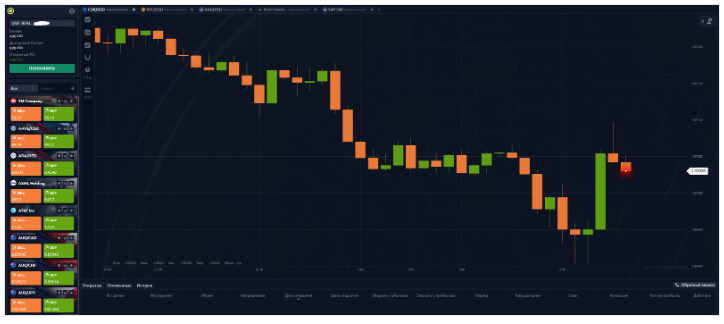

Upon registration, users gain entry to a rather rudimentary web trading platform lacking extensive customization capabilities or advanced features. Remarkably, this platform mirrors those utilized by several counterfeit brokers we’ve come across previously. Fraudsters employ manipulated trading software to deceive their targets, creating the illusion that their funds are genuinely being invested and even generating profits. This observation underscores the deceptive tactics employed by such entities and emphasizes the importance of thorough due diligence before engaging in any financial transactions.

Reputable brokers provide clients with an extensive array of trading software options, encompassing desktop applications, mobile apps, and web-based platforms. Among the most prevalent platforms in the industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have solidified their status as industry standards owing to their diverse range of features. They offer ample opportunities for customization, support multiple account usage, enable the creation and execution of custom scripts for automated trading, and facilitate the backtesting of trade strategies. The comprehensive capabilities of MT4 and MT5 make them favored choices among traders seeking robust and versatile trading solutions.

Minimum Deposit

| Onyx TCS | FP Markets | XM | HFM | |

| Minimum deposit | $150 | $100 | $5 | $0 |

Onyx TCS mandates a minimum deposit of 150 USD. Remarkably, for an equivalent or sometimes even lower sum, individuals could initiate a starter trading account with nearly any reputable broker, including prominent brands within the industry. This substantial price differential raises questions about the competitiveness and value proposition offered by Onyx TCS in comparison to established players in the market.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

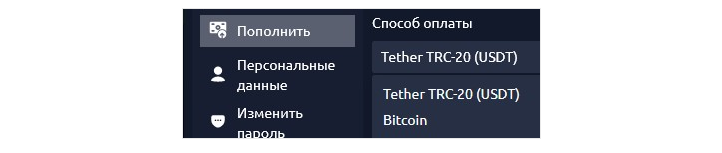

Onyx TCS solely accepts cryptocurrency deposits, a common tactic among financial scammers. Cryptocurrencies offer anonymity to scammers and prevent victims from seeking refunds.

Although some legitimate brokers do accept digital currencies like Bitcoin, they typically offer them alongside other transparent payment methods such as credit/debit cards, bank transfers, or popular e-wallets like PayPal, Neteller, or Skrill. This diverse range of payment options ensures flexibility and convenience for clients, while also maintaining transparency and security in financial transactions.

Trading Instruments

Onyx TCS trading platform includes currency pairs, indices, stocks, and cryptocurrencies. However, the availability of cryptocurrency derivatives trading suggests that this broker is not licensed in the United Kingdom. Financial regulations in the UK prohibit brokers from offering crypto derivatives trading, indicating a potential regulatory non-compliance by Onyx TCS. This discrepancy highlights the importance of verifying a broker’s licensing and adherence to regulatory standards before engaging in trading activities.

Onyx TCS Spread

| Onyx TCS | FP Markets | XM | HFM | |

| Spread EURUSD | 0.1 | 1.0 | 1.1 | 0.9 |

| Spread GBPUSD | 0.1 | 1.2 | 1.3 | 1.2 |

| Spread USDJPY | 0.1 | 1.2 | 1.3 | 1.1 |

In the trading platform, we observe an extremely tight spread of only 0.1 pip. Such a minimal spread suggests that the broker may be compensating by charging an additional commission. However, without access to other basic trading parameters, such as commission rates and fees, it is challenging for traders to fully understand the cost structure associated with their transactions. This lack of transparency raises concerns about the overall fairness and integrity of the broker’s pricing model.

Onyx TCS Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Onyx TCS | 500:1 | 500:1 | 500:1 | 500:1 | 500:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

Onyx TCS promotes leverage ranging from 1:100 to 1:500 across various types of trading accounts. This serves as further indication that Onyx TCS may not be a licensed broker operating within the European Union (EU) or the United Kingdom (UK). Regulatory authorities in these jurisdictions impose strict limitations on leverage offered by brokers to retail traders, typically capping it at much lower levels to mitigate the risks associated with high leverage trading. The advertised high leverage levels by Onyx TCS suggest a potential non-compliance with EU and UK regulatory standards.

High leverage indeed presents the potential for larger profits, but it also amplifies the risk of sudden and substantial losses. Consequently, major regulatory bodies impose limitations on leverage for retail traders. For instance, the Financial Conduct Authority (FCA), akin to regulators in the European Union (EU), restricts leverage to 1:30 for trading major currency pairs and imposes even lower leverage limits for assets prone to higher volatility. These measures aim to safeguard retail traders by mitigating the risks associated with excessive leverage and promoting responsible trading practices.

Onyx TCS Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Onyx TCS | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Onyx TCS does not specify extraordinary conditions for withdrawal. But these types of scams always surprise you with hidden fees and other tricks that prevent you from withdrawing your money back.

Onyx TCS Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| False claims of regulation | |

| Blacklisted | |

| Only crypto payments | |

| Risky leverage ratios |