In the dynamic realm of forex trading, PhoenixFireFx presents itself as a broker regulated in the UK, attracting the interest of numerous investors with assurances of reliability and safety. However, upon closer examination, our thorough investigation reveals a starkly different reality.

Contrary to their assertions, PhoenixFireFx is not under regulation as they profess. Their operations remain opaque, a significant red flag for potential investors. Such ambiguity and lack of accountability render them a perilous option for traders seeking a secure trading environment.

Prior to considering trading with PhoenixFireFx, it is imperative to review our comprehensive assessment of the company.

PhoenixFireFx Regulation

Although PhoenixFireFx appears to be a reputable forex broker operating within the highly regulated financial market of the UK, it is essential to exercise caution before making any decisions. Upon closer examination, it becomes evident that their purported regulatory status in the UK is unfounded.

This concern is further compounded by an official warning issued by the UK’s Financial Conduct Authority (FCA), which explicitly states that PhoenixFireFx lacks authorization to conduct business within the UK. FCA warnings are significant as they typically follow complaints from clients regarding deceptive practices, aiming to safeguard other investors from similar deception.

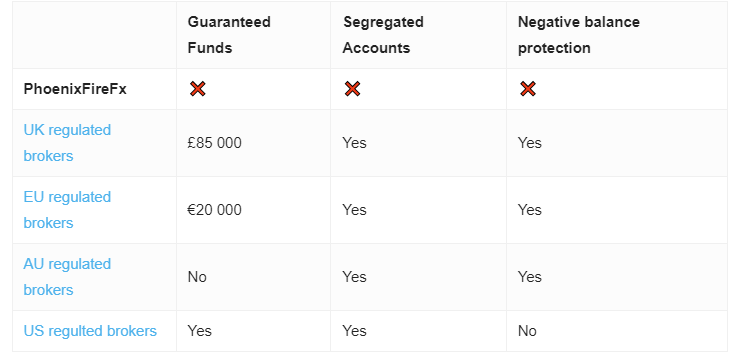

Given the gravity of these issues, investors should consider turning to more dependable and officially regulated brokers for their trading endeavors. Opting for a broker with legitimate approval from a reputable regulator such as the FCA is imperative to safeguarding one’s investments and financial well-being.

Trading Platform

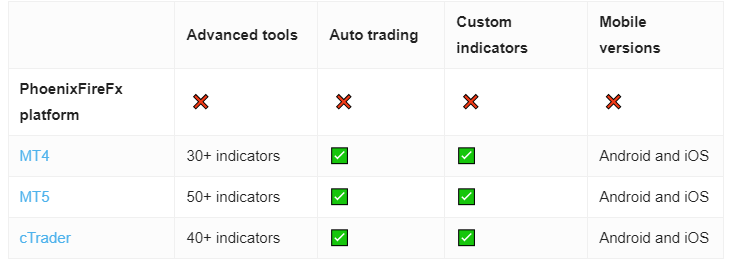

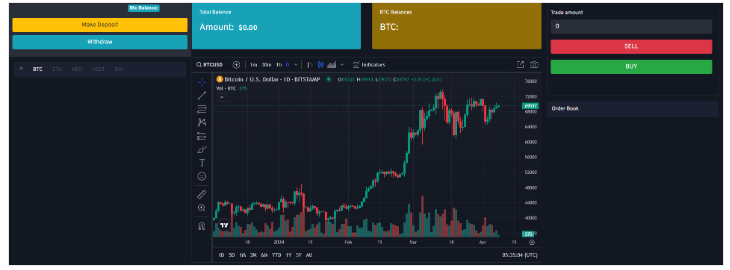

PhoenixFireFx’s binary options platform fails to meet expectations. Upon signing up, we encountered only a single TradingView chart, lacking any unique or distinguishing features. Consequently, it blends in with numerous similar, less reliable options available in the market.

Take a look:

Given the broker’s questionable reliability and the lackluster features of its binary options platform, it is advisable for traders to avoid PhoenixFireFx. Safeguarding investments is paramount, and this broker appears to fall short in providing that security.

For those seeking a top-tier and user-friendly trading experience, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) emerge as superior alternatives. Renowned for their robust charting tools and extensive array of technical analysis features, they have garnered widespread acclaim among traders worldwide. Opting for a platform renowned for its reliability is crucial, as it not only enhances your trading capabilities but also serves to safeguard your financial assets.

Minimum Deposit

PhoenixFireFx’s account setup presents potential concerns for interested traders due to its various minimum deposit requirements. The thresholds differ significantly across its account tiers: a Silver account mandates a minimum deposit of $1,000, while a Gold account necessitates $2,500, and a Premium account begins at $3,500.

It’s essential to emphasize that many reputable brokers offer more accessible options, often requiring significantly lower initial deposits. For example, it is common for well-regarded brokers to provide Micro accounts where traders can start with deposits as modest as under $50. This lower entry point is particularly appealing to beginners or individuals seeking to engage in trading with a smaller financial commitment.

Payment Methods

PhoenixFireFx appears to provide a restricted array of payment methods on its platform, exclusively accepting Credit/Debit card transactions (specifically Visa and MasterCard) as well as cryptocurrencies (Bitcoin and Ethereum).

This restricted selection may raise concerns for potential users as it lacks the flexibility commonly found with many other brokers. Typically, broader support includes additional options such as bank transfers and e-wallets, catering to a wider spectrum of preferences and requirements.

Trading Instruments

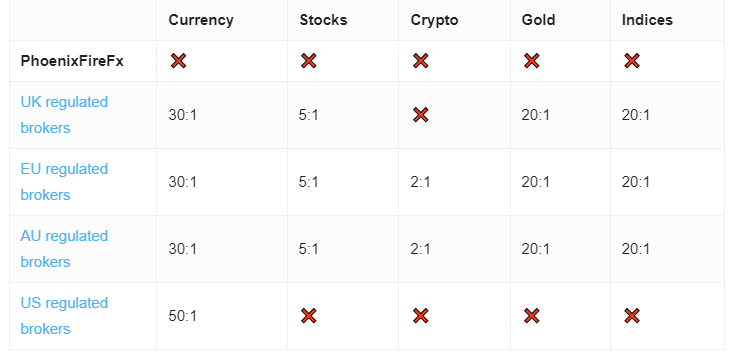

PhoenixFireFx’s assertions of providing trading services in forex and binary options demand thorough examination, particularly given the apparent lack of reliability and transparency surrounding the platform and its operating entity. Prior to engaging with any trading platform, it is imperative for traders to exercise due diligence.

This involves verifying regulatory compliance, comprehending the terms and conditions, and researching user reviews as well as any regulatory alerts or warnings associated with the company. Trading in forex and binary options entails substantial risk, and dealing with an unreliable platform heightens the potential for financial loss and susceptibility to fraudulent activities.

Traders should prioritize platforms that are forthcoming about their regulatory standing, furnish clear information regarding associated risks, and offer robust customer support. Furthermore, opting for platforms endorsed by reputable financial regulatory bodies can provide an additional layer of security and assurance.

PhoenixFireFx Spread

Binary options trading platforms function in a distinct manner compared to traditional forex or stock trading platforms. Unlike conventional trading, binary options trading does not involve spreads. Instead, it revolves around predicting whether the price of an asset will increase or decrease within a specified time frame. If the trader’s prediction proves accurate, they receive a predetermined profit; however, if incorrect, they forfeit the funds invested in that specific trade. The straightforward nature of this all-or-nothing approach is what attracts some traders to binary options. However, it’s important to note that this simplicity is also associated with high levels of risk.

PhoenixFireFx Leverage

Similarly, binary options trading does not entail the utilization of leverage. Unlike forex or stock trading, where leverage enables traders to borrow funds to amplify their trading positions, binary options trading revolves around a straightforward yes/no proposition regarding the price movement of an asset within a predefined time frame. Traders determine their investment amount for each trade, and the potential return or loss is established at the time of the investment. Consequently, traders are aware of the precise amount they stand to gain or lose, without the complexities of leverage, which can magnify both profits and losses in other trading formats.

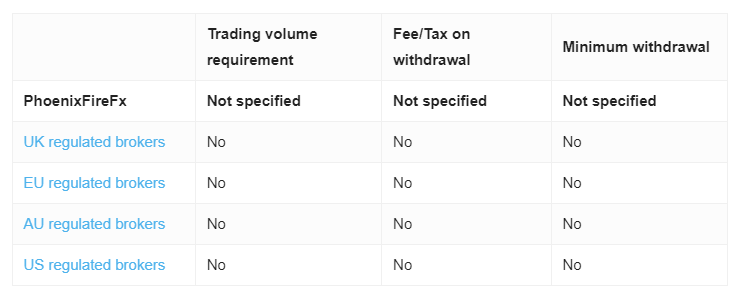

PhoenixFireFx Withdrawal Requirements

The absence of transparent information concerning fees and withdrawal prerequisites on the PhoenixFireFx website represents another significant cause for concern!

In the realm of online trading, transparency regarding financial transactions, encompassing deposits, withdrawals, and any applicable fees, is paramount for traders to adeptly oversee their finances.