When selecting a reliable and regulated forex broker, it is worth reconsidering PrimusCFD. Although they assert regulation in prominent regions like Cyprus and offshore locations such as Vanuatu, they lack a valid forex license to operate in these areas or elsewhere.

Given this essential information, we highly recommend reviewing our comprehensive evaluation of PrimusCFD before making any investment choices. This precaution is crucial to safeguard your funds and investments.

PrimusCFD Regulation

PrimusCFD presents itself as a prominent European broker based in Cyprus. However, upon closer inspection, we discovered some troubling information. We verified with the Cyprus Securities and Exchange Commission (CySEC), which regulates forex brokers in Cyprus, and found that PrimusCFD does not hold a valid forex license to operate there.

Furthermore, the Italian regulatory authority, the Commissione Nazionale per le Società e la Borsa (CONSOB), has issued a clear warning about PrimusCFD, labeling it as an unauthorized entity violating the law.

Given these significant red flags, it is clear that PrimusCFD operates outside regulatory boundaries and poses substantial risks. We strongly recommend avoiding PrimusCFD to safeguard your financial interests and investments.

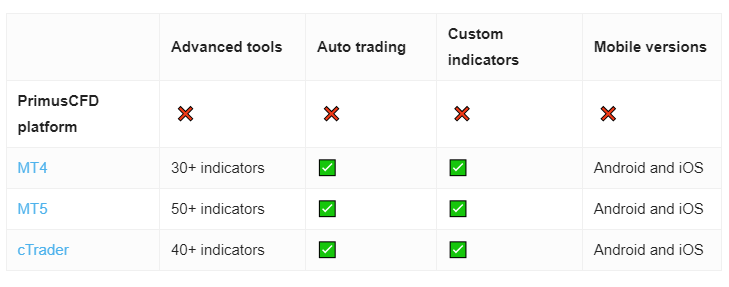

Trading Platform

PrimusCFD lacks transparency regarding their account types and minimum deposit requirements, which is a major drawback for potential traders. Clear information in these areas is essential for making informed decisions and establishing trust in a broker.

When a broker fails to provide such essential information, it creates uncertainty and makes it difficult for traders to assess whether the broker aligns with their trading goals and requirements. Knowing the different account options and the minimum deposit needed helps traders choose the most suitable platform for their financial strategy. Therefore, the lack of this information from PrimusCFD can be a major concern for anyone considering using their services.

Minimum Deposit

PrimusCFD lacks clear information about their account types and minimum deposit requirements, which is a significant drawback. For traders, transparency in these areas is essential for making informed decisions and building trust with a broker.

Without this information, it becomes challenging to determine if PrimusCFD meets your trading needs and expectations. This lack of clarity can create uncertainty and hinder your ability to select a broker that aligns with your financial goals and trading strategies.

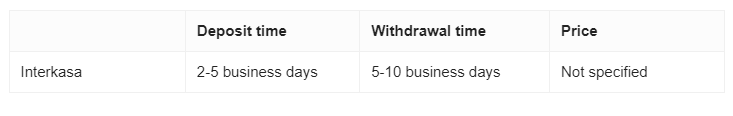

Payment Methods

PrimusCFD exclusively supports payments through Interkasa, an online payment processing system. It’s important to be aware of this limited payment option if you are considering conducting financial transactions with them.

In contrast, other reputable brokers accept a variety of standard payment methods, including credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller. This flexibility can make managing your investments significantly more convenient.

Trading Instruments

PrimusCFD advertises trading across multiple asset classes, including Forex, shares, commodities, cryptocurrencies, and indices. However, serious concerns about the company’s regulatory status and overall reliability cast doubt on the accessibility of these trading options.

This discrepancy raises significant red flags, making it essential to thoroughly verify their claims. Protecting your investments by ensuring you’re dealing with a trustworthy and transparent broker is crucial.

PrimusCFD Spread

PrimusCFD offers average spreads on major currency pairs, such as 1.2 pips on EURUSD, 1.2 pips on GBPUSD, and 1.3 pips on USDJPY. However, it’s important to note that reputable brokers typically offer spreads within a range of up to 1.5 pips.

Therefore, you don’t need to trade with an unregulated broker to get such competitive spreads. Prioritizing regulated brokers can ensure both your security and competitive trading conditions.

PrimusCFD Leverage

PrimusCFD allegedly offers generous leverage of up to 400:1, which strongly suggests that the company is not regulated in Cyprus.

Legitimate brokers in Cyprus are required to cap their leverage at 30:1 to protect customers. This unusually high leverage is a red flag, indicating that PrimusCFD does not adhere to the regulatory standards designed to ensure trader safety.

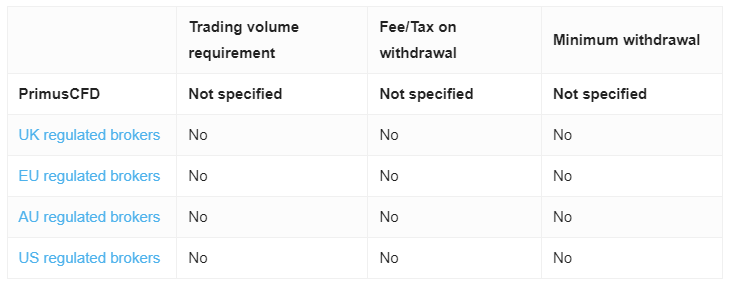

Withdrawal Requirements

PrimusCFD does not provide essential details regarding their withdrawal fees and conditions. This lack of transparency can be problematic for traders, as understanding these fees and conditions is crucial for managing investments effectively and avoiding unexpected charges.

Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims regulation in Cyprus | |

| CONSOB warning | |

| No reliable trading software | |

| Non-transparent trading conditions |