Profit Pulse Zone presents itself as an award-winning financial services provider operating in tightly regulated jurisdictions worldwide. However, even a cursory fact check reveals otherwise. Profit Pulse Zone is merely another online scam posing as a forex and CFD broker. Let’s delve into why entrusting your funds to Profit Pulse Zone is ill-advised and explore superior alternatives when selecting an investment intermediary.

Profit Pulse Zone Regulation

The regulatory status of a financial services provider is paramount. Licensed brokers furnish comprehensive details about their operating company, location, authorized jurisdictions, and regulatory oversight. However, this critical information is conspicuously absent from the Profit Pulse Zone website.

While the company asserts its base in the United States, it simultaneously declares its refusal to accept customers from that jurisdiction. This discrepancy raises significant doubts about the legitimacy and transparency of Profit Pulse Zone as a financial services provider.

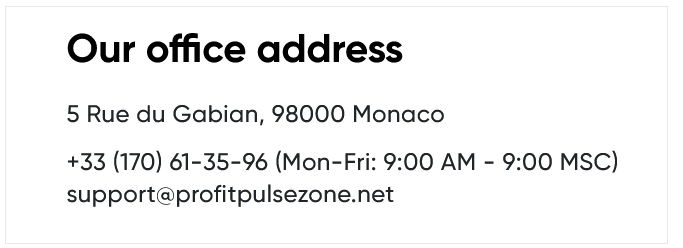

The contact address is in Monaco:

And the text of the Terms and Conditions references the offshore jurisdiction of Vanuatu:

The absence of a company name or regulatory license details is a glaring red flag. Upon investigation, it becomes evident that no licensed broker under the trade name and domain of Profit Pulse Zone exists in the registers of financial regulators across mentioned jurisdictions.

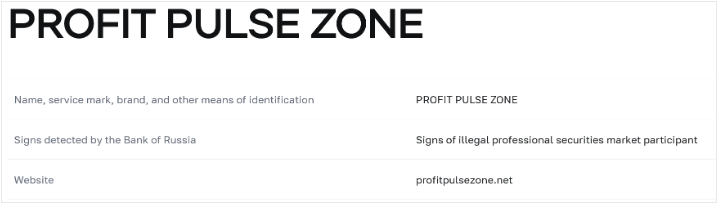

Furthermore, the availability of the website in English and Russian, coupled with the Russian fiscal authorities’ warning against Profit Pulse Zone as an unlicensed financial services provider, underscores the dubious nature of the platform. This lack of regulatory authorization and official recognition from financial authorities raises serious concerns about the legitimacy and trustworthiness of Profit Pulse Zone.

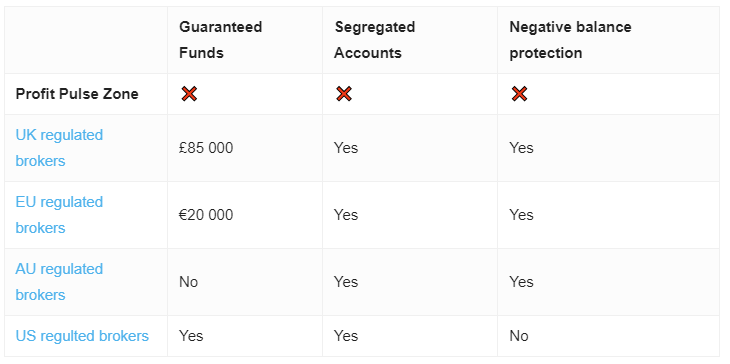

Under no circumstances should you entrust your funds to such anonymous websites replete with false and contradictory information. Instead, consider turning to reputable companies operating under the supervision of esteemed regulatory bodies like the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK. As a customer of these regulated entities, you benefit from various safeguards, including negative balance protection and fund guarantees in the event of broker insolvency, up to EUR 20,000 in the EU and £85,000 in the UK. These regulatory assurances provide peace of mind and protect your investments against potential risks.

Trading Platform

After account registration we get access to web-based trading software. Here is how it looks like:

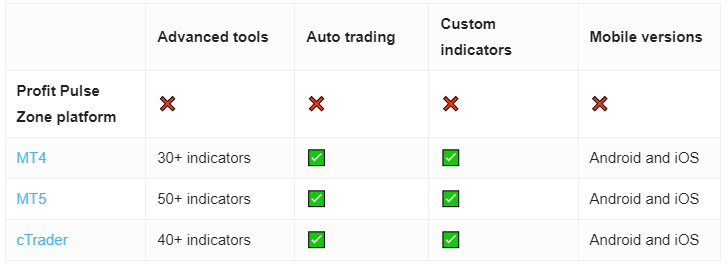

While this platform may offer basic order placement functionality, it pales in comparison to the robust capabilities provided by MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It’s no coincidence that these platforms have become industry standards. They boast a plethora of features, including extensive customization options, support for multiple accounts, the ability to design and deploy custom scripts for automated trading, and robust tools for backtesting trading strategies.

However, it’s important to note that the presence of a trading platform alone does not enhance the legitimacy of this website, nor does it guarantee that the alleged broker offers genuine trading opportunities. Many scammers employ manipulated trading software to deceive victims into believing their funds are being invested. Therefore, it’s essential to exercise caution and conduct thorough research before engaging with any trading platform or broker.

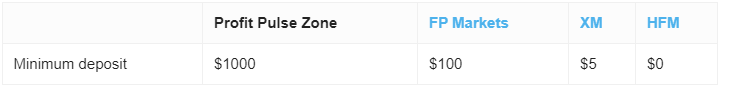

Minimum Deposit

Profit Pulse Zone imposes a significantly high minimum deposit requirement of $1000 for a basic account. Contrastingly, you could initiate trading with renowned industry leaders for as low as $100 or even $10. With such established brands, you gain access to reputable platforms, robust customer support, and greater regulatory oversight, mitigating the risks associated with dubious brokers like Profit Pulse Zone. Therefore, there’s little incentive to jeopardize your investments with such shady entities.

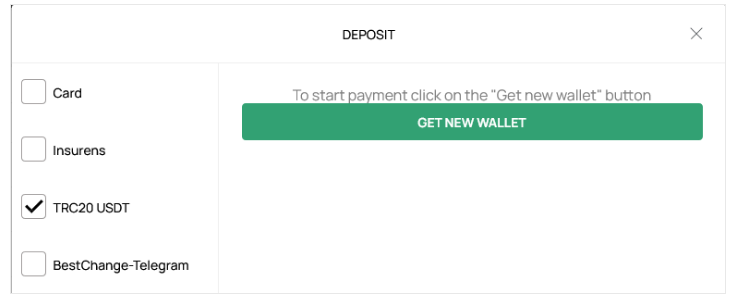

Payment Methods

Profit Pulse Zone calls to deposit funds mainly via cryptocurrencies and obscure Russian payment providers like activatetrade.cash.

Absolutely, scammers often favor cryptocurrencies due to the irreversible nature of transactions, which makes refunds virtually impossible. While there are indeed legitimate brokers that accept digital currencies like Bitcoin, they typically offer them alongside other transparent payment methods such as credit/debit cards, bank transfers, or popular e-wallets like PayPal, Neteller, or Skrill. This diversified payment approach not only provides convenience for clients but also enhances transparency and security, aligning with industry best practices and regulatory standards.

Trading Instruments

It primarily advertises cryptocurrency trading, but its trading software purportedly encompasses inflows from all major asset classes, including currency pairs, commodities, and equities. However, as previously mentioned, the trading services offered by this fraudulent broker are undoubtedly fictitious. This discrepancy between advertised services and actual operations further underscores the deceitful nature of Profit Pulse Zone and highlights the importance of conducting thorough due diligence before engaging with any online trading platform.

Profit Pulse Zone Spread

Even if the Profit Pulse Zone trading platform displays a seemingly low spread of 0.9 pips for benchmark currency pairs like EUR/USD, it’s essential to recognize that this apparent profitability is irrelevant if the trades executed on the platform are fictitious. Deceptive brokers may manipulate trading data to create an illusion of profitability, ultimately deceiving traders into depositing funds. Therefore, it’s crucial to exercise caution and skepticism when evaluating trading platforms and to prioritize thorough research and verification of a broker’s legitimacy before committing any funds.

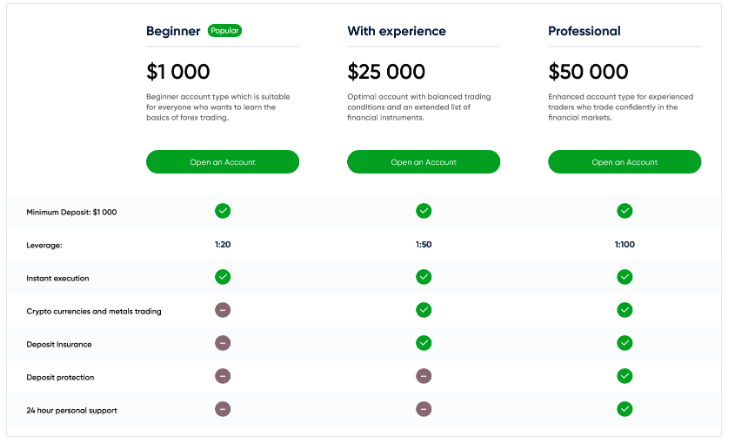

Profit Pulse Zone Leverage

Profit Pulse Zone offers leverage of up to 1:100, which is further proof that it is not a licensed broker operating in the EU, US or any other highly regulated jurisdiction.

Absolutely, trading with high leverage can potentially yield higher profits, but it also significantly amplifies the risk of sudden and substantial losses in proportion to the leverage used. To protect retail traders from excessive risk, leading regulators impose leverage limitations. For instance, in the EU, UK, and Australia, the maximum permitted leverage for retail traders is typically capped at 1:30, while in the US, it is limited to 1:50. Moreover, these maximum levels usually apply to trading major currency pairs, with even more restricted leverage for assets deemed more volatile. These regulatory measures aim to safeguard traders by mitigating the potential for extreme losses due to overleveraging.

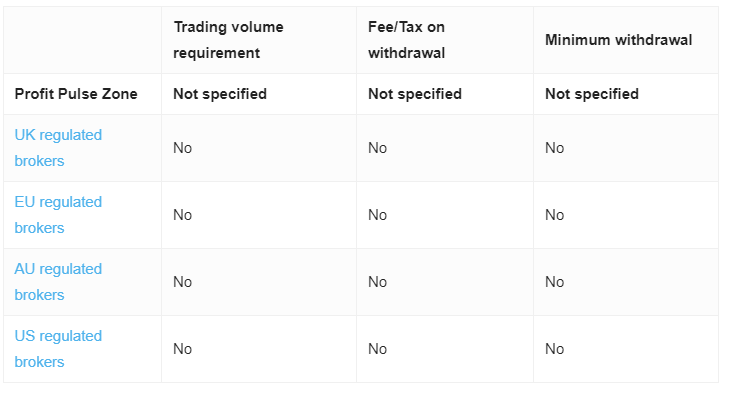

Profit Pulse Zone Withdrawal Requirements

While Profit Pulse Zone may not explicitly detail extraordinary withdrawal conditions, it’s common for scams of this nature to spring surprises with hidden fees and other tactics that obstruct the withdrawal process. These traps often revolve around bonuses offered, where traders are enticed with seemingly generous incentives but find themselves entangled in complex terms and conditions that hinder withdrawal attempts. Therefore, it’s crucial to exercise caution and thoroughly review all terms and conditions, particularly concerning bonuses and withdrawal procedures, to avoid falling victim to such deceptive practices.

Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| Fake legal details | |

| Blacklisted | |

| High minimum deposit | |

| Risky leverage ratios |