S-Ativlam website appears familiar, not due to its portrayal as a reputable, regulated broker, but rather because it closely resembles numerous other fraudulent brokers we’ve encountered. In this assessment, we’ll outline methods for recognizing such scams and guide you towards more reliable financial service providers.

S-Ativlam Regulation

The primary piece of information regarding a financial services provider is its regulatory status. Legitimate brokers furnish extensive details about their operating company, location, authorized jurisdictions, and the regulatory bodies overseeing their operations.

S-Ativlam fails to disclose the entity behind its website. Even the Terms and Conditions neglect to mention the legal entity’s name. This lack of transparency strongly suggests fraudulent activity.

Furthermore, S-Ativlam lists a contact address in Cyprus, which appears to be fictitious. Such an opaque online presence cannot legally offer financial services in a regulated jurisdiction.

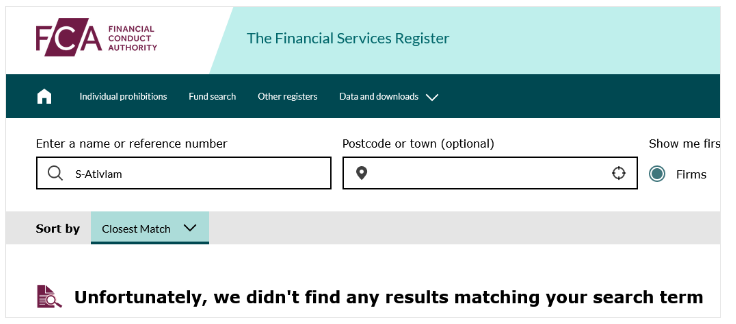

Despite claiming to hold licenses from financial regulators in Cyprus, Dubai, the UK, and South Africa, an examination of the relevant regulatory records reveals this assertion to be false.

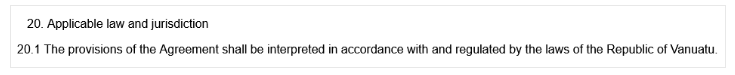

The Terms and Conditions specify as the applicable jurisdiction Vanuatu – an offshore zone.

Russian financial authorities have issued a warning to investors regarding S-Ativlam, stating that it lacks proper licensing.

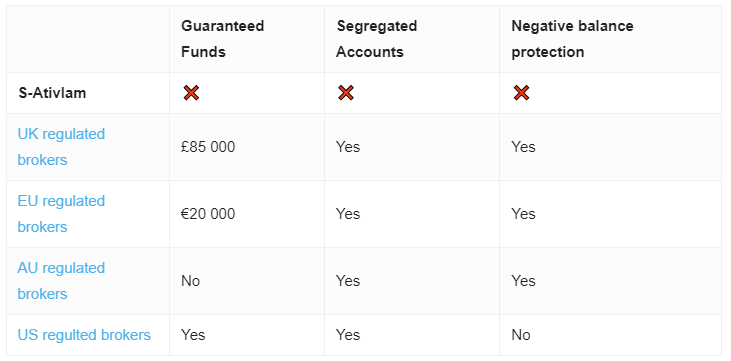

It’s crucial to avoid entrusting your funds to such anonymous websites that are replete with false and conflicting information. Instead, consider engaging with reputable companies that operate under the supervision of respected regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK. By doing so, you’ll benefit from various safeguards, including protection against negative balances and guarantees for your funds in case the broker faces bankruptcy. In the EU, this guarantee can amount to EUR 20,000, while in the UK, it’s up to 85,000 GBP. Regulations in the UK and EU encompass significant measures aimed at enhancing investor protection and fostering market integrity and transparency, such as transaction reporting. Additionally, regulated brokers are mandated to segregate operational funds from client funds.

Trading Platform

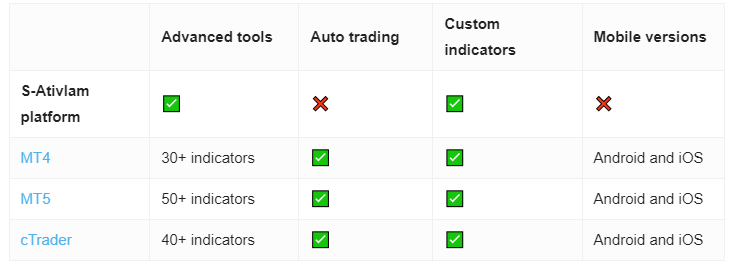

S-Ativlam employs a rudimentary web trading platform. However, it’s important to highlight that the mere presence of a trading platform does not enhance the legitimacy of this website nor does it assure that the purported broker facilitates authentic trading. Numerous scammers utilize manipulated trading software to deceive their victims into believing that their funds are being invested legitimately.

Although the platform offers fundamental features such as order placement, chart customization, and application of technical indicators, it lacks the advanced functionalities found in the industry’s most prevalent trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have become industry standards due to their extensive feature sets, which include diverse customization options, support for multiple accounts, the ability to create and deploy custom scripts for automated trading, and the capability to backtest trade strategies.

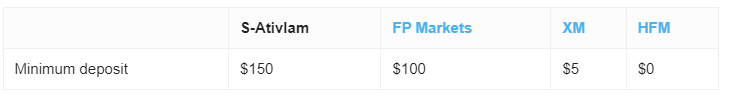

Minimum Deposit

S-Ativlam mandates a minimum deposit of 150 USD for a starter account. However, with a comparable or even lower amount, you could open a trading account with any licensed broker, including some of the industry’s leading brands.

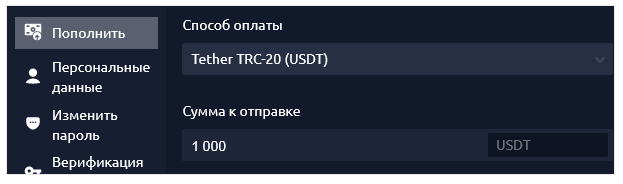

Payment Methods

It comes as no surprise that S-Ativlam exclusively accepts cryptocurrencies as the sole payment method. This aligns with the preferred payment method of many financial scammers. Cryptocurrencies offer a level of anonymity, making them conducive to fraudulent activities. Additionally, they prevent defrauded individuals from seeking refunds, further benefiting scammers.

While there are indeed legitimate brokers that accept digital currencies such as Bitcoin, they typically do so in conjunction with other transparent payment methods like credit/debit cards, bank transfers, or popular e-wallets such as PayPal, Neteller, or Skrill. This diversified range of payment options reflects their commitment to transparency and offers clients greater flexibility and choice in managing their funds.

Trading Instruments

S-Ativlam theoretically provides trading options in forex, stocks, indices, commodities, and cryptocurrencies. However, as previously highlighted, this trading activity is highly dubious and likely not legitimate. It is strongly advisable to invest in financial markets exclusively through duly licensed brokers to safeguard your interests and ensure the security of your investments.

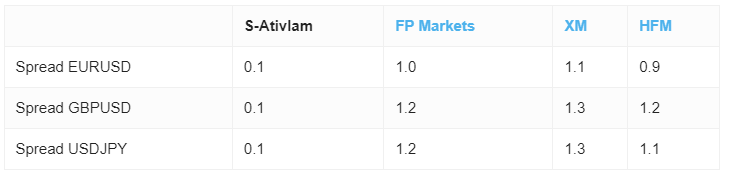

S-Ativlam Spread

In the trading platform, a remarkably low spread of only 0.1 pip is observed. Such a minimal spread typically indicates that the broker charges a commission for trades. However, S-Ativlam fails to furnish information regarding the price incurred by the trader, which raises concerns about transparency and the true cost of trading with this broker.

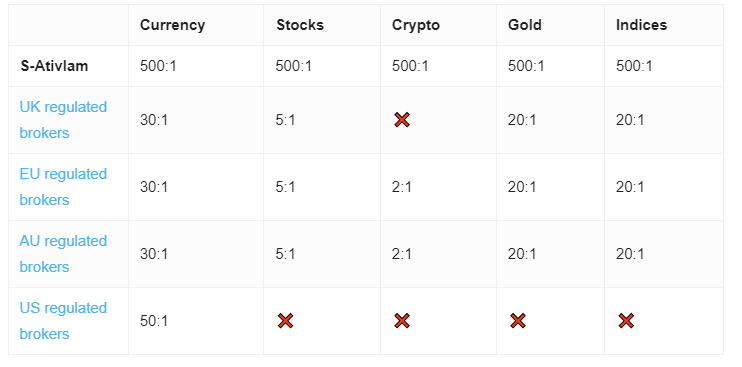

S-Ativlam Leverage

S-Ativlam offers leverage ranging from 1:100 to 1:500 across various account types. This discrepancy serves as additional evidence suggesting that S-Ativlam is not a licensed broker in the EU or the UK. High leverage can potentially amplify profits, but it also escalates the risk of abrupt and substantial losses. Recognizing these risks, major regulators impose limitations on leverage for retail traders. For instance, the FCA, along with EU regulators, restricts leverage to 1:30 for trading major currency pairs and imposes even lower limits for more volatile assets.

Regulated brokers typically extend higher leverage solely to professional clients who must satisfy stringent criteria regarding capital and experience, consequently forgoing the protections enjoyed by retail traders.

If you do not meet the qualifications as a professional trader but are inclined to engage in high-leverage trading, the most feasible alternative is to utilize the services of an offshore affiliate associated with a reputable brand.

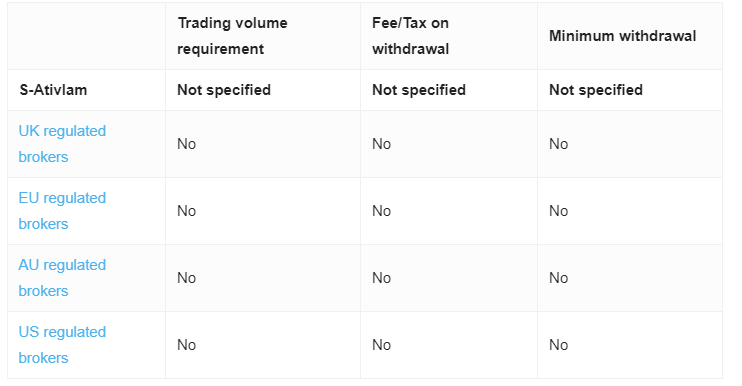

S-Ativlam Withdrawal Requirements

S-Ativlam does not explicitly outline exceptional conditions for withdrawal. However, such scams typically spring surprises with concealed fees and other tactics that hinder the withdrawal of funds. Frequently, these pitfalls are associated with the bonuses offered by the platform.

S-Ativlam Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| False claims of regulation | |

| Blacklisted | |

| Only crypto payments | |

| Risky leverage ratios |