SkyFexCo, despite asserting regulatory compliance and Australian registration, does not possess the necessary forex license to operate lawfully in Australia. Essentially, SkyFexCo seems to be a deceitful platform targeting traders seeking a dependable forex trading venue.

We highly advise steering clear of SkyFexCo to safeguard your financial well-being and security. It’s imperative to engage with a reputable and licensed broker to ensure a secure and trustworthy trading environment.

SkyFexCo Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| kyFexCo | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

SkyFexCo asserts its registration and regulation in Australia, a globally respected financial hub. However, our investigation reveals that the company operates without any regulatory oversight in this jurisdiction. This significant inconsistency raises doubts about the authenticity of their claims, marking them as considerable red flags within the trading community.

Given these discrepancies, it’s vital to steer clear of SkyFexCo. We strongly recommend partnering with brokers who not only hold regulation but also maintain transparent and verifiable track records. Ensuring your broker possesses a valid license and adheres to strict regulatory standards is paramount for a secure and dependable trading environment.

To aid in making an informed decision, we’ve compiled a table featuring some of the top brokers regulated across various jurisdictions. This resource enables you to select a partner that aligns best with your trading requirements.

Trading Platform

Furthermore, we strongly discourage registering or opening an account with SkyFexCo. Our efforts to interact with the platform were fruitless, as the company demands a deposit before allowing access to their trading software. This requirement indicates a significant risk of potential financial setbacks, making it wise to refrain from investing in this software. Depositing funds into a platform lacking credibility primarily benefits those engaged in scams.

Safeguarding your investments and ensuring a secure trading journey necessitates selecting a reputable broker and dependable trading software. We suggest contemplating platforms such as MetaTrader, renowned in the industry for their reliability and functionality. Avoid any platforms that raise suspicion and invest solely with trusted providers to mitigate risks and safeguard your financial interests.

Minimum Deposit

Moreover, SkyFexCo presents four account types: Premium, Compound, Pro, and Standard, each with distinct minimum deposit requirements. Specifically, the Premium account demands a $1,000 deposit, the Compound account $5,000, the Pro account $10,000, and the most economical, the Standard account, necessitates $350.

In contrast, reputable forex brokers typically stipulate deposits not exceeding $250. This significant variance in deposit requirements heightens concerns regarding SkyFexCo’s operational standards compared to industry standards. Such elevated minimum deposits can pose barriers for novice traders and deviate from the accessibility and client trust typically associated with reputable brokers.

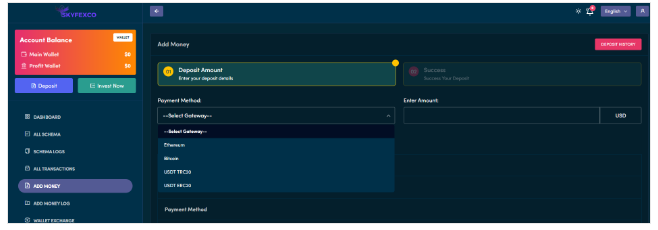

Payment Methods

It comes as no surprise that SkyFexCo accepts payments via cryptocurrencies like Bitcoin, Ethereum, and USDT. While cryptocurrencies can provide anonymity and transactional speed, their utilization by this broker may raise concerns due to the absence of regulatory oversight.

In contrast, trustworthy brokers usually offer a wide range of payment options, including credit/debit cards, bank transfers, and e-wallet systems such as Skrill, PayPal, and Neteller. These conventional payment methods are typically linked to established financial infrastructures, providing a level of security and traceability that transactions solely reliant on cryptocurrencies may lack.

Trading Instruments

SkyFexCo’s narrow selection, featuring only forex and cryptocurrencies, presents yet another reason to steer clear of it. With uncertainties surrounding SkyFexCo, we strongly discourage choosing them as your broker. Instead, selecting brokers with proven track records for reliability and transparency is a wise decision.

Reputable brokers provide a diverse range of trading instruments beyond forex and cryptocurrencies. They also maintain high service standards, fostering a trustworthy and secure trading environment for their clientele. This holistic approach to trading not only protects your investments but also elevates your overall trading experience.

SkyFexCo Spread

Furthermore, SkyFexCo’s failure to disclose essential trading conditions, such as spreads, is a substantial red flag signaling a lack of transparency. In forex trading, clarity regarding spreads—the variance between the buying and selling price of a currency pair—is vital, as it impacts every trade and potential profitability. This lack of transparency from SkyFexCo is worrisome, as it hinders traders from making informed decisions and comprehending the actual cost of their trading activities. Opting for brokers who transparently disclose all trading conditions, including spreads, is imperative for fostering a fair and transparent trading environment.

SkyFexCo Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| SkyFexCo | Not specified | ❌ | Not specified | ❌ | ❌ |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

Likewise, the lack of information regarding the leverage options offered by SkyFexCo adds to concerns about the transparency of their services. Leverage plays a crucial role in forex trading, enabling traders to control sizable positions with a comparatively small capital outlay. However, it also amplifies the risk of substantial losses, underscoring the importance of brokers clearly outlining their leverage policies.

SkyFexCo Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| SkyFexCo | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

In conclusion, SkyFexCo’s specific information regarding withdrawal fees and associated requirements remains notably elusive, as comprehensive details were not readily available on their website. This lack of transparency regarding withdrawal policies, including any potential fees or conditions, is a crucial consideration for traders when making informed decisions about their financial transactions with a broker.

The transparency of withdrawal terms is paramount, as hidden fees or restrictive conditions can significantly affect the accessibility of funds and overall trading satisfaction. It is advisable for traders to select brokers who offer clear, detailed descriptions of their withdrawal policies, thereby ensuring a smooth and transparent financial process.

SkyFexCo Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Falsely claims registration in Australia | |

| No reliable trading software | |

| Non-transparent trading conditions | |

| Allows payments through cryptocurrencies only |