Smart Limited Group positions itself as a reputable forex and CFD broker, boasting accolades that suggest reliability for managing investments. However, a simple verification process uncovers otherwise. Through this assessment, we aim to elucidate why Smart Limited Group falls short of its claims, exposing it as yet another fraudulent entity in the online realm. Furthermore, we will offer alternative avenues for investment, directing you towards more trustworthy intermediaries.

Smart Limited Group Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Smart Limited Group | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

A legitimate broker’s website typically offers transparent and thorough information about the owning company, its location, and the regulatory frameworks it adheres to. Licensed financial entities are obliged to furnish extensive legal documentation.

Regrettably, such transparency is conspicuously absent from the Smart Limited Group website. Vital details such as company contact information and regulatory licenses are conspicuously absent. The sole document available, a generic Privacy Policy, lacks any mention of a legal entity or jurisdiction.

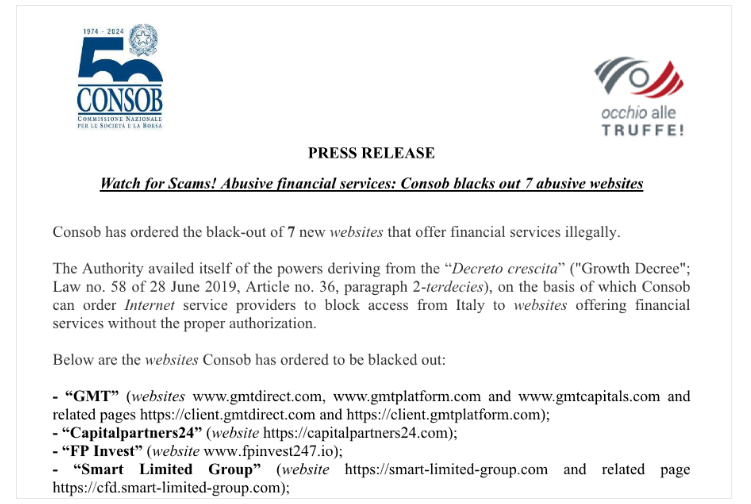

The Smart Limited Group has attracted scrutiny from the Italian financial regulator CONSOB, which has cautioned investors against its legitimacy as a financial services provider.

Before entrusting your funds to financial instruments, it’s crucial to ensure you’re dealing with a licensed intermediary and not one of the many fraudulent entities lurking online. It’s unwise to place your trust in anonymous websites rife with false and conflicting information.

Instead, consider reputable companies operating under the supervision of esteemed regulatory bodies like the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK. As a client of these firms, you’ll benefit from various assurances, including negative balance protection and fund guarantees in the event of broker insolvency. These guarantees amount to EUR 20,000 in the EU and 85,000 GBP in the UK.

Regulations in the UK and EU encompass crucial measures aimed at enhancing investor protection, market integrity, and transparency, such as transaction reporting. Regulated brokers are obligated to segregate their operational funds from client funds, further safeguarding investors’ interests.

Trading Platform

Smart Limited Group touts a cutting-edge, user-friendly trading platform as one of its key offerings. However, upon registering an account, users encounter a basic web trading platform that lacks extensive customization features or advanced functionalities. Alarmingly, this platform closely resembles ones utilized by several fraudulent brokers previously encountered. Such scammers manipulate trading software to deceive victims into believing that their funds are genuinely being invested and generating profits.

While the platform offered by Smart Limited Group allows for basic order placement, it pales in comparison to the robust capabilities provided by MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It’s no surprise that these platforms have become the industry standard. They boast an extensive array of features, including diverse customization options, support for multiple accounts, the ability to create and deploy custom scripts for automated trading, and robust tools for backtesting trade strategies.

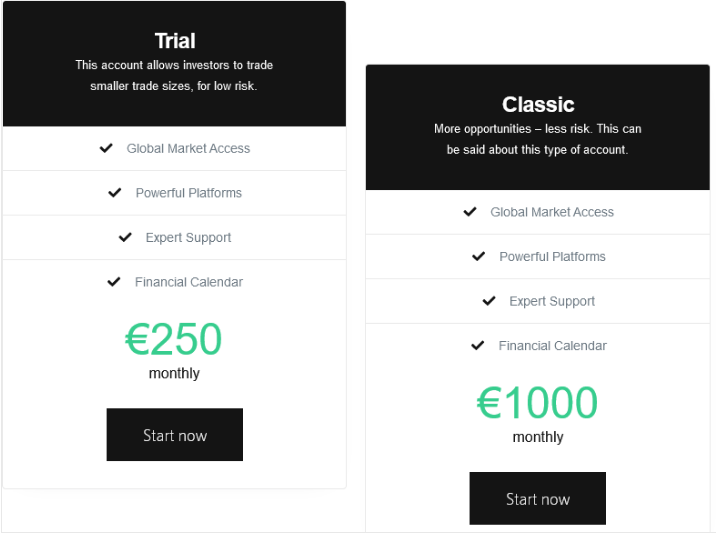

Minimum Deposit

Smart Limited Group stipulates a minimum deposit of 250 EUR, which aligns with the industry norm. However, it’s worth noting that this amount could afford you the opportunity to open a trading account with a reputable and properly licensed forex broker. Several prominent brands in the industry provide Micro and Cent accounts with remarkably low entry thresholds, making them particularly suitable for novice investors.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

Smart Limited Group exclusively accepts cryptocurrency deposits, a common characteristic among financial scammers. Cryptocurrencies serve as their preferred payment method due to the anonymity they afford scammers, while simultaneously preventing victims from seeking refunds.

Although there are legitimate brokers that do accept digital currencies such as Bitcoin, they typically offer a range of transparent payment methods including credit/debit cards, bank transfers, and popular e-wallets like PayPal, Neteller, or Skrill.

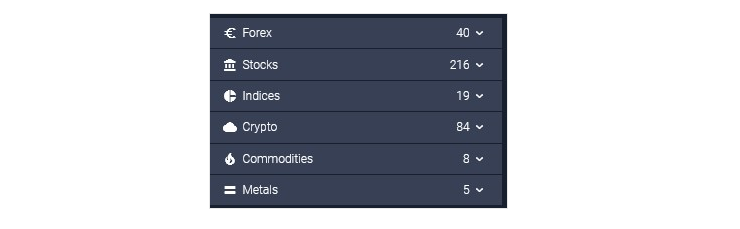

Trading Instruments

While Smart Limited Group boasts an extensive array of trading options, encompassing over 200 stocks, 40 currency pairs, more than 80 cryptocurrencies, as well as indices, commodities, and metals, it’s important to reiterate that there’s no substantial evidence to support the authenticity of this trading activity.

Prudence dictates that investors should make their financial market investments exclusively through brokers who are rigorously licensed and reputable.

Smart Limited Group Spread

While the trading platform displays an enticingly low spread of 0.6-0.7 pips, Smart Limited Group fails to furnish details regarding underlying trading parameters, such as the potential existence of additional commissions. Furthermore, in light of the fact that the trading activity is fictitious, any appearance of profitability becomes irrelevant.

Smart Limited Group Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Smart Limited Group | 100:1 | 100:1 | 100:1 | 100:1 | 100:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

The trading platform provided by Smart Limited Group offers a fixed leverage of 1:100. It’s noteworthy that regulated brokers typically refrain from providing such high levels of leverage to retail traders due to the inherent risks of experiencing sudden and substantial losses.

Brokers typically reserve higher leverage ratios for professional clients who fully understand and accept the risks associated with such trading. If you do not meet the criteria to be classified as a professional trader but still wish to engage in high-leverage trading, one option is to consider utilizing the services of an offshore affiliate associated with an established brand.

Smart Limited Group Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Smart Limited Group | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Due to Smart Limited Group’s lack of proper legal documentation, it remains uncertain what tactics the fraudsters may employ. Typically, fraudulent brokers create hurdles to withdrawing funds by imposing exorbitant fees and imposing unattainable trading volume requirements.

Pros and Cons

| Pros | Cons |

| Notning to mention | Anonimous |

| Blaclisted by the CONSOB | |

| No legal documentation | |

| Only crypto payments | |

| Risky leverag ratios |