Choosing a forex broker necessitates a thorough assessment of their transparency and trustworthiness. Unfortunately, Solid Trade falls short in both areas. The broker’s deliberate concealment of its operational location, ownership, and registration status is deeply troubling.

Additionally, the lack of a valid forex license further erodes Solid Trade’s credibility and legitimacy. This major shortcoming casts serious doubt on the broker’s reliability.

Given these substantial issues, it is highly recommended to avoid Solid Trade. Protecting your financial security and interests is paramount, and engaging with a broker that lacks transparency and proper licensing could jeopardize them.

Solid Trade Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Solid Trade | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

From the outset, Solid Trade raises significant concerns due to its lack of transparency and intentional withholding of crucial information needed for ensuring accountability.

One of the most alarming issues is the absence of a valid forex license, which is essential for any reputable broker. This lack of proper licensing makes Solid Trade a highly risky choice for potential clients.

Compounding these concerns, the Comisión Nacional del Mercado de Valores (CNMV), Spain’s financial regulatory authority, has issued a warning about Solid Trade’s unauthorized operations within their jurisdiction. This warning highlights the potential dangers of engaging with this broker.

In light of these serious issues, prospective traders are strongly advised to avoid Solid Trade. It is crucial to prioritize financial safety by selecting a broker that is transparent, properly licensed, and committed to providing a secure trading environment in the forex market.

Trading Platform

| Advanced tools | Auto trading | Custom indicators | Mobile versions | |

| Solid Trade platform | ❌ | ❌ | ❌ | ❌ |

| MT4 | 30+ indicators | ✅ | ✅ | Android and iOS |

| MT5 | 50+ indicators | ✅ | ✅ | Android and iOS |

| cTrader | 40+ indicators | ✅ | ✅ | Android and iOS |

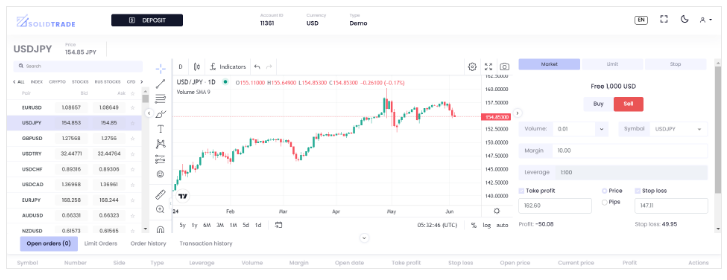

Solid Trade’s web-based trading platform, which features charts from TradingView, may initially seem legitimate. However, our testing exposed its limited functionality, casting serious doubt on its overall effectiveness.

For those seeking a high-quality trading experience, alternatives like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are highly recommended. These platforms are renowned for their reliability and extensive range of features, making them a preferred choice within the trading community.

In conclusion, while Solid Trade might initially appear beginner-friendly, its lack of advanced tools and features could significantly limit your trading potential. Opting for robust platforms like MT4 or MT5 will likely offer a more comprehensive and effective trading experience.

Minimum Deposit

Solid Trade imposes a high entry barrier for traders, starting with a minimum trading amount of $100 for their Student account. This barrier rises steeply with their other account tiers: $10,000 for Starter, $50,000 for Premium, $100,000 for Advanced, $500,000 for Pro, and a staggering $1,000,000 for the VIP account.

In contrast, most reputable forex brokers typically require more affordable deposit amounts, often not exceeding $250. This makes Solid Trade’s high deposit thresholds particularly concerning for traders seeking a cost-effective entry into the forex market.

In summary, although Solid Trade’s tiered accounts may suggest a diverse range of services, their steep deposit requirements do not align with industry standards. Prospective traders are likely to find better value and accessibility with brokers that offer lower initial deposits.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Credit Card | Instant | 24 hours | Free |

Solid Trade restricts its payment options exclusively to credit and debit card payments. This limited approach contrasts sharply with the practices of reputable brokers, who typically offer a variety of payment methods, including bank transfers, e-wallets, and other convenient options to accommodate different trader preferences.

This lack of flexibility in payment methods can be inconvenient and may raise concerns about the broker’s overall reliability and commitment to providing a user-friendly experience.

While Solid Trade’s focus on card payments might appeal to some, the absence of diverse payment options is a significant drawback. Traders might find more convenience and reliability with brokers that support a wider range of payment methods.

Trading Instruments

Solid Trade claims to offer a diverse range of trading assets, including stocks, indices, currencies, and cryptocurrencies. This variety might seem appealing to traders looking to diversify their portfolios.

However, given the numerous concerns surrounding Solid Trade—such as its lack of transparency, absence of a valid forex license, and limited payment options—it’s crucial to approach these claims with caution.

While the broad selection of assets is a positive feature, it doesn’t outweigh the significant red flags associated with this broker. Potential traders should carefully consider these issues before engaging with Solid Trade.

Solid Trade Spread

Based on our analysis, Solid Trade offers relatively tight spreads for major currency pairs, with observed spreads of approximately 0.8 pips for EUR/USD, 0.3 pips for GBP/USD, and 0.8 pips for USD/JPY. While these spreads are competitive, they do not significantly differentiate Solid Trade from other brokers in the market.

Given the serious concerns about Solid Trade, such as its lack of transparency, absence of a valid forex license, high deposit requirements, and limited payment options, the average spreads are not enough to mitigate these issues.

Therefore, although Solid Trade provides reasonable spreads on major currency pairs, traders should consider the broader range of concerns before deciding to engage with this broker. Many brokers in the market not only offer competitive spreads but also provide a higher level of trustworthiness and better overall service.

Solid Trade Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Solid Trade | Not specified | Not specified | Not specified | Not specified | Not specified |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

Solid Trade does not disclose the leverage they offer. This omission is concerning, as leverage is a critical aspect of forex trading that significantly impacts a trader’s strategy and risk management.

Reputable brokers typically provide clear information about their leverage options, ensuring traders can make informed decisions. The lack of transparency about leverage further adds to the list of concerns surrounding Solid Trade, including their lack of a valid forex license, high deposit requirements, and limited payment options.

In summary, the absence of clear information about leverage is another red flag for potential traders. It is essential to choose a broker that is transparent about all trading conditions, ensuring a safe and informed trading environment.

Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Solid Trade | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Lastly, similar to their lack of information about leverage, Solid Trade’s absence of clear information about withdrawal fees is concerning. Hidden costs can significantly impact a trader’s profitability and overall experience. Reliable brokers typically provide detailed information about all applicable fees upfront, ensuring traders can make informed decisions.

While the relatively quick withdrawal processing time is a positive aspect, the lack of clarity on withdrawal fees is a significant drawback. Traders should seek brokers that offer full transparency about all costs and fees associated with their services to ensure a more secure and informed trading experience.

Solid Trade Pros and Cons

| Pros | Cons |

| None | Unregulated |

| Anonymous website | |

| No reliable trading software | |

| CNMV warning | |

| High minimum deposit requirements |