Tradeontop encourages individuals to engage in financial market investment via a purportedly reputable forex broker. However, upon closer examination, it becomes evident that this entity lacks legitimacy as a financial services provider. This review aims to help readers recognize such scams and directs them to more reliable investment intermediaries.

Tradeontop Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Tradeontop | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

The crucial aspect regarding a financial services provider is its regulatory standing. Legitimate brokers furnish comprehensive details regarding their operating company, location, authorized jurisdictions, and regulatory oversight bodies. However, it’s essential to note that the presence of such information doesn’t automatically ensure its accuracy or reliability.

While a UK contact address is provided on the homepage, crucial details such as the company name or regulatory license information are conspicuously absent.

The Terms and Conditions initially assert that this broker is operated by Tradeontop Limited, a company purportedly located in the UK. However, the document subsequently declares that the governing jurisdiction is Saint Lucia, an offshore zone.

Trading Platform

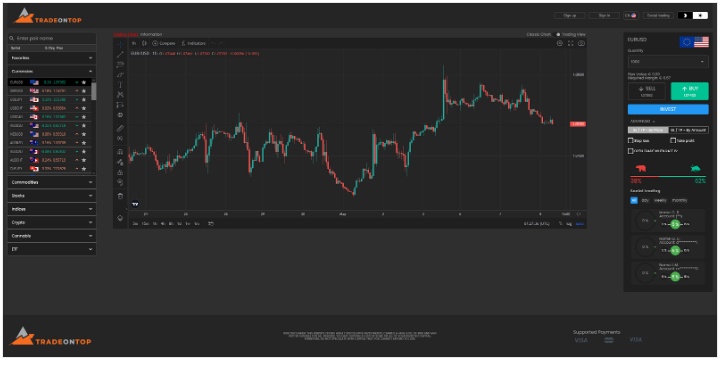

Upon account registration, users gain access to a rather rudimentary web trading platform lacking extensive customization options or advanced features. Interestingly, this platform mirrors those utilized by several fraudulent brokers we’ve encountered previously. Scammers employ manipulated trading software to deceive victims into thinking their funds are genuinely invested and even yielding profits.

Although the platform offers fundamental features for order placement, chart customization, and technical indicator application, it falls short in providing the more sophisticated functionality present in the industry’s leading trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have become industry benchmarks due to their extensive feature sets, including diverse customization options, multi-account capabilities, the ability to create and implement custom scripts for automated trading, and the capacity for backtesting trading strategies.

Minimum Deposit

Tradeontop stipulates a minimum deposit requirement of 250 USD, which aligns with the industry standard. However, it’s worth noting that for the same amount, one could open a trading account with a reputable and properly licensed forex broker. Many prominent brands in the industry provide Micro and Cent accounts with extremely low entry thresholds, making them ideal for novice investors.

Payment Methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

In the Tradeontop deposit menu, only one payment method option is available—credit/debit card. However, upon selection, the menu redirects users to a form for purchasing a training course on the website train4trading.com. This deceptive tactic strongly suggests that the operation is fraudulent.

Reputable brokers typically provide clients with a range of transparent payment methods, including bank transfers and established e-wallets like PayPal, Skrill, or Neteller.

Trading Instruments

The Tradeontop trading platform purportedly includes currency pairs, commodities, stocks, indices, ETFs, and cryptocurrencies. However, this claim is undoubtedly fictitious. Moreover, brokers genuinely based in the UK typically do not offer cryptocurrency trading due to regulations set by the Financial Conduct Authority (FCA).

Tradeontop Spread

While the trading platform displays a spread of 1.1 pips, which is relatively standard in the industry, it remains uncertain whether Tradeontop imposes additional commissions. However, given the suspicions surrounding the legitimacy of the trades facilitated by this platform, it’s important to exercise caution and thoroughly investigate any potential hidden fees or charges.

Tradeontop Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Tradeontop | 500:1 | 500:1 | 500:1 | 500:1 | 500:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

The discrepancy between the leverage displayed in the trading platform (1:200) and the higher level advertised on the website (1:500) provides further evidence that Tradeontop is not a legitimate broker based in the UK. High leverage can potentially yield greater profits but also entails a heightened risk of substantial and sudden losses. Recognizing this risk, leading regulators impose restrictions on leverage for retail traders. For instance, the FCA, along with EU regulators, caps leverage at 1:30 for trading major currency pairs and even lower levels for more volatile assets.

Additionally, the claim that Tradeontop offers bonuses is another red flag. Regulated brokers are prohibited from providing bonuses and promotions due to regulatory constraints. Scammers often exploit promises of seemingly generous bonuses to ensnare potential victims with exploitative terms and conditions.

Tradeontop Withdrawal Requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Tradeontop | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

Tradeontop’s assertion of a 3.5% withdrawal fee with a minimum of 30 USD stands in stark contrast to the practices of most legitimate brokers, which typically do not levy transaction fees.

Moreover, if an account has been awarded a bonus, the ability to withdraw funds is often contingent upon fulfilling substantial minimum trade volume requirements, typically ranging from 40 to 50 times the bonus amount. This requirement significantly impedes clients’ access to their funds and is a common tactic employed by scammers to impose onerous conditions on withdrawals.

Tradeontop Pros and Cons

| Pros | Cons |

| Notning to mention | Fake legal details |

| Unregulated | |

| Blacklisted by the CONSOB | |

| Scam bonus terms | |

| Risky leverage ratios |