The crucial aspect to understand regarding TrustsCapital is that it’s highly unadvisable to entrust your capital to it. Despite its claims of being a reputable forex broker, this website lacks legitimacy and credibility. Our review reveals TrustsCapital as nothing but another fraudulent scheme on the internet. We’ll also guide you towards reliable brokers where you can genuinely begin investing in the financial markets.

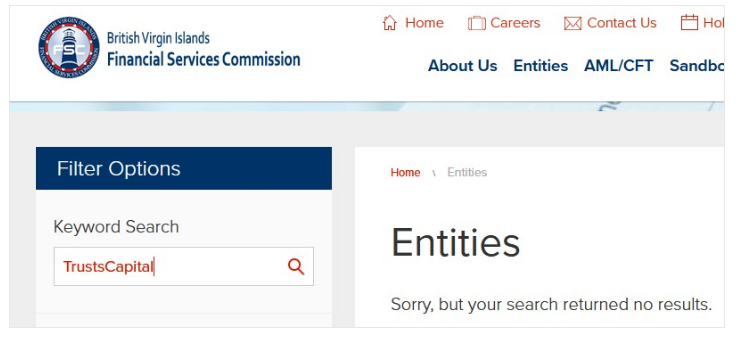

TrustsCapital Regulation

Reputable forex brokers are transparent about their legal entity, location, licenses, and regulatory oversight. Any absence or unclear presentation of such information is a warning sign of potential fraud.

TrustsCapital asserts its headquarters in the British Virgin Islands with an office in London, which raises suspicion since offshore brokers aren’t permitted to operate in regulated areas like the UK. Moreover, the Terms and Conditions lack a company name or jurisdiction specification, furthering doubts.

Upon investigation, financial regulators in both the UK and the BVI have no records of a licensed broker under the TrustsCapital brand and domain.

Before committing your funds to financial endeavors, it’s vital to ensure you engage with a licensed intermediary and avoid the numerous online scammers.

For secure trading on financial markets, consider reputable brokers operating from established financial centers such as the UK. These brokers adhere to strict criteria for financial stability and operational transparency mandated by regulatory bodies like the Financial Conduct Authority (FCA). They are obligated to offer clients negative balance protection and participate in a guarantee fund covering up to GBP 85,000 of a client’s investment in the event of broker insolvency.

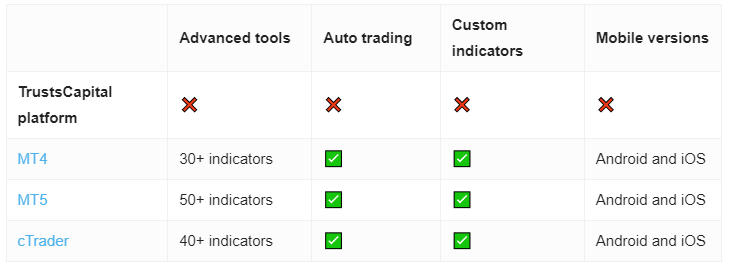

Trading Platform

TrustsCapital uses a pretty basic web trading platform. Here is how it looks like:

We’ve observed the same platform utilized by several fraudulent brokers we’ve encountered. Scammers exploit manipulated trading software to deceive victims into believing their funds are genuinely being invested and yielding profits.

In contrast, legitimate brokers provide clients with a diverse array of trading software options, including desktop, mobile apps, and web-based platforms. The industry’s leading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), have become the gold standard due to their extensive features. These features include customizable options, support for multiple accounts, the ability to create and execute custom scripts for automated trading, and the capability to backtest trading strategies.

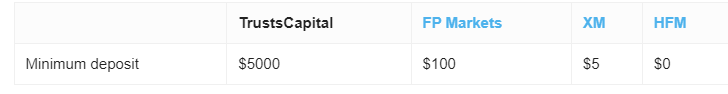

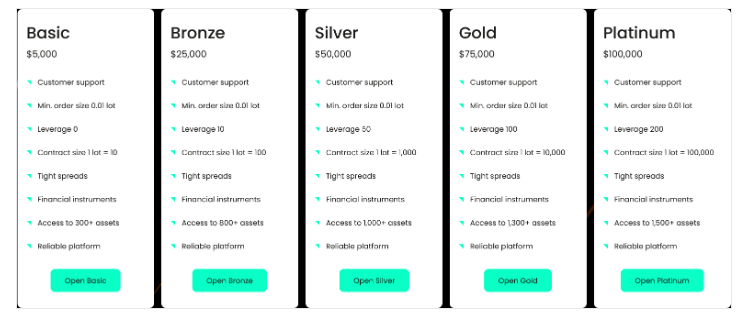

Minimum Deposit

As per the account type descriptions, TrustsCapital mandates a minimum deposit of 5,000 USD. This sum appears exorbitantly high, especially when compared to the mere 50 USD or even just 5 USD required to open a trading account with some of the most reputable brands in the industry.

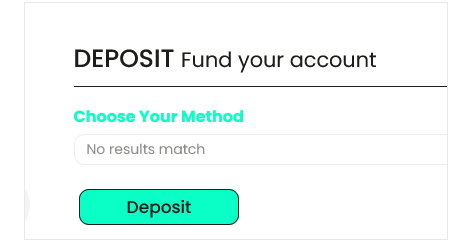

Payment Methods

At the time of composing this review, the deposit menu was inactive, preventing us from determining the available payment methods.

Our experience reveals that fraudulent brokers often promote traditional payment methods but ultimately push potential victims towards cryptocurrency transactions. This approach ensures anonymity for the scammers and denies defrauded individuals the ability to seek refunds or chargebacks.

In contrast, reputable brokers usually present clients with a diverse selection of transparent payment options. These options commonly include bank transfers, credit/debit cards, and established e-wallet services like PayPal, Skrill, or Neteller.

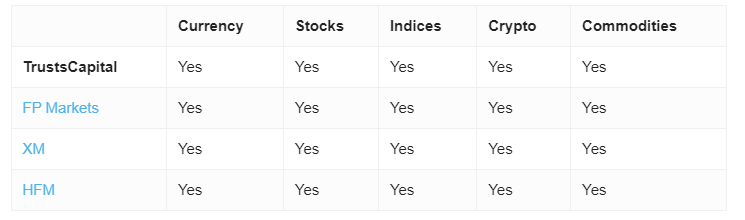

Trading Instruments

The tradable instruments on the TrustsCapital platform encompass currency pairs, commodities, indices, equities, and cryptocurrencies. The inclusion of cryptocurrencies serves as additional evidence suggesting that TrustsCapital is not a legitimate broker authorized to operate in the UK. The Financial Conduct Authority (FCA) prohibits brokers in the UK from offering cryptocurrency derivatives trading.

TrustsCapital Spread

In the TrustsCapital trading software, we notice a zero spread, implying that the broker likely levies some form of commission. Typically, these commissions are charged per lot traded. However, TrustsCapital fails to disclose information about the fee structure paid by the trader.

TrustsCapital Leverage

TrustsCapital advertises leverage up to 1:200, a level of risk that exceeds what a UK licensed broker can legally offer. Regulatory bodies such as the FCA, along with EU regulators, impose limits on leverage, capping it at 1:30 for trading major currency pairs and even lower for assets with higher volatility.

Regulated brokers exclusively offer higher leverage to professional clients, who must meet stringent criteria regarding capital and experience.. However, they forfeit the protections available to retail traders.

If you’re not eligible as a professional trader but desire high-leverage trading, the most practical option is to use the services of an offshore affiliate linked with a reputable brand.

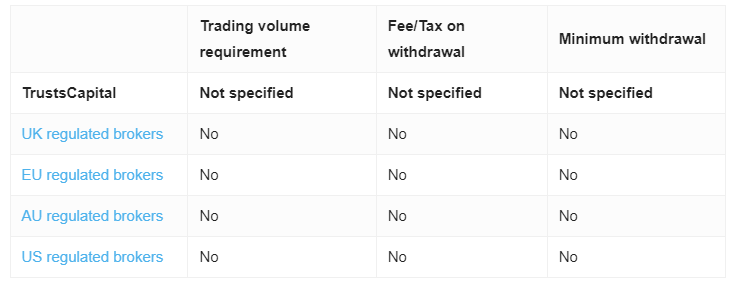

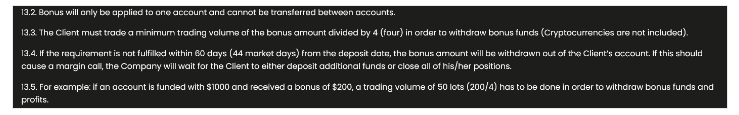

Withdrawal Requirements

Within the Terms and Conditions, a common scam tactic emerges, aiming to impede money withdrawals. If the account has been granted a bonus—prohibited in the UK—it can only initiate a withdrawal after fulfilling the minimum traded volume requirements. These requirements, stated as an unusual formula—number of lots equal to the deposit amount divided by four—are both high and oddly phrased.

TrustsCapital Pros and Cons

| Pros | Cons |

| Notning to mention | False claims of regulation |

| Fake legal details | |

| Scam withdrawal terms | |

| Risky leverage ratios | |

| No clarity on trading cost |