Opting to use Trustyswap as your forex broker could pose significant risks, given its status as an unregulated entity. This lack of oversight presents a clear danger for any trader considering their services.

Compounding these concerns, two major regulatory authorities have specifically flagged Trustyswap for its questionable operations, classifying it as an unauthorized broker. These warnings serve as crucial indicators of the associated risks.

In the realm of forex trading, where safeguarding your financial assets is paramount, dealing with a broker like Trustyswap, which lacks credibility and authorization from relevant bodies, is highly ill-advised. It is strongly recommended to avoid this broker altogether to protect your investments.

Trustyswap Regulation

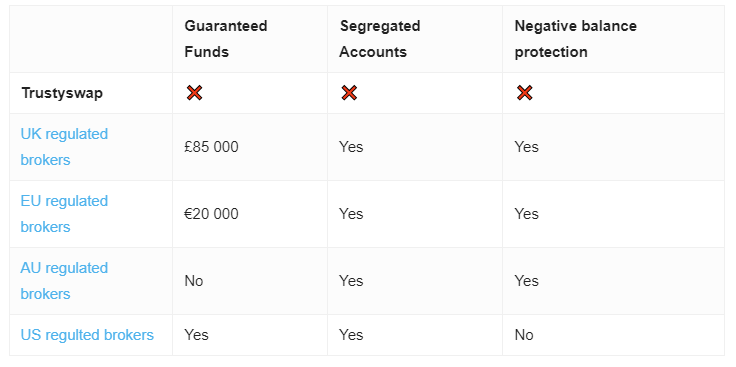

Trustyswap positions itself as a reputable brokerage firm based in the UK; however, upon closer inspection, significant inconsistencies come to light. Notably, the firm lacks registration with the UK’s Financial Conduct Authority (FCA), raising substantial doubts about its adherence to regulatory standards and legality.

The gravity of these doubts is underscored by a direct warning from the FCA, explicitly highlighting Trustyswap’s unapproved status and casting doubt on the legality of its operations within the UK. This advisory signals increased risks for potential investors.

Furthermore, Trustyswap’s practices have not only drawn attention from the FCA but have also come under scrutiny from international regulators, such as Spain’s Comisión Nacional del Mercado de Valores (CNMV), which has issued its own cautions regarding the broker. This global regulatory concern further calls into question the integrity of the broker’s operations.

Given these concerns, we strongly discourage investment with Trustyswap. Investors are advised to seek out brokers with established track records of reliability and strict adherence to financial regulations, ensuring the security and proper management of their investments.

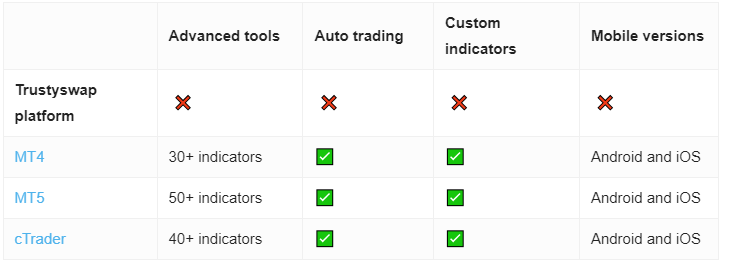

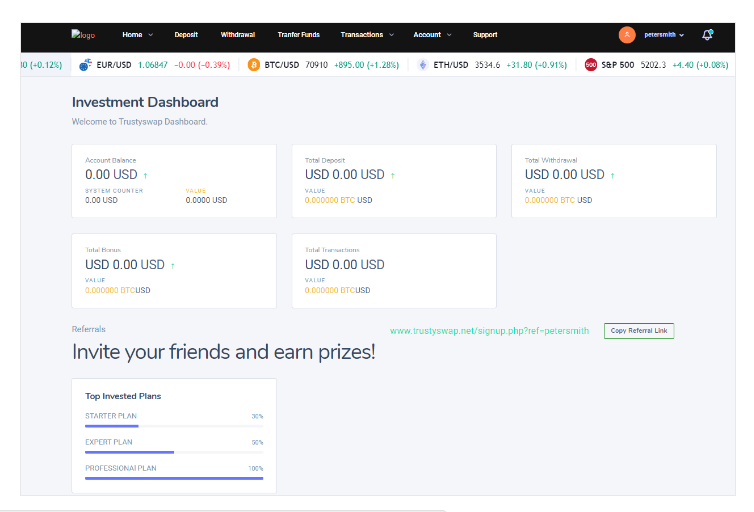

Trading Platform

Trustyswap’s approach raises concerns as it mandates traders to deposit funds before accessing its web-based trading platform. This practice sharply contrasts with that of more reputable brokers, who commonly offer demo accounts. These accounts enable traders to explore the platform and practice trading without any financial risk.

Take a look:

Within the forex trading sector, the gold standard for a robust and efficient trading experience is epitomized by the MetaTrader platforms. Celebrated for their top-notch quality and dependability, these platforms establish a high standard that Trustyswap’s offerings fail to reach. The MetaTrader platforms boast a wide range of tools and features that adeptly cater to both beginner and seasoned traders, providing an unparalleled trading experience with extensive capabilities. This disparity underscores Trustyswap’s shortcomings and emphasizes the advantages of selecting more established and user-friendly platforms.

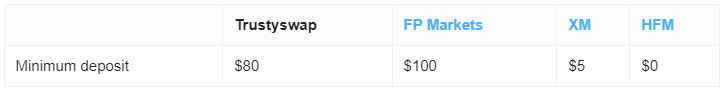

Minimum Deposit

Trustyswap distinguishes its offerings through three distinct account types, each tailored to accommodate various trading preferences and financial thresholds. These include the Starter account, requiring a minimum deposit of $80; the Expert account, demanding a substantial $10,000; and the Professional account, set at an even steeper $80,000. These deposit requirements significantly surpass those established by many leading brokers in the industry.

Conversely, reputable brokers typically set much lower entry barriers. It is customary to encounter minimum deposits that do not exceed $200, making it considerably more accessible for a broader range of investors to initiate trading. This lower threshold not only enhances accessibility but also signifies a commitment to inclusivity and the democratization of trading opportunities. Such standards serve as important indicators of a broker’s dedication to fostering a balanced and equitable trading environment, facilitating entry for new traders while upholding the seriousness of the investment.

Payment Methods

Trustyswap’s payment options are notably restricted, confined solely to cryptocurrencies such as USDT, Bitcoin, and Ethereum. This limited selection significantly impedes accessibility and convenience for traders, particularly when compared to the diverse range of payment methods offered by more established brokers.

Recognized brokers in the market recognize the importance of flexible payment solutions and accommodate a broad spectrum of methods. These typically encompass credit and debit cards, e-wallets like PayPal, Skrill, and Neteller, alongside traditional bank transfers and various cryptocurrencies. This diversity not only caters to the preferences and needs of a global clientele but also enriches the trading experience by facilitating swift, effortless, and secure transactions.

The constrained payment methods available through Trustyswap could pose significant challenges for prospective clients seeking to deposit or withdraw funds. This limitation prompts a thorough reevaluation of their services for anyone contemplating Trustyswap as a trading partner, emphasizing the significance of financial transaction flexibility in ensuring effective trading.

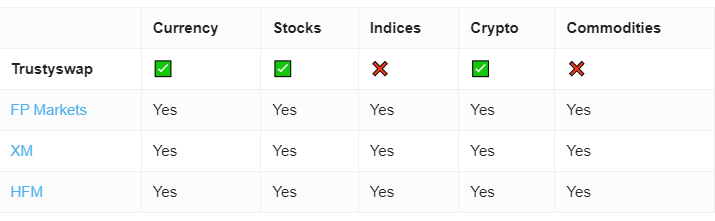

Trading Instruments

Trustyswap promotes a wide array of trading instruments on its website, spanning Forex, Stocks, ETFs, and Cryptocurrencies, ostensibly catering to traders seeking diverse investment options. However, the absence of a legitimate trading platform significantly undermines the credibility of these offerings, casting serious doubts on their actual availability and the feasibility of effectively trading them.

This disparity between advertised promises and the practical reality of trading capabilities raises significant concerns. It underscores the crucial importance for traders to verify the operational integrity and authenticity of a broker’s platform before entrusting their funds.

For traders aiming to diversify their investment portfolios across various asset classes, it is imperative to select brokers that not only provide a broad range of instruments but also furnish a secure, efficient, and dependable trading platform. Such criteria are essential to ensure that traders can capitalize on market opportunities effectively and safely across different sectors. This approach helps safeguard investments while maximizing potential returns.

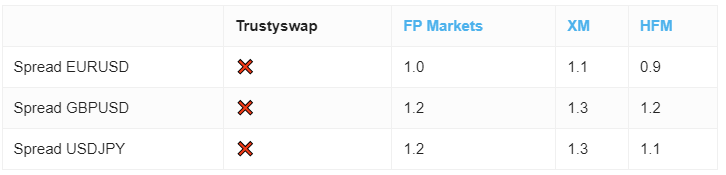

Trustyswap Spread

The absence of clearly disclosed spreads on Trustyswap’s website raises a significant red flag for traders who value transparency in trading expenses. Transparently listed spreads are essential as they aid traders in comprehending potential costs and evaluating the competitiveness of a broker’s pricing compared to others in the market.

Traders should prioritize brokers who provide comprehensive information about their trading conditions and costs. Having clear visibility into these expenses enables traders to strategize and manage their investments effectively, ensuring there are no hidden costs that could affect their trading outcomes.

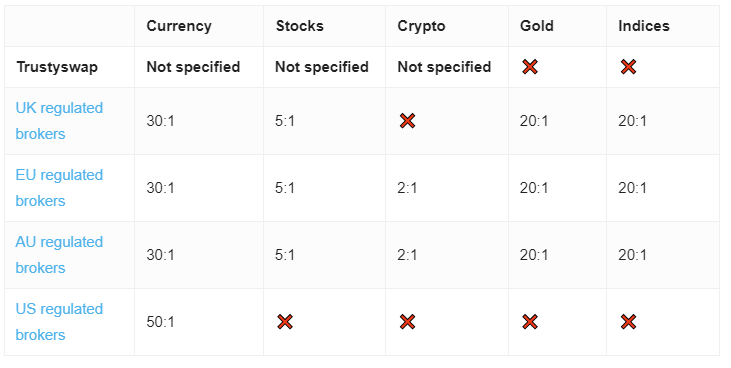

Trustyswap Leverage

The absence of specific details regarding leverage options on Trustyswap’s platform introduces another layer of complexity for traders assessing their services. Leverage is a fundamental aspect of forex and CFD trading, enabling traders to open substantial positions with a relatively modest amount of capital. Without clear information on the available levels of leverage, it becomes challenging for traders to accurately assess the potential risks and rewards of trading on margin with this broker.

For traders who prioritize making well-informed decisions, selecting brokers that provide explicit information about their leverage settings and trading conditions is crucial. Therefore, opting for a broker that emphasizes clear communication in these areas is essential for establishing a trustworthy and effective trading partnership.

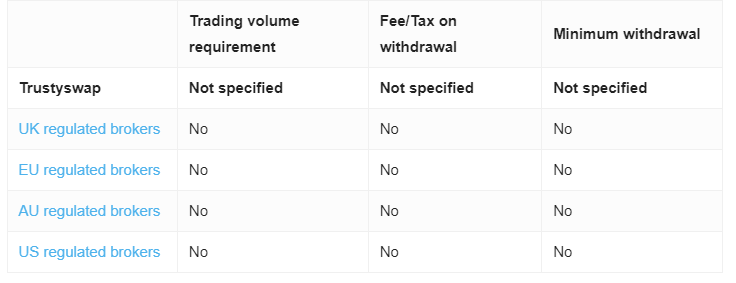

Trustyswap Withdrawal Requirements

The lack of detailed information about withdrawal fees on Trustyswap’s platform poses a significant issue for traders evaluating the broker’s complete cost structure. Transparency regarding all transaction-related expenses is crucial for making well-informed decisions.

For traders who prioritize transparency and strategic planning, it is advisable to select brokers who clearly delineate their fee structures, including withdrawal charges. This transparency aids traders in meticulously calculating their net returns and planning their investments with confidence, ensuring there are no surprises that could negatively impact their trading outcomes.