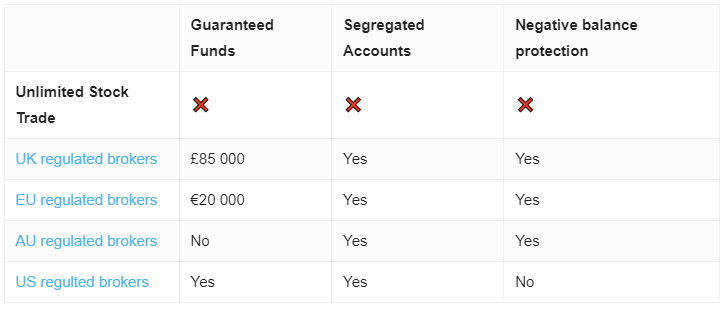

Navigating the dynamic and intricate forex market demands not only skill but also a trustworthy trading partner. However, the absence of regulatory oversight at Unlimited Stock Trade significantly undermines its credibility, making it an unreliable option for traders. This lack of regulation is particularly concerning in an industry known for its complexities and potential risks.

Traders are strongly advised to exercise caution and avoid involvement with Unlimited Stock Trade. Opting for a broker that is regulated and well-established can significantly bolster your security and success in the forex market.

Unlimited Stock Trade Regulation

Unlimited Stock Trade, presenting itself as a reputable forex broker in London, UK, falls short in crucial aspects. Despite its assertions, Unlimited Stock Trade lacks the essential forex license from the UK’s Financial Conduct Authority (FCA), a fundamental requirement for legitimate operations within the UK’s financial markets. This absence casts significant doubt on its legitimacy and operational integrity.

The situation is exacerbated by direct action from the FCA, which has explicitly identified Unlimited Stock Trade’s activities as fraudulent. Issuing a stern warning, the authority classifies it as an unauthorized firm, solidifying its reputation as untrustworthy within the financial community.

Given these revelations, engaging with Unlimited Stock Trade entails considerable risks that far outweigh any potential benefits. We strongly advise those seeking a secure and reliable forex trading experience to opt for brokers that are not only regulated but also well-established and hold a positive industry reputation.

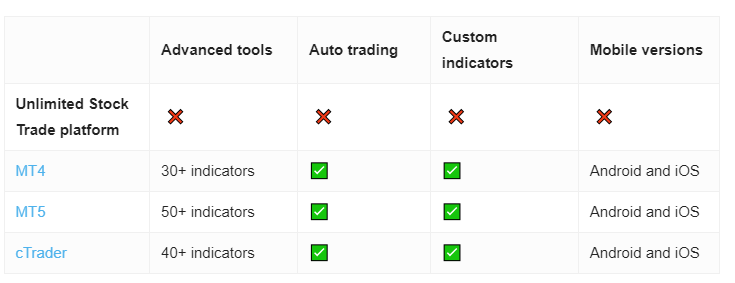

Trading Platform

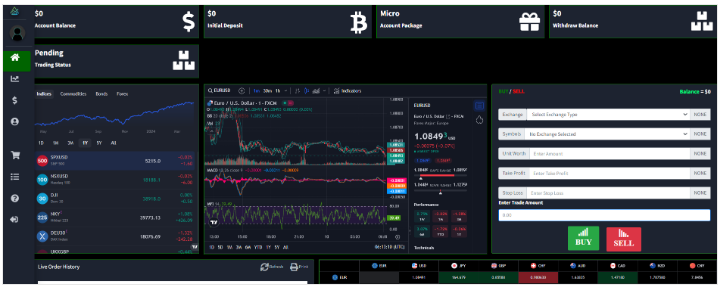

Despite Unlimited Stock Trade’s claims of offering a superior trading platform, our investigation reveals a stark disparity between their assertions and reality. Their web-based trading platform falls short in providing essential functionalities crucial for effective forex trading. This deficiency is particularly concerning for traders who prioritize efficiency and value in their trading activities. Furthermore, the platform is restricted to binary options trading, which may not cater to the diverse strategies employed in forex trading.

Take a look:

In the quest for a dependable and user-friendly trading experience, MetaTrader emerges as a highly recommended alternative. Renowned for its intuitive interface, MetaTrader caters to both novice and experienced traders, providing a suite of tools and resources that augment trading outcomes.

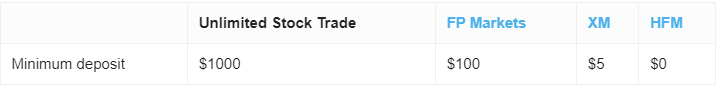

Minimum Deposit

Unlimited Stock Trade offers a range of five account types, each with varying minimum deposit requirements to accommodate different trader profiles. These accounts start with the Bronze account, which necessitates a $1,000 deposit, followed by the Silver account at $5,000, the Gold account at $15,000, the Diamond account at $30,000, and finally, the Pearl account at the highest tier, requiring a $50,000 deposit.

It’s essential to recognize that most reputable brokers typically stipulate much lower minimum deposits, typically not exceeding $250. Traders seeking both value and accessibility in their trading pursuits should carefully evaluate this notable contrast in deposit requirements.

Payment Methods

Unlimited Stock Trade sets itself apart by adopting an exclusive cryptocurrency payment policy, a notable departure from conventional practices among forex brokers. Specifically, they accept Bitcoin, Ethereum, and Tether, aligning their payment infrastructure with the growing utilization of digital currencies in financial transactions.

This crypto-centric payment strategy presents both opportunities and challenges. On the positive side, it harnesses the innovative potential of digital assets, providing traders with an alternative to traditional payment methods. However, the downside is that this approach restricts payment options, potentially hindering accessibility for traders who are not well-versed in cryptocurrencies. Moreover, it may complicate the onboarding process for new traders who lack familiarity with digital currencies.

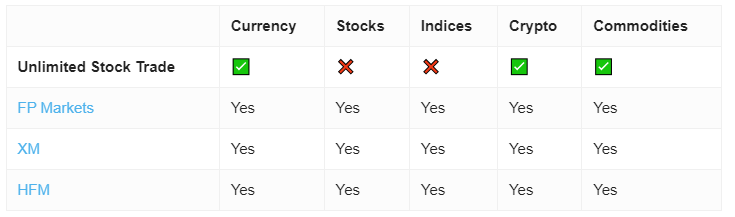

Trading Instruments

According to their website, Unlimited Stock Trade purports to offer trading opportunities in Forex, cryptocurrencies, and commodities. However, this assertion appears to be misleading, as they lack a genuine trading platform capable of supporting such diverse trading instruments. This discrepancy raises significant concerns regarding the transparency and reliability of Unlimited Stock Trade, further questioning their legitimacy as a broker.

For traders, it’s essential to verify the authenticity of the trading tools and resources claimed by a broker before committing funds. This ensures that they engage with platforms that genuinely cater to their trading needs and adhere to regulatory standards.

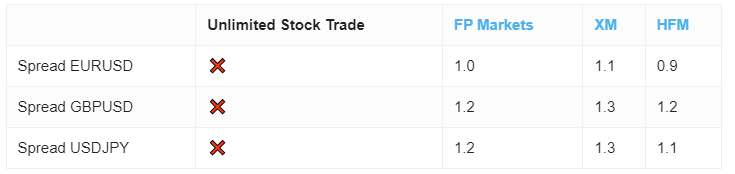

Unlimited Stock Trade Spread

Unlimited Stock Trade advertises a minimum spread of 3.3 pips on their entry-level Bronze account, which decreases to a minimum of 0.5 pips on their premium Pearl account. These figures are notably higher than the industry average, particularly when compared to the more competitive spreads around 1.5 pips typically offered by reputable forex brokers.

Forex traders highly value lower spreads because they directly correlate with reduced trading costs and significantly contribute to enhancing profitability. The higher-than-average spreads presented by Unlimited Stock Trade, especially on their lower-tier accounts, significantly deviate from industry standards, potentially compromising the financial efficiency of traders using their platform.

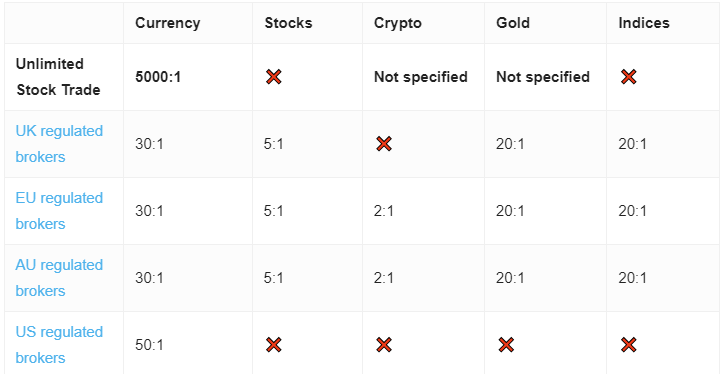

Unlimited Stock Trade Leverage

Unlimited Stock Trade claims to offer exceptionally high leverage, with options reaching up to 5000:1 on their Pearl account, decreasing to 500:1 on lower-tier accounts. However, this assertion raises significant doubts as it contradicts UK regulations, which mandate a maximum leverage cap of 30:1 for forex brokers to safeguard traders from excessive risk.

Such exaggerated leverage offerings are often characteristic of unregulated entities and can be indicative of scam operations.

Scammers often use them to lure unsuspecting traders with promises of substantial profits from minimal investments.

While high-leverage trading may seem appealing due to the potential for significant returns, it carries substantial risks, especially for inexperienced traders who may lack the necessary skills to manage such leverage effectively. High leverage can amplify losses just as much as it can increase gains, potentially leading to rapid account depletion. Therefore, if you are considering trading with high leverage, it is crucial to select a reputable and regulated broker that offers negative balance protection. This feature is essential as it shields your account from falling into a negative balance, thereby limiting your liability if the market moves unfavorably against your positions.

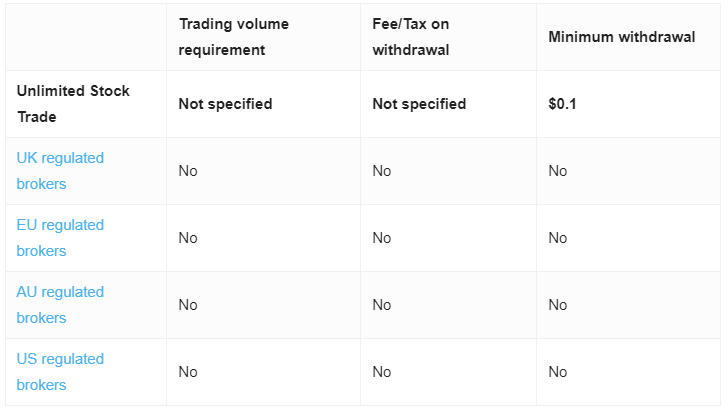

Unlimited Stock Trade Withdrawal Requirements

Unlimited Stock Trade’s vague stance on withdrawal fees and requirements is a significant cause for concern. Instead of offering detailed and transparent information, they primarily emphasize their ability to process withdrawals quickly and mention a minimal withdrawal amount of $0.1. However, the lack of clarity regarding associated fees is troubling for traders who rely on a complete understanding of the terms and conditions governing their financial transactions.

The absence of explicit details about withdrawal fees can result in unforeseen costs for traders, eroding trust and reliability. Transparency in financial dealings is crucial, especially in forex trading, where the precision of transactional terms can greatly impact profitability and operational ease. We advise traders to seek out brokers that offer comprehensive, clear, and upfront descriptions of all their terms, especially regarding costs that could impact their investment returns.