Wealth trade asserts itself as a legitimate forex broker based in the UK, yet its operations fall within a regulatory gray zone, devoid of oversight from established financial regulatory bodies. This absence of regulation poses a considerable concern for prospective investors.

Hence, if contemplating investment with Wealth trade, it’s highly advisable to peruse our thorough review for deeper insight into the entity you’ll be engaging with. Educating yourself through meticulous research can empower you to make a more prudent and informed choice, shielding you from the substantial financial risks linked with unregulated entities such as Wealth trade.

Wealth Trade Regulation

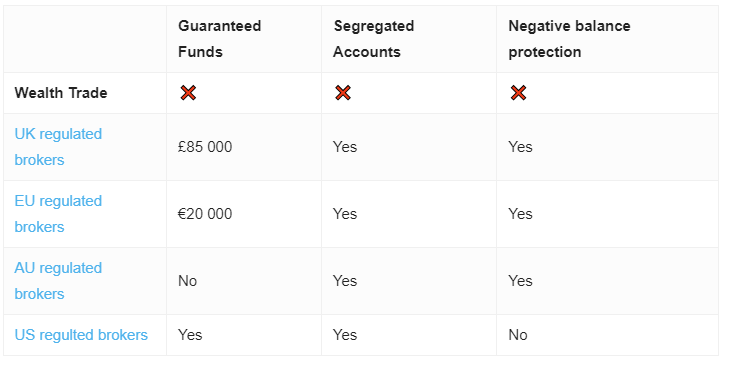

To begin, despite presenting itself as a legitimate broker based in the UK, Wealth trade lacks the essential forex license required for lawful operations. This crucial omission hasn’t escaped the attention of the Financial Conduct Authority (FCA), the primary financial regulatory body in the UK. In a bid to safeguard traders, the FCA has explicitly cautioned against Wealth trade, categorizing it as an unauthorized firm providing financial services in the UK without the requisite legal authorizations.

Consequently, potential investors are strongly urged to exercise prudence and refrain from entrusting their investments to unregulated entities like Wealth trade. Dealing with such firms carries notable risks to your financial well-being, potentially resulting in significant financial setbacks. It’s imperative to always verify that any trading platform or broker is duly authorized and regulated by competent authorities such as the FCA to shield your investments from such vulnerabilities.

Wealth Trade Trading Platform

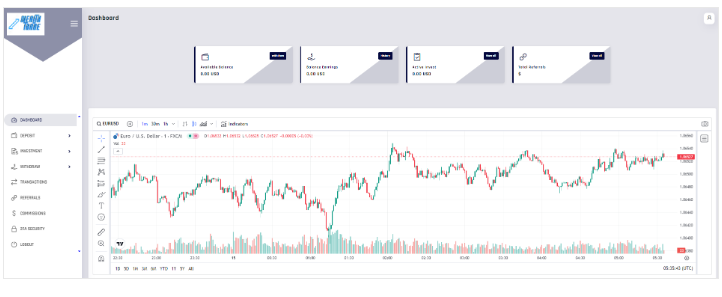

Wealthstrade’s web-based platform falls short of expectations, primarily relying on TradingView-enabled charts that lack essential functionalities necessary for conducting actual trading activities.

See it below:

This significant limitation can significantly hinder the trading experience and the ability to execute trades efficiently and effectively.

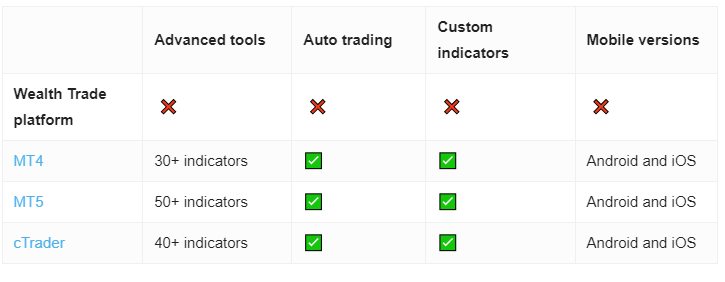

Given these constraints, we strongly recommend traders to invest their time and resources with a reputable broker that supports the well-established and widely acclaimed MetaTrader platforms. These platforms provide robust features and comprehensive tools crucial for effective trading, thereby greatly enhancing your trading performance.

For a detailed list of reliable brokers offering advanced trading technologies, including the MetaTrader platforms, please refer to the table provided above. This guidance ensures that you select a platform that not only adheres to regulatory standards but also provides you with the essential tools for successful and secure trading.

Minimum Deposit

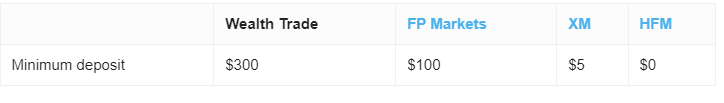

Wealthstrade imposes notably high thresholds for opening trading accounts, which sharply contrast with standard market practices. Typically, the minimum deposit required to open a trading account with established brokers does not exceed $250. However, Wealthstrade’s requirements deviate significantly from this:

- Starter Account: The minimum deposit is $300, slightly above the usual market range.

- Edge Account: This account necessitates a minimum deposit of $1,500, considerably higher than the market norm.

- Silver Account: To open this account, a trader must deposit at least $6,000.

- Diamond Account: The highest tier account demands an even steeper $11,000 to get started.

These amounts surpass what is commonly expected or required by most established brokers in the market. Such high deposit requirements could potentially deter new or average traders who are unable to commit such substantial amounts upfront. For traders seeking more accessible entry points into the forex market, it is advisable to consider brokers that offer more reasonable and lower deposit thresholds, ensuring that trading remains inclusive and accessible to all investment levels.

Payment Methods

Wealthstrade’s accepted payment methods are notably restrictive, as the platform exclusively deals in cryptocurrencies such as Bitcoin, Ethereum, and USDT, as per their website. This limitation could present a significant inconvenience for traders accustomed to or preferring a broader variety of payment methods.

In the diverse landscape of online trading, flexibility in payment options is crucial. Many traders seek the ability to utilize multiple payment avenues like bank transfers, e-wallets, credit and debit cards, or cryptocurrencies to align with their individual preferences and financial setups. Relying solely on cryptocurrencies may not only restrict the platform’s accessibility for potential users but also raise concerns regarding the volatility and unpredictability associated with crypto payments.

Consequently, the restriction to only accepting cryptocurrencies could be a significant drawback for those considering trading with Wealthstrade. Traders seeking versatility in payment options might find this limitation a compelling reason to explore other brokers capable of accommodating a more extensive range of financial instruments and payment methods, thereby ensuring a more tailored and convenient trading experience.

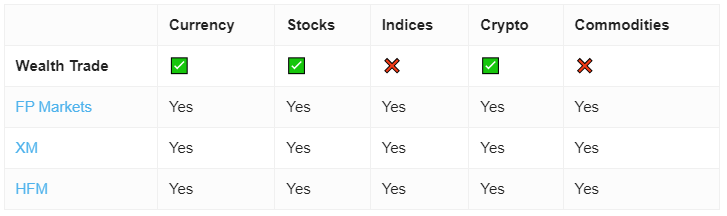

Trading Instruments

Despite verification indicating that Wealthstrade does not operate a legitimate trading platform, their website asserts to offer access to a diverse range of trading options. These purported options encompass Forex, Stocks, Cryptocurrencies, and Commodities, theoretically providing a spectrum of investment opportunities for traders.

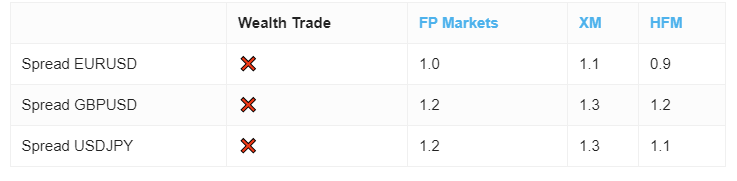

Wealth Trade Spread

Wealthstrade’s advertising assertions of providing reduced spreads on their platform are concerning, particularly due to the absence of specific information or figures to substantiate these claims. Most importantly, they lack a functional trading platform. This lack of transparency and functionality in their operations raises significant concerns for traders who value clear and straightforward information regarding trading costs.

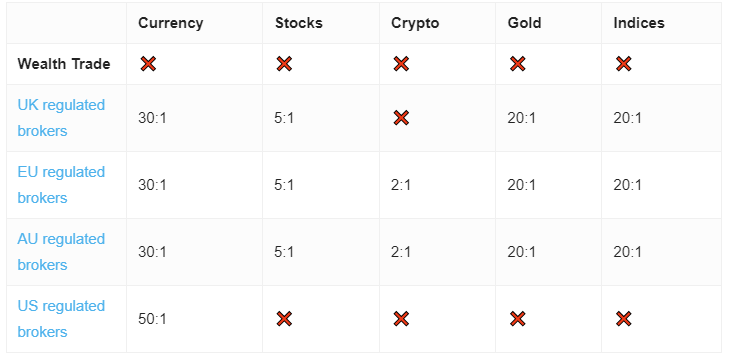

Wealth Trade Leverage

Wealthstrade’s lack of transparency extends to its leverage options, which are not clearly specified on their platform. This absence of detailed information about leverage practices is a significant concern, as leverage plays a pivotal role in forex trading, substantially influencing both the risk and potential returns of trading activities.

Wealth Trade Withdrawal Requirements

Wealthstrade’s failure to disclose essential information regarding withdrawal fees and specific requirements, despite claiming to process withdrawals “immediately” to your Bitcoin wallet, raises additional concerns about its transparency and reliability.