Wealthyfinancetraders presents itself as an established and reputable forex broker, enticing users to enter the world of financial trading. However, even a basic fact check reveals that everything on this website is a lie. Wealthyfinancetraders is simply another online scam disguised as a broker. Let’s delve deeper into why you should steer clear of this website and how you can identify a legitimate financial services provider that meets your needs.

Wealthyfinancetraders Regulation

The first thing to look for on a forex broker’s website is the legal entity that operates it, its location, and the regulatory oversight it falls under. However, the availability of such information does not guarantee its accuracy or authenticity.

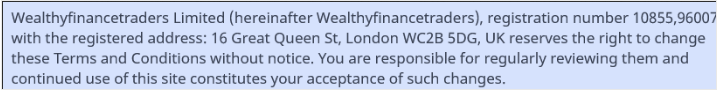

On the Wealthyfinancetraders website, we don’t see a company name displayed. The Terms and Conditions initially mention a company called Wealthyfinancetraders Limited, purportedly based in the UK, as the entity behind this alleged broker.

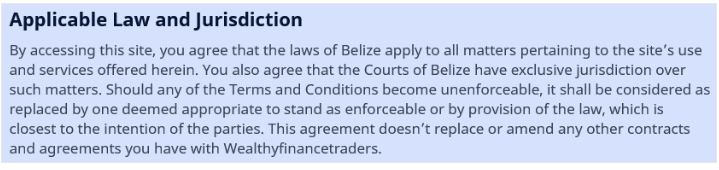

Indeed, such contradictions are typical of scam websites. Despite initially stating that Wealthyfinancetraders Limited is based in the UK, the Terms and Conditions document contradicts this information by specifying the applicable jurisdiction as the offshore zone of Belize. These inconsistencies raise serious doubts about the legitimacy and reliability of Wealthyfinancetraders as a forex broker.

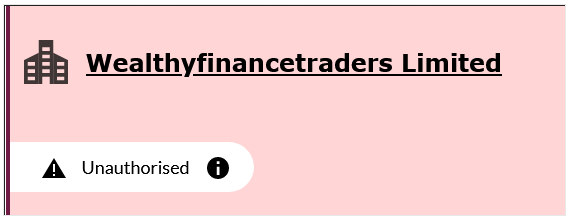

To offer financial services in the UK, a company must be authorized by the Financial Conduct Authority (FCA). However, upon checking the FCA register, we find a clear warning indicating that Wealthyfinancetraders Limited is not a licensed company. This warning further confirms the lack of regulatory approval for Wealthyfinancetraders to operate as a financial services provider in the UK.

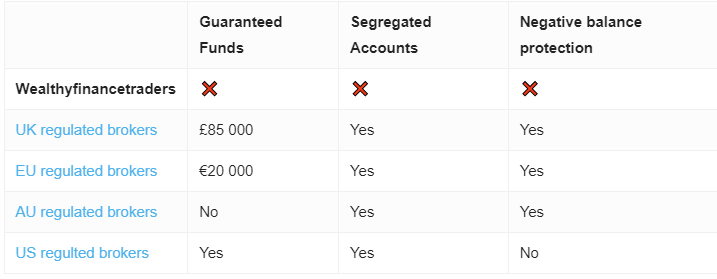

When investing in financial instruments, beware of fake brokers online. Ensure the broker holds necessary licenses. Working with a company authorized and supervised by regulatory institutions like the UK’s Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) offers benefits.

Customers enjoy guarantees, including negative balance protection and funds safeguarding if the broker goes bankrupt. In the EU, this guarantee is up to EUR 20,000; in the UK, it’s up to 85,000 GBP, providing added security for investors.

Trading Platform

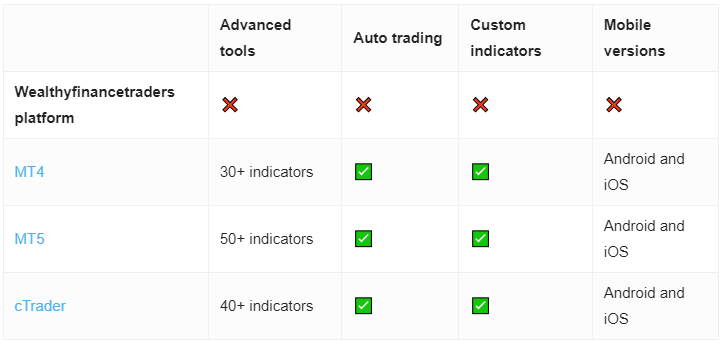

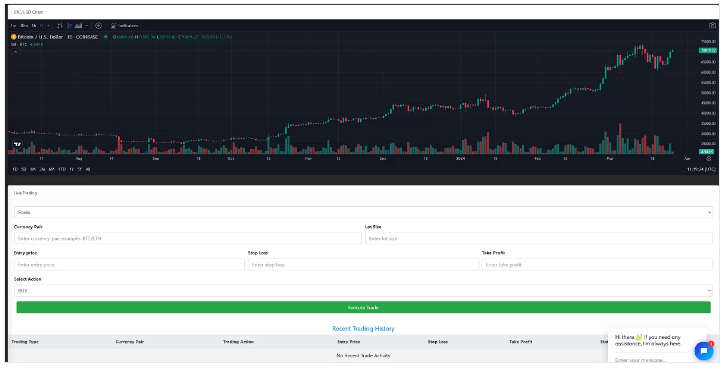

Wealthyfinancetraders claims to offer the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. However, after registering an account, users do not get access to this popular software. Instead, in the Wealthyfinancetraders dashboard, a supposed web trading platform is provided that bears no resemblance to MetaTrader. It is not functioning trading software but rather a poor imitation. This discrepancy between the promised MetaTrader platforms and the actual trading software provided further undermines the credibility and trustworthiness of Wealthyfinancetraders as a broker.

Plenty of legitimate, regulated brokers enable their clients to take advantage of MT4 and MT5‘s capabilities. These platforms have established themselves as leaders because they offer a wide range of features, including a variety of options for customization, multiple account usage, designing and implementing custom scripts for automated trading, and backtesting trade strategies. These reputable brokers prioritize providing their clients with access to industry-standard trading platforms like MT4 and MT5, ensuring a seamless and feature-rich trading experience.

Minimum Deposit

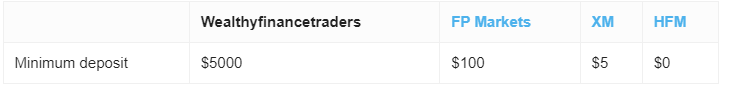

Wealthyfinancetraders requires a minimum deposit of 5,000 USD, which is significantly higher than the initial investment required by some of the industry’s leading brands. In comparison, these leading brands typically require a much lower initial investment, often as low as a thousand times less than what Wealthyfinancetraders demands. Such a high minimum deposit requirement may deter many potential traders and raise suspicions about the intentions and legitimacy of Wealthyfinancetraders as a broker.

Payment Methods

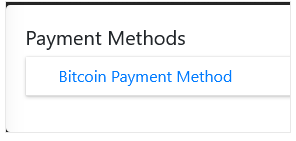

We weren’t surprised to discover that the only payment method accepted by Wealthyfinancetraders is cryptocurrencies. This is a common choice for most financial scammers. Cryptocurrencies offer a degree of anonymity and do not allow defrauded individuals to request refunds, making them ideal for fraudulent activities. This payment method raises further concerns about the legitimacy and trustworthiness of Wealthyfinancetraders as a broker.

Legitimate brokers typically offer clients a wide choice of transparent payment methods, including bank transfer, credit/debit cards, and established e-wallets such as PayPal, Skrill, or Neteller. These payment options provide transparency, security, and convenience for traders, reflecting the broker’s commitment to ensuring a seamless and trustworthy trading experience for their clients.

Trading Instruments

Wealthyfinancetraders advertises trading in a large number of instruments across all major asset classes. However, as has become clear, this website lacks the legal authorization and technological capacity to facilitate trading in financial instruments. This discrepancy between their advertised services and their actual capabilities further underscores the lack of legitimacy and reliability of Wealthyfinancetraders as a broker. Investors should exercise caution and avoid engaging with such platforms to protect their investments and financial well-being.

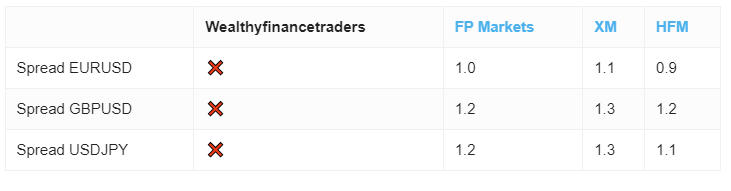

Wealthyfinancetraders Spread

Wealthyfinancetraders promises a typical industry spread of 1.5 pips. However, as a fake broker offering no real trading, these promises hold no real meaning. This deceptive practice of making promises without the ability to deliver further highlights the fraudulent nature of Wealthyfinancetraders. Investors should be cautious and avoid engaging with such platforms to mitigate the risk of financial harm.

Wealthyfinancetraders Leverage

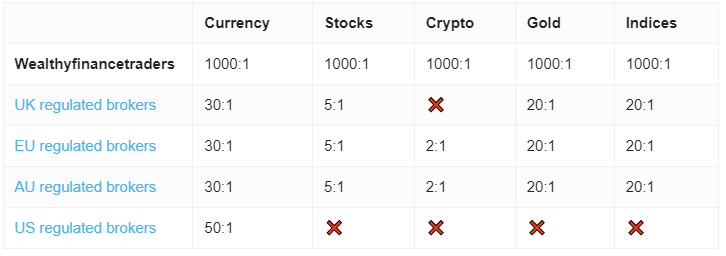

Wealthyfinancetraders advertises very high leverage of up to 1:1000, which is evidence that this is not a licensed UK-based broker. Regulatory bodies like the FCA in the UK and EU regulators limit leverage to 1:30 for trading in major currency pairs and even lower levels for more volatile assets.

Another piece of evidence is the claim that Wealthyfinancetraders offers bonuses.

Regulators prohibit regulated brokers from offering bonuses and promotions.

Scammers often use promises of supposedly generous bonuses to tie their potential victims to extortionate terms. Wealthyfinancetraders does not provide clear information about the conditions attached to bonuses.

If you are still willing to take the risk of high-leverage trading and want to take advantage of bonuses, promotions, and prize games, the best option is to use the services of offshore brokers operating under an established brand. However, caution is advised, as high leverage and bonuses can increase the risk of financial loss.

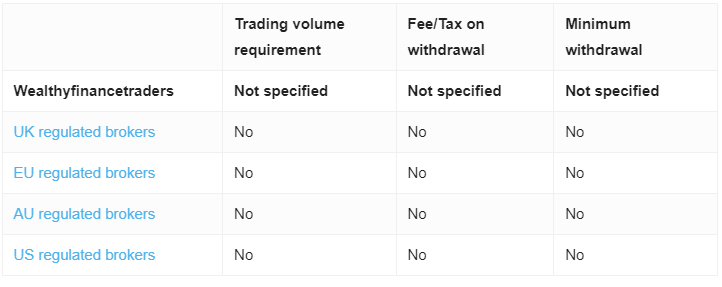

Wealthyfinancetraders Withdrawal Requirements

Wealthyfinancetraders does not specify extraordinary conditions for withdrawal. However, these types of scams often surprise you with hidden fees and other tricks that prevent you from withdrawing your money back. It’s common for such fraudulent platforms to impose unexpected hurdles or additional charges when users attempt to withdraw funds, making it challenging for investors to access their money. This lack of transparency and potential for obstacles in the withdrawal process further underscores the risk associated with engaging with Wealthyfinancetraders or similar unregulated brokers.